Bybit is a popular crypto derivatives exchange launched in 2018 that allows traders to speculate on cryptocurrency price movements, offering leverage up to 100x.

In 2022, Bybit introduced copy trading, allowing less experienced traders to automatically copy positions opened by more seasoned traders on the platform. This removes the need for constant market analysis or execution of trades yourself.

In this Bybit copy trading guide, we’ll walk through getting set up with an account, connecting with profitable traders, configuring your risk settings, and placing your first copy trade. Understanding the basics is key if you’re considering social crypto trading as an alternative to manual trading. Copy trading has benefits like simplicity and tapping into others’ expertise, but also unique risks to weigh.

Getting Started with Bybit Copy Trading

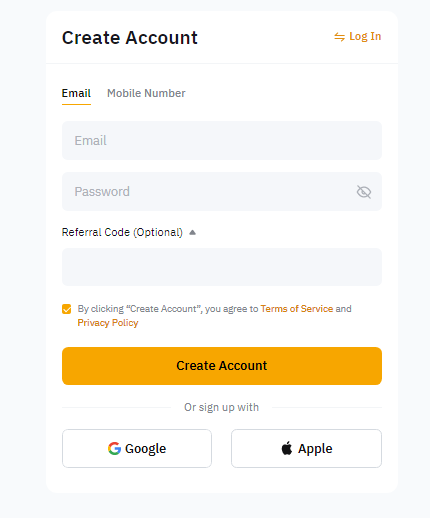

Signing Up for a Bybit Account

The first step is creating your own Bybit account, which just requires an email and password. You’ll need to confirm your email and identity before depositing any funds. The sign-up process is quick and Bybit supports logins using Google, Facebook, Apple, or phone numbers to skip manual form filling.

Funding Your Bybit Account

Once signed up, you’ll need to deposit USDT or other cryptocurrencies into your Bybit wallet to trade with. Bybit allows crypto deposits and withdrawals for free. You can fund your account peer-to-peer using external wallets or purchase crypto directly from payment providers like Banxa.

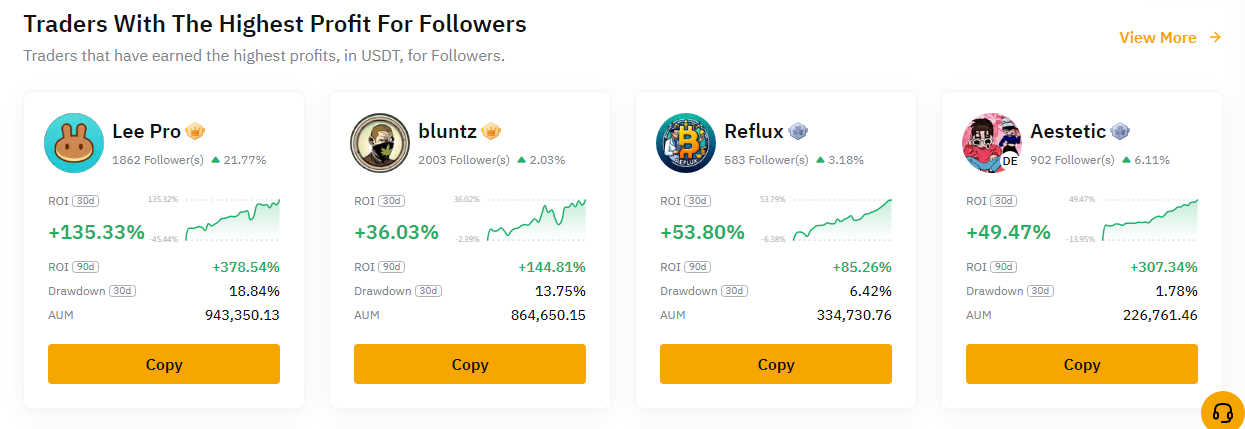

Finding and Selecting Traders

Under the Copy Trading tab, you can browse trader statistics and profiles to find profitable traders with strategies that match your risk tolerance.

It’s important to vet traders thoroughly rather than just picking those with the highest returns. Check their risk scores, follower counts, durations trading with Bybit, and recent performance through market ups and downs.

Configuring Risk Management

You can customize risk management when copying traders, rather than fully mirroring their portfolios. Settings like copy proportion allow you to copy positions at lower size. You can also set a max open order value ceiling to limit your capital at risk per signal. Using stop losses is highly recommended.

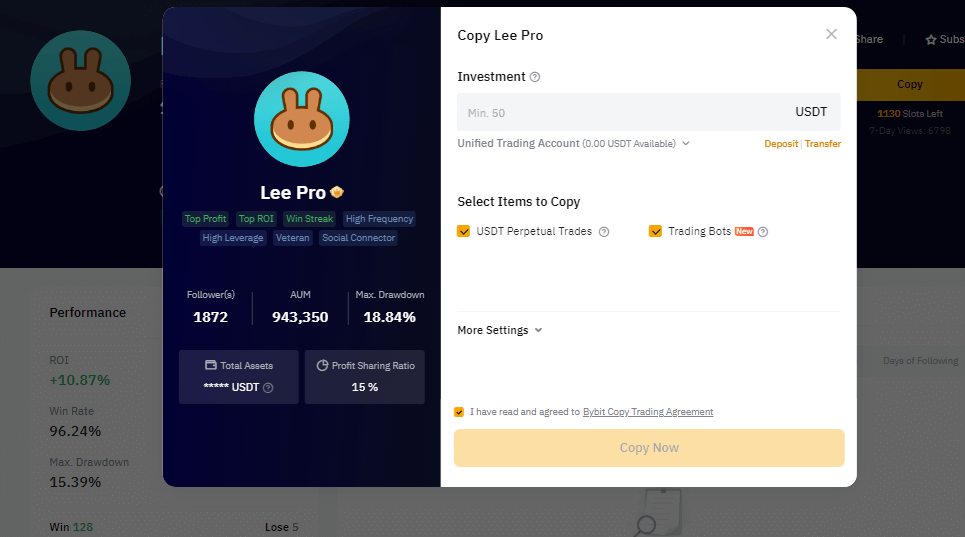

Placing Your First Copy Trade

Once you’ve identified one or more traders to copy, click the copy button on their profile page and allocate a proportion of your Bybit balance towards copy trading.

Every trade they open will then be mirrored into your Bybit account automatically. You can pause, stop or manually close copy trades at any time based on your own risk preferences.

Evaluating Traders to Copy

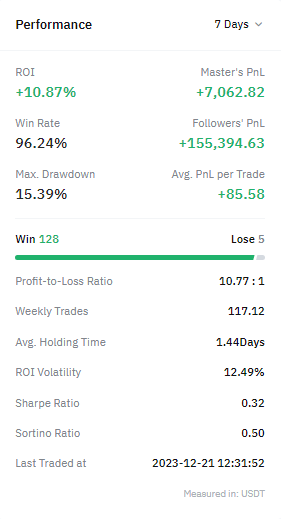

Looking at Profiles and Past Performance

When browsing the catalog of traders on Bybit’s copy trading platform, pay close attention to their historical performance and backgrounds. Check profitability and drawdown metrics over recent months and through various market conditions.

Favor traders with consistent positive returns rather than short-term lucky strikes.

Reviewing Risk Scores and Management

Bybit assigns all copy traders transparent risk scores from 1-10 so you can gauge their risk appetites before copying. Generally, the higher the returns, the higher the risk score. Ensure traders properly utilize tools like take profit limits and stop losses to manage risk, rather than relying solely on leverage.

Considering Copiers and Transparency

In addition to risk scores, the number of current copiers can provide social proof of a trader’s skills. Transparency stats indicate how much insight traders provide into their strategies, signaling credibility. Higher transparency and copier counts signal experienced traders with backtested strategies.

Following Long Term vs Short Term

Some profitable Bybit copy traders specialize in short-term scalping while others focus on long-term positions across crypto market cycles. Assess whether a trader’s typical holding periods align with your investing horizons and risk tolerance before copying.

Key Features and Tools

Configuring Stop Losses and Take Profits

Bybit lets you customize stop losses and take profits to your own risk tolerance when copying others’ trades. Though the copied trader controls entry and exit timing, you decide the loss limits and profit targets applied to your copied positions.

Copy Proportion Settings

Rather than mirroring 100% of traders’ positions, you can choose what proportion to copy, from 10% to 150%. This allows you to scale copied trades to your portfolio size and risk appetite. A lower copy proportion has less risk.

Partial Close Settings

Bybit copy trading includes the option to set automatic partial closes when copied positions reach certain profit thresholds, like 20% or 50% gains. This helps realize some profits while keeping the core position open according to the trader.

Platform Overview

Bybit allows copy trading via its full-featured web trading interface or its mobile apps for Android and iOS. The platform provides insightful dashboards and analytics on trading performance for both traders and copiers.

Analytics for Traders and Copiers

Both traders and copiers get access to tools like detailed statistics on profit and loss, open and closed trades, risk metrics, and more. This empowers informed decisions around risk management when using copy trading services.

Advantages and Disadvantages

Benefits for New Traders

The main appeal of copy trading is simpler crypto participation for new traders. By mirroring skilled traders, you skip the need for technical and fundamental analysis or developing trading discipline around entries/exits. Social trading also provides managed diversification.

Risks of Relying on Others

However, handing control to external traders has inherent risks. Even vetted traders can underperform or blow up accounts during severe market volatility. Bybit provides transparency stats and risk management tools, but copied trading still demands trust without direct accountability.

Transparency and Accountability

While essential for evaluating skill, transparency stats detailing strategy success rates, use of leverage, etc. could be inflated. And if traders take more risks knowing copiers will bear losses, accountability issues arise on Bybit’s trading leaderboards.

Fees and Profit Sharing

Copy Trading Fees

Bybit applies a 10% fee to profits earned from copy trading when you close matched deals. If you earn $100 copying a trade, you keep $90 while $10 goes to Bybit. Partial closes also incur fees. Bybit does not charge subscription fees upfront to use copy trading services.

Distributing Profits and Losses

Gains and losses from copied trades are directly reflected in your Bybit account per the copy proportion you set. If a trade by the copied investor gains 50% and you use a 50% copy proportion on it, your position sees a 25% gain. This allows proportional scaling of results.

By clearly conveying both the advantages like managed diversification and risks like lack of direct accountability, traders can make informed decisions about integrating copy trading into their crypto participation strategies.

Read also! Bybit Card Review

Best Suited Users

Crypto copy trading is best suited for beginner investors lacking the skill, time or desire to actively trade and analyze markets themselves. It allows capitalizing on others’ expertise.

The tool also helps intermediate traders diversify and manage portfolio risk across multiple high-performing trading strategies. Professional money managers could build client bases by showcasing profitable strategies.

Take Away

In summary, Bybit’s crypto copy trading introduces easier access to crypto markets for new traders by mirroring positions from vetted investors. The platform provides helpful analytics and social proofing tools for evaluating traders to copy.

However, handing account control to external traders inherently carries account drawdown risks if markets move against their strategies. Bybit tries to promote accountability through transparent track records, but has room to grow on that front.

As Bybit continues improving copy trading infrastructure, we hope to see continued enhancements like more accountability measures beyond just transparency stats and risk scores for copied traders.

Introducing options to copy portfolios from professional crypto hedge funds through Bybit partnerships could provide more credible and vetted talent to evaluate.

The platform foundations look strong, and copy trading services should only expand and solidify as a simpler gateway to crypto.