This Betterment Review breaks down how one of the first robo-advisors continues to shape modern investing. With personalized portfolios and tax-efficient tools, it promises smarter returns. Here’s what you need to know before signing up.

Betterment Review: Quick Stats

- Founded: 2008, New York City

- Assets Under Management: $50+ billion

- Active Users: 900,000+

- Management Fee: 0.25% annually (Digital); 0.65% annually (Premium)

- Account Minimum: $10 to start investing

- Headquarters: New York, NY

- Regulatory Status: SEC-registered investment advisor, FINRA/SIPC member

Best For:

✅ Beginners seeking automated, hands-off investing

✅ Goal-focused investors (retirement, house, emergency fund)

✅ Socially responsible investors (3 SRI portfolios)

✅ Those wanting optional human CFP access ($100K+ for Premium)

✅ Investors prioritizing tax-loss harvesting

✅ Cash management with high APY (3.75%)

Not Ideal For:

❌ Active traders wanting sophisticated charting tools

❌ Investors seeking lowest possible fees (Vanguard 0.15%)

❌ Those needing 529 college savings plans (not offered)

❌ Advanced investors wanting direct indexing

❌ International investors (US only)

What is Betterment?

Betterment is an American SEC-registered investment advisor and financial advisory company founded in 2008 that provides digital investments, retirement, and cash management services. As one of the first robo-advisors, Betterment pioneered automated investing for everyday Americans.

Betterment has over $65B in assets under management and more than 1,000,000 customer accounts as of 2026. The platform combines low-cost automated investing with goal-based planning tools and sophisticated tax optimization.

Two Service Tiers

Betterment Digital (0.25% fee)

- Automated portfolio management

- Goal-based investing tools

- Tax-loss harvesting (TLH+)

- Email and live chat support

- Access to financial planning resources

Betterment Premium (0.65% fee, $100K minimum)

- All Digital plan features

- Unlimited phone access to certified financial planners (CFPs)

- Financial planning for assets outside Betterment

- Priority customer service

- Enhanced Cash Reserve APY boost (0.25% additional)

- 20% discount on Trust & Will estate planning

Betterment remains a stellar performer in Bankrate’s reviews of the top robo-advisors, offering key features such as portfolio management alongside premium ones such as tax-loss harvesting—all at a competitive price. Unlike competitors, Betterment offers the broadest range of expert-curated portfolio strategies (12+ options) and goal-based planning that makes it especially beginner-friendly.

Pricing and Fees

Betterment Digital

Management Fee: 0.25% annually for the Digital plan

Monthly Fee Option: $4 per month for accounts under $20,000 without recurring deposits of $250+

Example Costs:

- $1,000 balance: $48/year ($4/month) = 4.8%

- $10,000 balance: $48/year ($4/month) = 0.48%

- $20,000+ balance: $50/year (0.25%) = 0.25%

- $100,000 balance: $250/year = 0.25%

How to Avoid $4/Month Fee:

- Maintain $20,000+ across all Betterment accounts

- OR set up automatic deposits of $250+/month

Betterment Premium

Management Fee: 0.65% annual fee, requires minimum $100,000 balance

Note: The premium plan charges 0.65 percent of assets (up from 0.4 percent previously)

Premium Benefits Worth the Extra 0.40%:

- Unlimited CFP consultations (phone, scheduled calls)

- Financial planning for ALL assets (not just Betterment)

- Backdoor Roth IRA conversion guidance

- Tax-efficient asset transfer strategies

- Retirement income planning

- 0.25% APY boost on Cash Reserve (Premium clients only)

Additional Costs

ETF Expense Ratios: 0.06-0.20% annually (industry-low, varies by portfolio)

Crypto Portfolio: 1% management fee (higher than standard portfolios)

No Hidden Fees

Zero fees for:

- Account opening or closing

- Deposits or withdrawals

- Rebalancing (automatic)

- Trading commissions

- Transfer fees (incoming over $5,000)

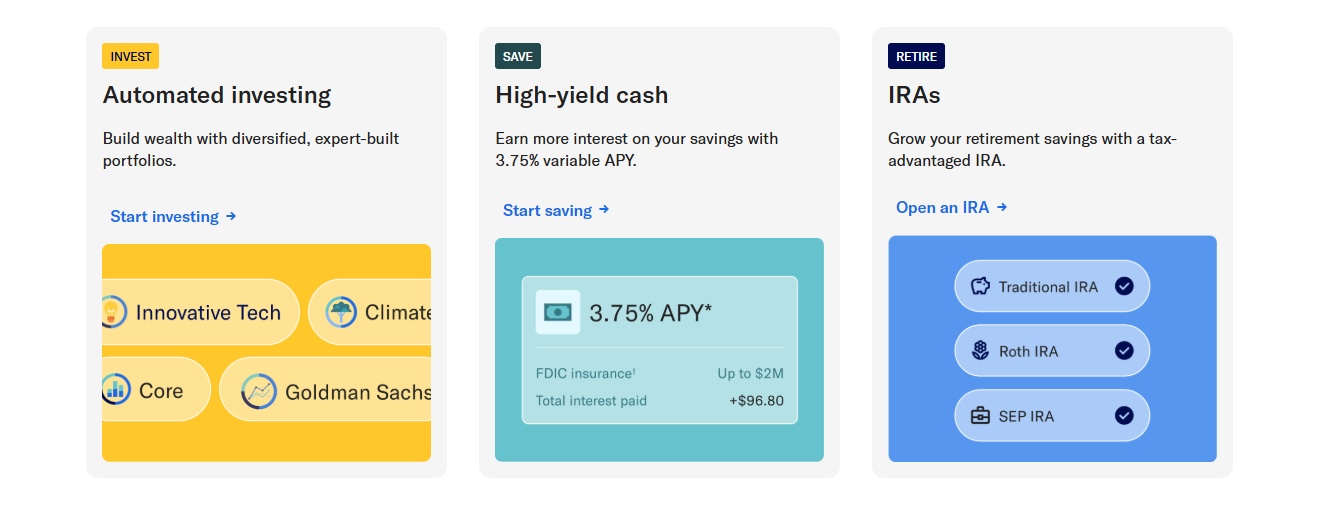

Account Types Available

Retirement Accounts (IRAs)

Betterment offers Traditional, Roth, and SEP IRAs for individual retirement savings with annual advisory fees of 0.25% for standard plan and 0.40% for Premium plan

Traditional IRA

- Pre-tax contributions

- Tax-deferred growth

- Required minimum distributions (RMDs) at age 73

Roth IRA

- After-tax contributions

- Tax-free growth and withdrawals

- No RMDs

- Income limits apply

SEP IRA

- For self-employed and small business owners

- Higher contribution limits ($69,000 for 2025)

Rollover IRA

- Transfer 401(k) from former employers

- Streamlined rollover process

Taxable Accounts

- Individual investment accounts

- Joint accounts

- Trust accounts

Cash Management

Cash Reserve Account

- As of September 23, 2025, the APY offered for Cash Reserve is 3.75%

- FDIC insurance up to $2 million at program banks ($4 million for joint accounts)

- No monthly fees

- No minimum balance (after $10 initial deposit)

- Unlimited withdrawals

Betterment Checking

- Debit card with no fees

- ATM fee reimbursements

- No overdraft fees

- Mobile check deposits

What Betterment DOESN’T Offer

❌ 529 College Savings Plans (major gap vs. Wealthfront)

❌ HSA (Health Savings Accounts)

❌ Custodial accounts (UGMA/UTMA)

Investment Philosophy and Portfolio Options

Core Investment Strategy

Betterment uses Modern Portfolio Theory (MPT) with passive index investing through low-cost ETFs. Betterment focuses on a goal-based investing approach, allowing users to allocate funds toward specific financial objectives such as retirement savings, homeownership, or general wealth accumulation.

12+ Expert-Built Portfolio Strategies

Betterment offers eight additional customized portfolio options:

1. Core Portfolio

- Globally diversified portfolio of low-cost ETFs across stocks and bonds

- 101 possible stock-to-bond allocations

- Automatic rebalancing when allocation drifts 3%+

- Primary ETFs from Vanguard

2. Socially Responsible Investing (SRI) – 3 Options

Broad Impact Portfolio

- ESG criteria across environmental, social, governance

- Eliminates harmful industries

- Broadly diversified

Climate Impact Portfolio

- Lower carbon emissions focus

- Green energy investments

- Climate-conscious companies

Social Impact Portfolio

- Gender diversity emphasis

- Minority empowerment

- Includes JUST, SHE, VETZ ETFs

3. Innovative Technology Portfolio

- High-growth tech companies

- AI, semiconductors, clean energy, blockchain

- Higher risk/higher potential returns

4. Value Tilt Portfolio

- Focus on undervalued stocks

- Potential to outperform market

- Based on value factor investing

5. Crypto ETF Portfolio

- Bitcoin and Ethereum ETF exposure in taxable and IRA accounts with 1% management fee

- Launched November 2024

- Automatic rebalancing

6. Flexible Portfolio

- Custom asset class weights

- For experienced investors

- Adjust allocations beyond preset models

7. Goldman Sachs Smart Beta

- Risk-adjusted returns

- Factor-based investing

- Institutional-grade strategy

8. BlackRock Target Income

- 100% bonds with various yields and risk tolerance levels

- For higher-income individuals

- Municipal bond optimization

Asset Classes

- US Stocks (large-cap, mid-cap, small-cap)

- International Developed Markets

- Emerging Markets

- US Bonds (government, corporate, municipal)

- International Bonds

- Real Estate (REITs)

- Commodities

Tax Optimization Features

Tax-Loss Harvesting+ (TLH+)

Betterment offers an automated tax loss harvesting feature called Tax Loss Harvesting+ (TLH+), an algorithm that regularly checks for opportunities to sell securities at a loss and replaces them with similar ones, allowing investors to offset taxes on gains and income.

How TLH+ Works:

- Monitors portfolio daily for loss opportunities

- Sells losing positions to realize losses

- Buys similar (not identical) ETF immediately

- Maintains optimal asset allocation

- Protects against violating the wash sale rule across all linked accounts

Tax Benefits:

- Offset short-term capital gains (taxed up to 37%)

- Offset long-term capital gains (taxed up to 20%)

- Deduct up to $3,000 against ordinary income annually

- Carry forward unused losses indefinitely

Performance: 69% of TLH users had fees covered by tax savings in 2022

Tax Coordination

Tax Coordination optimizes asset location across accounts

How It Works:

- Places tax-inefficient assets (bonds, REITs) in tax-deferred accounts (IRAs)

- Places tax-efficient assets (stocks) in taxable accounts

- Minimizes overall tax burden

- Automatic optimization

Additional Tax Features

Tax-Impact Tool:

- Shows how portfolio changes affect your taxes before you act

- Estimates capital gains/losses

- Helps with withdrawal planning

Charitable Giving Tool:

- Donate securities directly through app to your choice of charity, potentially netting you a tax benefit

- Avoid capital gains taxes on appreciated shares

- Receive charitable deduction

Municipal Bonds:

- Available in Target Income portfolio

- Tax-free interest for high-income earners

- State and federal tax benefits

Goal-Based Investing

Multiple Financial Goals

Betterment allows you to create multiple goals within one account:

Retirement

- 401(k) rollover guidance

- Social Security integration

- Required minimum distribution (RMD) planning

- Retirement income strategies

Major Purchase

- Home down payment

- Car purchase

- Wedding planning

Emergency Fund

- Conservative allocation

- High liquidity

- Cash Reserve integration

General Wealth Building

- Long-term growth focus

- Aggressive allocations available

Goal Tracking Features

Visual Progress Monitoring:

- Likelihood of success percentage

- Time to goal achievement

- Required monthly contributions

- Portfolio performance tracking

Personalized Recommendations:

- Increase contributions when behind

- Adjust timeline when ahead

- Rebalance suggestions

- Risk tolerance adjustments

Human Advisor Access

Betterment Premium CFP Services

Betterment Premium offers clients unlimited access to a team of CFPs who offer comprehensive financial planning to clients, including consultation on assets held outside of Betterment

What CFPs Can Help With:

- Retirement planning and projections

- Backdoor Roth IRA conversions

- Tax-efficient withdrawal strategies

- Portfolio rebalancing recommendations

- Major life event guidance (marriage, children, divorce)

- Asset allocation across all accounts

- Social Security claiming strategies

What CFPs DON’T Provide:

- Business planning advice

- Real estate investment guidance

- Active trading recommendations

- Estate planning (20% discount with Trust & Will)

Access Methods:

- Scheduled phone consultations

- Unlimited calls (no per-consultation fees)

- Email follow-ups

- Priority customer service

Digital Plan Support

Available Support:

- Email support during business hours

- Live chat support

- Comprehensive help center

- FAQ database

Limited:

- No phone access to CFPs

- Slower response times during peak periods

Customer Feedback: Digital plan users primarily interact through email and live chat during business hours, which works well for routine questions but can feel limited compared to competitors with 24/7 availability

User Experience and Technology

Mobile App

App Store Ratings:

- 4.8/5 rating on Apple App Store and 4.5/5 on Google Play

- The mobile app design makes it simple to track balances, set up recurring deposits, and monitor progress toward goals

Key Features:

- Portfolio tracking and performance

- Goal progress visualization

- Recurring deposit setup

- Tax document access

- Direct messaging with support

- Cash Reserve management

- Crypto portfolio (if subscribed)

User Feedback: Many users find it especially helpful for staying engaged with long-term investing without needing complex tools

Limitations: The app is light on advanced charting and its crypto dashboard is less developed than core investing features

Website (Desktop)

Platform Features:

- Comprehensive account management

- Detailed portfolio analytics

- Tax-impact simulator

- Goal planning tools

- Performance reporting

- Educational resources

Ease of Use: Highly intuitive interface designed for beginners, with clean navigation and visual goal tracking

Security and Safety

Regulatory Protection

SEC-Registered: Betterment is a registered investment advisor

FINRA/SIPC Member: Securities protected up to $500,000

FDIC Insurance: Cash Reserve funds FDIC-insured up to $2 million ($4 million for joint accounts) once deposited into program banks

Security Measures

Encryption: Bank-level 256-bit SSL encryption

Two-Factor Authentication (2FA): Available for all accounts

Account Monitoring: Unusual activity detection and alerts

Secure Linking: Third-party bank connections through Plaid

Pros and Cons

Betterment Pros

- ✅ Low $10 minimum to start

- ✅ 0.25% management fee (Digital plan)

- ✅ No trading or rebalancing fees

- ✅ CFP access with Premium plan ($100K minimum)

- ✅ Responsive email and chat support

- ✅ 12+ portfolio options, including SRI and crypto ETF

- ✅ Flexible Portfolio customization

- ✅ Tax-Loss Harvesting+ with wash-sale protection

- ✅ Tax Coordination for better asset location

- ✅ 3.75% APY Cash Reserve, up to $2M FDIC insured

- ✅ Free checking with debit card

- ✅ Goal-based interface, great for beginners

- ✅ Highly rated mobile app (4.8 iOS, 4.5 Android)

- ✅ Bankrate’s #1 robo-advisor 2025

Betterment Cons

- ❌ Premium fee high at 0.65%

- ❌ $4/month charge for small balances without deposits

- ❌ 1% crypto portfolio fee

- ❌ CFP access locked to $100K+ accounts

- ❌ Limited live support hours (M–F, 9 AM–8 PM ET)

- ❌ No direct indexing or 529 plans

- ❌ No HSA or custodial accounts

- ❌ Slow support during busy periods

- ❌ US-only availability

- ❌ No international, margin, or options trading

How Betterment Compares

vs. Wealthfront

|

||

|---|---|---|

Management Fee |

0.25% (Digital); 0.65% (Premium) |

0.25% (flat) |

Account Minimum |

$10 |

$500 |

Human Advisors |

Yes (Premium, $100K min) |

No |

Tax-Loss Harvesting |

Standard (all accounts) |

Advanced daily (all accounts) |

Direct Indexing |

No |

Yes ($100K+) |

529 Plans |

No |

Yes |

Portfolio Variety |

12+ strategies |

5-6 options |

Cash Account APY |

3.75% |

3.75% |

Best For |

Beginners, human guidance |

Tax optimization, advanced features |

Winner: Betterment for beginners and human advisor access; Wealthfront for tax optimization and advanced features

vs. Vanguard Digital Advisor

Management Fee |

0.25% |

0.15% |

Account Minimum |

$10 |

$3,000 |

Portfolio Variety |

12+ strategies |

1 standard portfolio |

Human Advisors |

Yes (Premium) |

Limited ($50K+) |

Goal-Based Tools |

Excellent |

Basic |

Brand Trust |

Strong (2008) |

Legendary (1975) |

Winner: Vanguard for lowest fees and brand trust; Betterment for technology, features, and accessibility

vs. Fidelity Go

|

||

|---|---|---|

Management Fee |

0.25% |

$0 (under $25K); 0.35% (over $25K) |

Account Minimum |

$10 |

$10 |

Tax-Loss Harvesting |

Yes |

No (major disadvantage) |

Portfolio Variety |

12+ strategies |

1 standard portfolio |

Cash Management |

Excellent (3.75% APY) |

Basic |

Winner: Fidelity Go for free management under $25K; Betterment for tax optimization and features

Who Should Choose Betterment?

Ideal Candidates

Beginners ($0-$10K)

- First-time investors

- Want simple, automated investing

- Need goal-based guidance

- Appreciate intuitive mobile app

- Don’t want to pick individual stocks

Young Professionals ($10K-$100K)

- Building retirement savings

- Want tax-loss harvesting

- Saving for house down payment

- Prefer hands-off approach

- Value goal tracking

Premium Clients ($100K-$500K)

- Want unlimited CFP access

- Need comprehensive financial planning

- Have assets across multiple institutions

- Willing to pay 0.65% for human guidance

- Appreciate priority support

Socially Conscious Investors

- Want ESG/SRI investment options

- Three distinct SRI strategies (Broad, Climate, Social)

- Willing to accept potentially lower returns for values alignment

Not Right For

Advanced Traders: Limited tools, no direct indexing, no options/futures

Fee-Sensitive Investors: Vanguard charges only 0.15%; Fidelity Go free under $25K

College Savers: No 529 plans (use Wealthfront, Vanguard, or Fidelity instead)

International Investors: US residents only

Small Account Without Auto-Deposits: $4/month fee can be prohibitive (4.8% on $1K account)

Compare

Wealthfront vs Betterment: Comprehensive Comparison Guide for Beginners

Acorns vs Betterment 2026: Which Robo-Advisor Is Best for You?

How to Get Started

Step-by-Step Account Opening

1. Visit Betterment: Go to betterment.com or download mobile app

2. Create Account: Provide email and create password

3. Choose Plan:

- Digital ($10 min, 0.25% fee)

- Premium ($100K min, 0.65% fee)

4. Answer Questions:

- Financial goals (retirement, house, etc.)

- Time horizon

- Risk tolerance

- Age and income

- Investment experience

5. Choose Account Type:

- Taxable (individual, joint, trust)

- Traditional IRA, Roth IRA, SEP IRA

- Cash Reserve

6. Select Portfolio:

- Core, SRI (Broad/Climate/Social), Innovative Tech, Value Tilt, Crypto, Flexible, Smart Beta, Target Income

7. Link Bank Account:

- Instant verification (Plaid)

- Or manual (routing/account numbers)

8. Fund Account:

- Minimum $10 to start investing

- ACH transfer (3-5 days)

- Set up recurring deposits (recommended to avoid $4/month fee)

9. Automatic Investing Begins:

- Portfolio built within 1 business day

- Daily monitoring and rebalancing

- TLH+ activates automatically

Timeline: 5-10 minutes to open; investing begins once funds clear (3-5 days)

Betterment Review: Final Verdict

Overall Rating: 4.5/5 ⭐⭐⭐⭐⭐

Betterment is a clear leader among robo-advisors. For most beginners and intermediate investors seeking automated, goal-based investing with optional human guidance, Betterment delivers exceptional value. The combination of low fees, sophisticated tax optimization, 12+ portfolio strategies, and top-rated mobile app make it the best all-around robo-advisor for 2026.

Get started at: betterment.com

Frequently Asked Questions

Is Betterment safe?

Yes. SEC-registered, FINRA/SIPC member with up to $500K securities protection. Cash Reserve offers up to $2 million in FDIC insurance. Strong security with 2FA available.

What are Betterment’s fees?

0.25% annually for Digital plan, 0.65% annually for Premium plan. $4/month for accounts under $ 20,000 without monthly deposits of $ 250 or more.

Can I talk to a financial advisor?

Yes with Premium plan ($100K minimum), which provides unlimited phone access to certified financial planners. Digital plan has email/chat only.

Does Betterment offer 529 college savings plans?

No. Major gap vs. competitors. Consider Wealthfront, Vanguard, or Fidelity for 529 plans.

How does tax-loss harvesting work?

TLH+ algorithm regularly checks for opportunities to sell securities at a loss and replaces them with similar ones, allowing investors to offset taxes on gains and income.

What’s the Cash Reserve interest rate?

3.75% APY as of September 23, 2025 (variable). Premium clients get additional 0.25% boost.

Can I avoid the $4/month fee?

Yes. Maintain $20K+ across all Betterment accounts OR set up automatic deposits of $250+/month.

Disclaimer: This review is for educational purposes. Investment decisions should be based on your personal situation. All information accurate as of January 2026 but subject to change.