If you’re ready to trade with serious capital, knowing the best prop trading firms in 2026 can save you time and money. We’ve compared payout speeds, challenge rules, and assets so you don’t have to. Whether you’re a cautious trader or a risk-taker, there’s a firm here for you.

Overview of the 5 Best Prop Trading Firms in 2026

Country of Origin |

Years in Operation |

Max Profit Split |

Payout Frequency |

Platforms |

|

Czech Republic |

10+ years |

Up to 90% (with scaling) |

Monthly (default) / On-demand after 14 days |

MT4, MT5, cTrader, DXtrade |

|

|

Israel |

9 years |

Up to 100% (program-dependent) |

Bi-weekly (first after 14 days) |

MT5 |

UAE |

2 years |

Up to 90% (depends on payout tier) |

Weekly, Bi-weekly, Monthly |

Match-Trader, cTrader |

|

South Africa |

~2 years |

80% |

Varies by program |

MT5, Match-Trader (TradingView charts) |

|

Bangladesh |

3 years |

Up to 95% (lifetime add-on) |

Every 5 business days |

MT4, MT5, cTrader |

What Is a Prop Trading Firm?

A prop trading firm is a company that trades Forex, futures, stocks, and other investments using its own money to make profits, and they hire skilled traders to do the trading in exchange for sharing the profits.

Think of it like this: Imagine you’re a talented chef but don’t have money to open your own restaurant. A prop trading firm is like a restaurant group who gives you a fully equipped kitchen and $100,000 worth of ingredients and supplies. If your restaurant makes money, you keep 60-80% of the profits and give the rest to them. If the restaurant loses money, it’s their loss, not yours. But they’ll stop giving you resources if you lose too much.

Here’s how it works in real trading:

- The firm gives traders money to buy and sell stocks, currencies, or other investments

- Traders use special computer programs and fast internet connections to make trades

- When trades make money, the trader keeps most of it (usually 50-80%)

- When trades lose money, the firm loses the money, not the trader

- The firm sets limits on how much a trader can lose in one day

- Traders don’t need to find clients or manage other people’s money

Prop trading is different from hedge funds, which take money from rich people and invest it for them, keeping only small fees. It’s also different from big banks, which do many things besides trading. Prop trading firms just focus on making money from trading, using their own cash, and sharing profits with their traders.

Let’s now address a common concern: Are prop trading firms legitimate—especially for beginners?

Are Prop Trading Firms Legit?

The short answer is yes! Most established prop trading firms are completely legit.For example, all five firms featured in our 2026 list—like FTMO and The5ers—have been in business for several years. You can find good reviews about them on Reddit and Trustpilot. That’s a strong sign you’re dealing with a legitimate prop trading company.

While this article contains only reputable and well-established firms, there are a few that don’t stand up to scrutiny, and you need to know how to tell them apart.

Here’s how to spot the difference:

Signs of scam prop firms:

- They ask you to pay large upfront fees to “prove yourself” or get “certified”

- They promise guaranteed profits or “easy money”

- They have no physical office address or legitimate company registration

- They ask for your personal trading account passwords

- They claim you can make thousands with no experience

- Their website looks cheap or has lots of spelling errors

- They pressure you to sign up immediately

Signs of legit prop firms:

- They pay you a salary or give you real trading capital without big upfront costs

- They have proper business licenses and regulatory compliance

- They have physical offices and real employees you can meet

- They’re transparent about risks and that most traders actually lose money

- They have a track record you can verify

- They invest in expensive trading technology and training

Lets now find a partner that fits your trading style from our list of the best prop trading firms in 2026.

The 5 Best Prop Trading Firms in 2026

To make it easy for you, we’ve narrowed the field to the five top-rated companies for beginners and pros.

FTMO

- Country of Origin: Czech Republic (established 2015)

- Assets: Forex, indices, commodities, crypto (via MT4, MT5, cTrader, DXtrade)

- Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader, DXtrade

- Maximum Allocation: Up to $400,000, scalable to $2,000,000 via scaling plan

- Account Size Options: $10K – $200K standard; aggressive risk capped at $200K

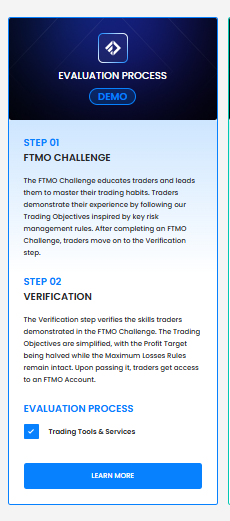

- Steps: Two-phase evaluation—Challenge then Verification—then access to funded account

- Profit Target: Standard 10% (plus doubled for aggressive), then 5% in Verification

- Daily Loss Limit: 5% (standard); higher for aggressive

- Max Loss: 10% (standard); higher for aggressive

- Profit Split: Up to 80%, rising to 90% after meeting scaling criteria

- Payout Frequency: Bi-weekly, with payouts processed within ~8 hours

- Price (Challenge Fee): Starts at approx €89 (~$90), increases to $183–$295 for advanced setups

Why we picked FTMO: Best-known for its structured evaluation process, strong trader support, multiple platform options, and generous scaling that rewards disciplined performance. Offers consistency, transparency, and real progression potential.

Read full FTMO Review

FTMO — Pros & Cons

Pros |

Cons |

Up to 90% profit split when you hit Scaling Plan milestones |

Default payout is monthly unless you trigger on‑demand after 14 days |

On‑demand withdrawals available 14–60 days from first trade |

10% max loss & 5% daily loss rules can feel strict for new traders |

Broad platform choice: MT4, MT5, cTrader, DXtrade |

US persons can’t use MT4/MT5/cTrader; limited to DXtrade |

Clear Scaling Plan (+25% balance bumps; max initial to $2M) |

Strict rule compliance culture; little tolerance for grey‑area tactics |

Long track record & frequent platform maintenance notices / transparency |

Pricing not shown here; fees are non‑trivial for larger accounts |

The5ers

- Country of Origin: Israel (founded 2016)

- Assets: Forex, metals, indices, commodities, crypto, stocks (via MT5)

- Trading Platforms: MetaTrader 5 only

- Maximum Allocation: Start up to $20K, scalable to $4,000,000

- Account Size Options: Funded accounts from $5K – $250K, depending on program

- Steps: Evaluation via programs—Bootcamp, Hyper Growth, High Stakes; then KYC/User Verification

- Profit Target: Varies—Bootcamp ~6%, High Stakes 8%+5%, Hyper Growth 10%

- Daily Loss Limit: Typically 3–5% depending on program

- Max Loss: Around 4–10% trailing drawdown depending on account type

- Profit Split: Starts around 50%, scales up to 100% as account grows

- Payout Frequency: Every two weeks, minimum withdrawal ~$150

- Price (Challenge Fee): From $39 to $495 depending on program

Why we picked The5ers: Extremely scalable, highly trusted (Trustpilot ~4.9), flexible programs with no time limit, and strong reputation for transparency and support. Great for traders aiming high.

The5ers — Pros & Cons

Pros |

Cons |

No time limits to pass evaluations across programs |

Inactivity >30 days can expire accounts |

Bi‑weekly payouts; first payout 14 days after funding |

Rules vary by program; reading fine print is essential |

High Stakes 2‑step with 8%/5% targets & unlimited days |

Platform focus is largely MT5; fewer platform choices than peers |

Marketing states profit split up to 100% (program‑dependent) |

Some programs use unique “performance/winning factor” metrics—non‑standard |

Multiple tracks (High Stakes, Hyper Growth, Freestyle) for different skill levels |

Account caps & scaling specifics vary by track; can confuse beginners |

FundingPips

- Country of Origin: United Arab Emirates (founded November 2022; ~2 years in business)

- Assets: Forex (focus), various CFD instruments — platforms include Match-Trader, TradeLocker, cTrader

- Trading Platforms: Match-Trader, TradeLocker, cTrader (cTrader not available to U.S. traders)

- Maximum Allocation: Up to $200K, scalable to $2,000,000

- Account Size Options: $5K, $10K, $25K, $50K, $100K (and possibly $200K packages)

- Steps: 1-step or 2-step evaluation; Master stage for advanced traders

- Profit Target: Typically ~8–10% depending on account level

- Daily Loss Limit: Usually 5%; some 3% depending on structure

- Max Loss: Often 10% total drawdown limit

- Profit Split: 60%–80% depending on payout schedule; up to 100% on monthly payouts

- Payout Frequency: Weekly (Tuesdays at 60%), bi-weekly (80%), monthly (100%)

- Price (Challenge Fee): Ranges from ~$29 for $5K plan to up to ~$499 for larger accounts; many are refundable upon first payout

Why we picked FundingPips: Very flexible payout structure (from 60% to 100%), multiple evaluation paths, affordable entry cost with refund policy, and very scalable. Some users note support and transparency issues—so it’s wise to review terms closely.

Read full FundingPips Review

FundingPips — Pros & Cons

Pros |

Cons |

Weekly Tuesday payouts; fast cadence once funded |

Profit split varies by payout frequency (weekly lower than monthly) |

Profit split up to 90% (Hot Seat/on‑demand tier); offers 1‑step/2‑step/Zero models |

Daily & max loss rules are tight: e.g., 3% daily / 6% max (1‑step) |

Broad model/menu with weekly/bi‑weekly/monthly reward cycles |

Public chatter includes critical posts; do your own due diligence |

Platforms include Match‑Trader and cTrader (tools in dashboard) |

Evaluation models/rules evolve—always re‑check T&Cs before buying |

Expanding to futures via FundingTicks (no daily DD; EOD trailing) |

Payout rails can differ by amount (e.g., <$500 USDT), adding friction |

Maven Trading

- Country of Origin: Based in Vancouver, Canada; launched in 2022

- Assets: Forex, indices, commodities, and crypto

- Trading Platforms: cTrader and Match-Trader

- Maximum Allocation: Account sizes range from $2,000 up to $100,000

- Account Size Options: $2K–$100K tiers

- Steps: Choose between 1-Step or 2-Step evaluation challenges

- Profit Target: Typically around 8% (e.g., 8% challenge target, then 5% verification)

- Daily Loss Limit: Approximately 2–3% based on plan (e.g., 2% daily drawdown)

- Max Loss: Around 5% overall drawdown (static or trailing)

- Profit Split: Starts at 80%, can scale up to 100% depending on longevity and performance

- Payout Frequency: Every 10 business days

- Price (Challenge Fee): Ranges from $15 up to ~$380 depending on the account tier

Why we picked Maven Trading: A newcomer with a clean, no-frills approach—transparent profit splits, competitive fees, fast payouts, and simple rules make it ideal for traders seeking clarity and straightforward structure.

Maven Trading — Pros & Cons

Pros |

Cons |

80% profit split across Instant, 1‑step, 2‑step, 3‑step |

Not a regulated broker; simulated environment (clearly disclosed) |

Multiple evaluation paths incl. 3‑step & Instant funding option |

Less third‑party longevity than decade‑old incumbents |

Platforms: MT5 (re‑introduced on own license) and Match‑Trader with TradingView charts |

Some rules (e.g., “consistency”/risk guidelines) may feel restrictive |

Scale up to $1M per scaling program |

Feature set and terms are updated frequently; re‑check before purchase |

Regional perks (e.g., ZAR payouts for South Africans) & fast payout marketing |

Profit split capped at 80% (vs. peers offering up to 90–95% in tiers) |

FundedNext

- Country of Origin: Registered in the UAE (Ajman, AFZ) with additional setup in Cyprus; well active in early 2025

- Assets: Offers simulated trading across multiple markets via CFD and futures—up to $300K in “sim“ funding

- Trading Platforms: Proprietary simulation platform (web-based)

- Maximum Allocation: Up to $300,000 simulated account funding

- Account Size Options: Varies per challenge; some provide quick access funding in days

- Steps: Options include “Stellar 1-Step” (2 days) and “Stellar 2-Step” (5 days) challenges—very rapid progression

- Profit Target: Typically around 8%, but can vary by challenge

- Daily Loss Limit: Not always clearly defined—depends on challenge rules; more emphasis is on consistency scoring

- Max Loss: Simulated trading with metrics focused on consistency and performance rather than fixed drawdown caps

- Profit Split: Up to 95% performance reward; plus a unique 15% profit share available during challenge phase

- Payout Frequency: Marketed “guaranteed payouts in 24 hours” for funded traders

- Price (Challenge Fee): Varies by challenge model; often includes free trials or refundable deposits (not always public)

Why we picked FundedNext: Ultra-fast access to funding, high profit splits, instantaneous payout promises, and flexible challenge durations—excellent for traders prioritizing speed and agility. Just be sure to read the terms about simulated vs. live environment and consistency criteria.

Read full FundedNext Review

FundedNext — Pros & Cons

Pros |

Cons |

Frequent rewards: payouts every 5 business days once funded |

First withdrawal often after a 21‑day window (per site snapshot) |

Profit split up to 95% via lifetime add‑on option |

Highest split requires a paid add‑on (cost/eligibility apply) |

Variety of models (e.g., Stellar 1‑Step/2‑Step/Lite); minimum 5 trading days common |

Rules differ by model; beginners must study each carefully |

Platforms include MT4/MT5 and cTrader access & trading tools |

Policy changes roll out often; always confirm in Help Center |

EAs/bots allowed on MT4/MT5 (with customization/uniqueness rules) |

Some regions/payment rails may have constraints; confirm before buying |

Comparing the Best Prop Trading Firms in 2026

Evaluation Model (speed) |

Max Profit Split |

Payout Speed/Frequency |

Scaling Cap |

Platforms |

|

|

Classic 2-Step (Challenge + Verification). |

Up to 90% (after scaling). |

First payout 14 days after first trade; then every 14 days. |

Scale up to $2M (allocation rules + scaling plan). |

MT4, MT5, cTrader, DXtrade. |

|

Multiple tracks: 2-Step High-Stakes (no time limit) and Instant/Freestyle options. |

Up to 90% on High-Stakes; (Freestyle has its own structure, incl. 100% of funded profits per program terms). |

Bi-weekly standard cycles (first after 14 days). |

Growth path advertised up to $4M (program-depended. |

MT5 (desktop/web/mobile for current programs). |

|

Offers 1-Step / 2-Step / 3-Step tracks; typical targets 8–10% (program-dependent). |

Up to 90% (with progression features; select promos mention up to 100% tiers at “Hot Seat”). |

Weekly payouts (requests processed on Tuesdays). |

Scaling plan facilitates up to $2M. |

MT5, cTrader, Match-Trader / TradeLocker (availability varies by program region). |

|

2-Step evaluation (straightforward objectives; details on site). |

Up to 90%. |

Payouts every 10 business days. |

(Firm markets aggressive scaling; hard cap not publicly specified.) |

cTrader & Match-Trader; MT5 support referenced via brokers varies. |

|

Stellar suite: 1-Step (fastest account access in 2 trading days) and 2-Step/Lite options. |

Up to 95% (and 15% reward on Challenge profits once criteria met). |

Guaranteed within 24 hours after eligibility (some models pay every 5 business days or 14 days thereafter). |

Publicly markets accounts up to $300k per challenge; scaling increases reward to 90% (model-specific). |

MT4, MT5, cTrader, Match-Trader. |

Prop-firm terms evolve often (fees, rules, platform availability). Always click through to the firm’s current documentation before you buy a challenge.

How Do Prop Trading Firms Work?

Prop trading firms operate on a performance-based funding model—they provide the capital, you provide the skill. To understand exactly how this works, let’s break it down step-by-step.

Step 1: The Evaluation Phase

Most firms require you to prove your trading ability before giving you real capital.

This is usually done through:

- Challenges or Auditions: Simulated trading accounts with rules you must follow.

- Key objectives:

- Profit Target – e.g., make 8–10% profit in a set period.

- Risk Limits – daily loss cap, max loss cap, and no high-risk gambles.

- Trading Days – some require a minimum number of trading days to ensure consistency.

Example: FTMO’s standard challenge requires hitting a 10% target in Phase 1 and 5% in Phase 2—while keeping daily losses under 5%.

Step 2: Getting Funded

If you pass, you move to a live funded account:

- You trade the firm’s capital (anywhere from $5,000 to over $500,000).

- All profits and losses are real.

- You must still follow risk management rules—break them and your account can be revoked.

Step 3: Profit Sharing

This is where you get paid for your skill:

- Firms usually offer 80%–90% profit splits (some even 100% on first payouts).

- Payouts happen weekly, bi-weekly, or monthly.

- Some firms allow crypto payouts for faster transfers.

Step 4: Scaling Plans

Many firms reward consistent traders with more capital:

- Trade well, avoid breaches, and they may double your account size over time.

- Scaling helps you grow from, say, $25k to $200k without putting in more personal money.

Step 5: Support & Tools

Beyond funding, prop firms often provide:

- Trading platforms – MT4, MT5, cTrader, TradingView, or firm-proprietary platforms.

- Market access – Forex, crypto, indices, metals, commodities, and more.

- Educational resources – Webinars, risk management training, trade analytics dashboards.

Like I mentioned at the onset, prop firms are like business partners—they give you resources and set the ground rules, you bring in results. Success depends on consistent discipline, not just hitting one lucky trade.

5 Mistakes Common Beginner Make (and How to Fix Them)

- Overtrading to hit the profit target fast

- The problem: You’re so focused on reaching that 8–10% goal that you take every setup you see, even low-quality ones, and end up hitting the daily loss limit.

- Solution: Treat your challenge like a marathon, not a sprint. Aim for steady, compounding gains. For example, if your profit target is 10% over 30 days, break it into smaller, realistic chunks—say 0.5% per day. One FTMO trader I know took 18 trading days to pass without ever risking more than 0.5% per trade.

- Switching strategies mid-challenge

- The problem: A losing streak tempts you to abandon your tested system for a “new” strategy you saw on YouTube last night.

- Solution: Commit to a single, backtested plan for the entire evaluation. If your strategy historically wins 55% of the time over 100 trades, a 3–5 loss streak is statistically normal—don’t panic. A The5ers trader recently passed their High-Stakes program by sticking to their London breakout strategy for the full challenge, even after a rough first week.

- Ignoring drawdown rules

- The problem: You focus only on the max loss for the account and forget the daily drawdown cap. One bad trade day can fail you, even if your total balance is fine.

- Solution: Use a daily loss buffer. If the rule is $500 max loss/day, stop trading once you’re down $300–$350. FundingPips traders often set soft limits like this to stay in control and avoid emotional revenge trading.

- Not practicing under real challenge conditions

- The problem: You trade a demo with no risk limits or different lot sizes, so the challenge feels unfamiliar—and mistakes multiply.

- Solution: Before paying for a challenge, run a 2–4 week “mock challenge” using the exact lot sizes, leverage, drawdown limits, and time restrictions of your chosen firm. FundedNext traders often simulate the Stellar program’s 1-step rules on a free MT5 demo to make the real test feel like just another day in the office.

- Treating the evaluation like a gamble

- The problem: You view the challenge fee as a lottery ticket, so you take wild, oversized trades to “get funded fast.”

- Solution: Shift your mindset—this is a job audition, not a casino bet. Maven Trader coaches advise risking no more than 0.5–1% per trade during evaluations. It’s not about passing in record time—it’s about proving you can protect capital while making consistent gains.

How to Choose the Right Prop Firm for You

If you’re new to prop trading, don’t just pick the firm with the biggest scaling cap or the flashiest profit split. Instead, think about how you actually trade.

For example, if you prefer quick setups and hate long waiting periods, a 1-step evaluation like FundedNext’s Stellar program might feel less frustrating than FTMO’s two-phase challenge. If you’re cautious and need breathing room, The5ers’ no-time-limit model can be a lifesaver—because you won’t have the pressure of hitting targets under a clock.

Also, be honest about your discipline: if you tend to take high-risk trades, a firm with tighter daily loss limits might force you to rein that in. And don’t forget practicalities like payout frequency—if you plan to live off your trading income, waiting 30 days for your first withdrawal could feel like an eternity. In short, match the firm’s rules to your trading style, personality, and cash-flow needs—not just the headline numbers.

Final Thoughts

Choosing the right prop trading firm in 2026 isn’t about finding the “biggest” or “flashiest” option—it’s about matching the firm’s rules, payouts, and style to how you trade. FTMO remains a top choice for many traders thanks to its long track record, flexible platforms, and generous scaling plan.

However, The5ers, FundingPips, Maven Trader, and FundedNext each have their own strengths that may suit different personalities, risk appetites, and payout needs. Take the time to study each firm’s rules, practice under their conditions, and treat your challenge like a professional audition, not a gamble. That’s the real key to getting—and keeping—a funded account.

Realated ↓

Top 10 Best Prop Trading Firms in UAE (2026)

Best Prop Trading Firms in Bangladesh: Top 10 Picks for 2026

FAQs

- Which is the best prop trading firm in 2026?

FTMO is widely considered the leader in 2026 for its reliability, platform variety, and scaling potential. It offers up to 90% profit split and has funded thousands of traders worldwide. - Are prop trading firms legit?

Yes, many are legitimate, but the industry also has unregulated or poorly managed firms. Always research their history, payout proof, and trader reviews before joining. - How do I pass a prop firm challenge on my first try?

Stick to a single, tested strategy, manage your risk at 0.5–1% per trade, and pace yourself toward the profit target instead of rushing. - What’s the fastest-paying prop firm in 2026?

FundedNext offers payouts every 5 business days, making it one of the quickest turnaround times in the industry. - Which prop firm is best for cautious traders?

The5ers is ideal for cautious traders because some programs have no time limit to reach the profit target, reducing pressure. - Do prop firms allow crypto trading?

Yes—most major firms like FTMO, FundingPips, and FundedNext support crypto pairs alongside forex, indices, and metals. - How much can I realistically make with a funded account?

It depends on your account size, profit split, and consistency. For example, a $100,000 FTMO account earning 5% in a month with a 90% split would pay $4,500 before tax.