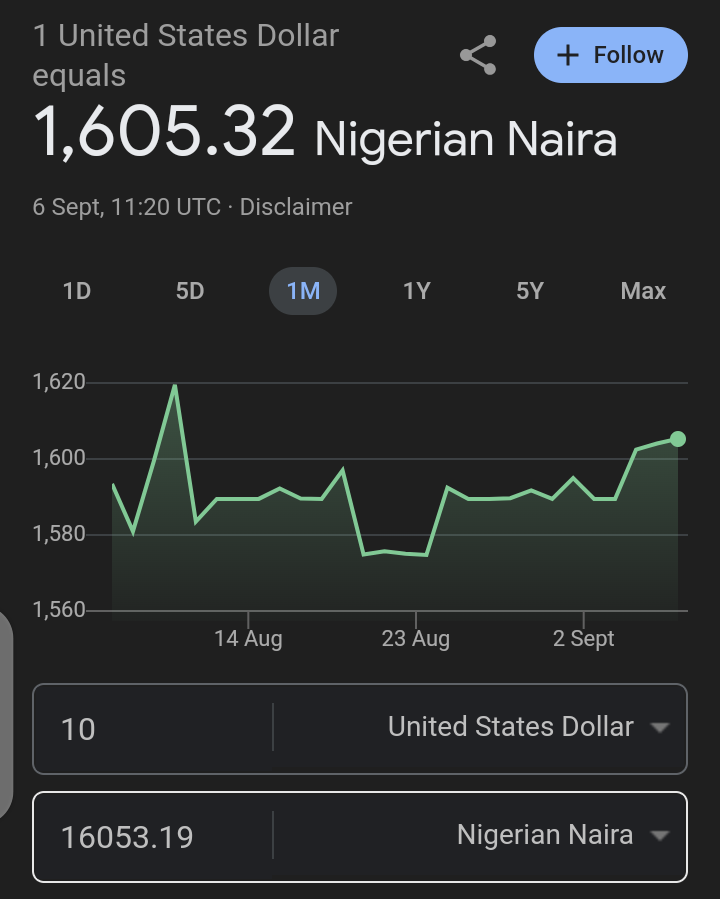

What’s Exness minimum deposit in Nigeria? If you’re looking for the answer to this question, you’re in the right place. The Exness minimum deposit for Nigerian traders is just $10, which is currently equivalent to 10,600 naira. This means that you can afford to try forex trading on this platform without worrying about burning a hole in your pocket. Right?

But for which type of account is this minimum deposit required? The answer might surprise you! And that’s why I’ve put together this easy-to-follow guide.

Before we start, let’s get familiar with this Forex broker.

What Is Exness Broker?

Exness is a well-known online broker that’s been around since 2008. It was started by a group of finance and IT professionals in Cyprus, where its main office is still located. Exness isn’t just some small-time operation – it’s a big player in the forex and CFD trading world, with over 800,000 active traders using its platform.

What makes Exness stand out is its strong reputation for safety and reliability. They have multiple regulatory licenses, which means different government authorities have checked them out and said they’re okay to do business.

Exness also offers something called negative balance protection. In simple terms, this means you can’t lose more money than you put into your account, even if the market goes crazy. They’re also PCI DSS certified, which is a fancy way of saying they use top-notch security to protect your payment information.

If you ever run into trouble, Exness has a customer support team available 24/7 to help you out.

To learn more, read our up-to-date Exness Nigeria Review.

Now let’s get to the reason why you’re here, and it is to find the answers to “what is Exness minimum deposit?”.

Let’s talk about it.

Exness Minimum Deposit In Nigeria

As mentioned in the outset, the minimum deposit at Exness for Nigerian traders is $10. With today’s exchange rate, the least amount of money you need to start trading is around ₦10,605.

It is important for us to stress that the $10 minimum deposit is when you choose a Standard account or a Standard Cent account.

Having said that, let’s break down the four different types of accounts Exness offers:

1. Standard Accounts

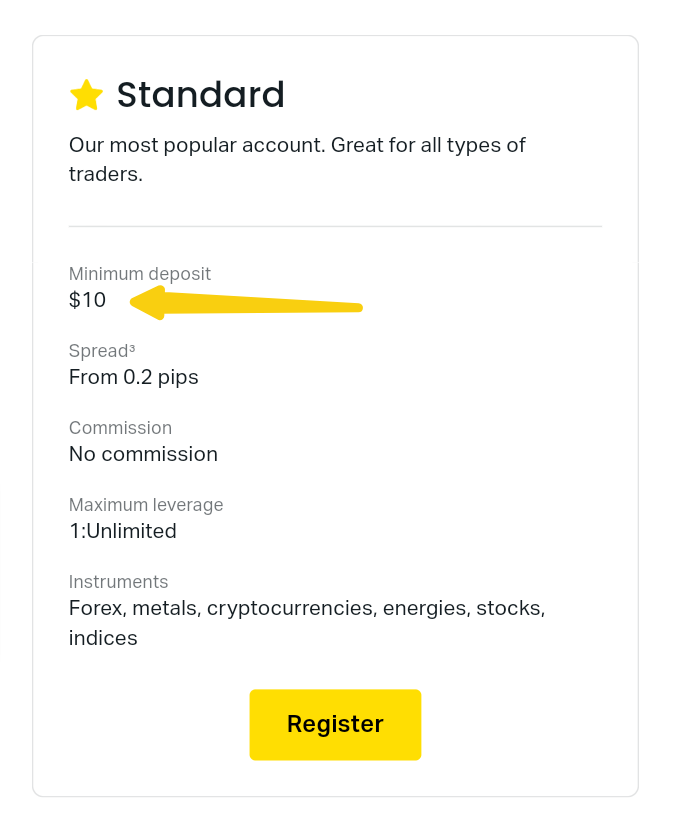

Standard

This is the most popular account. It’s good for all kinds of traders.

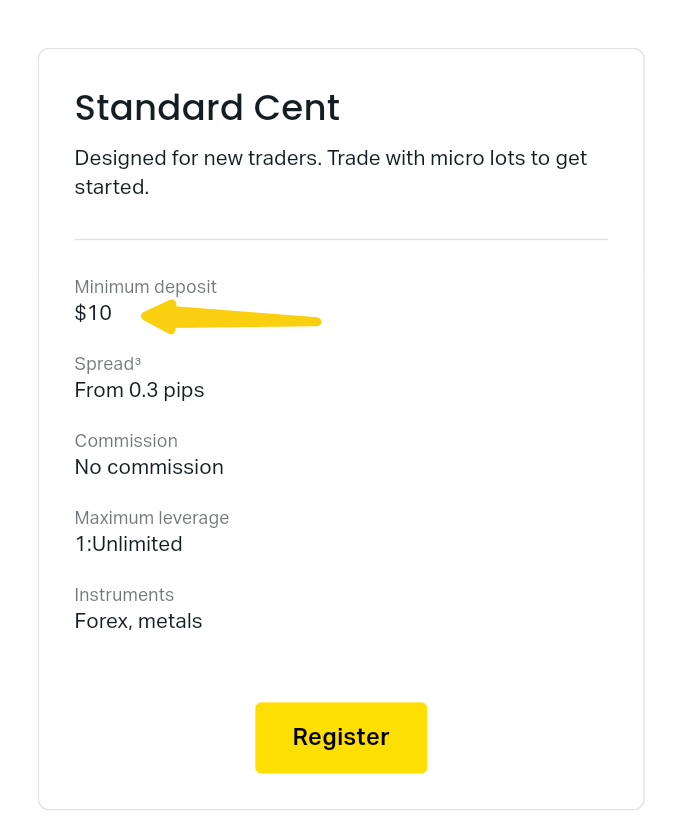

Standard Cent

This one’s designed for new traders. You can trade with very small amounts.

As you can see, both of these trading accounts now let you start with just $10.

Update: Following a recent update, Standard account and Standard Cent account types no longer have a minimum first deposit amount and depend entirely on the minimum deposit amount of the payment method chosen.

2. Professional Accounts

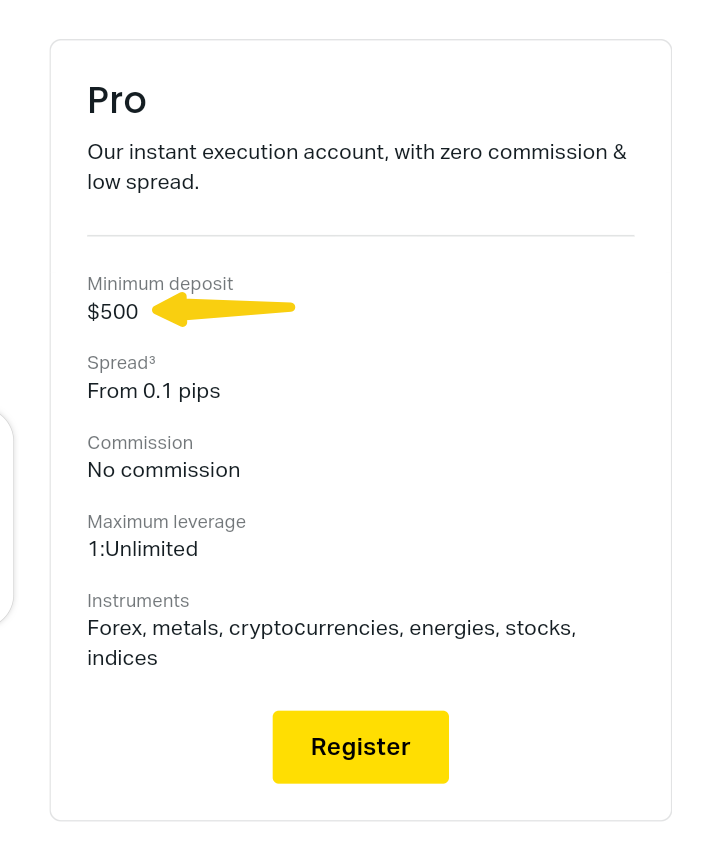

Pro

This account gives you fast trades, no extra fees, and low spreads.

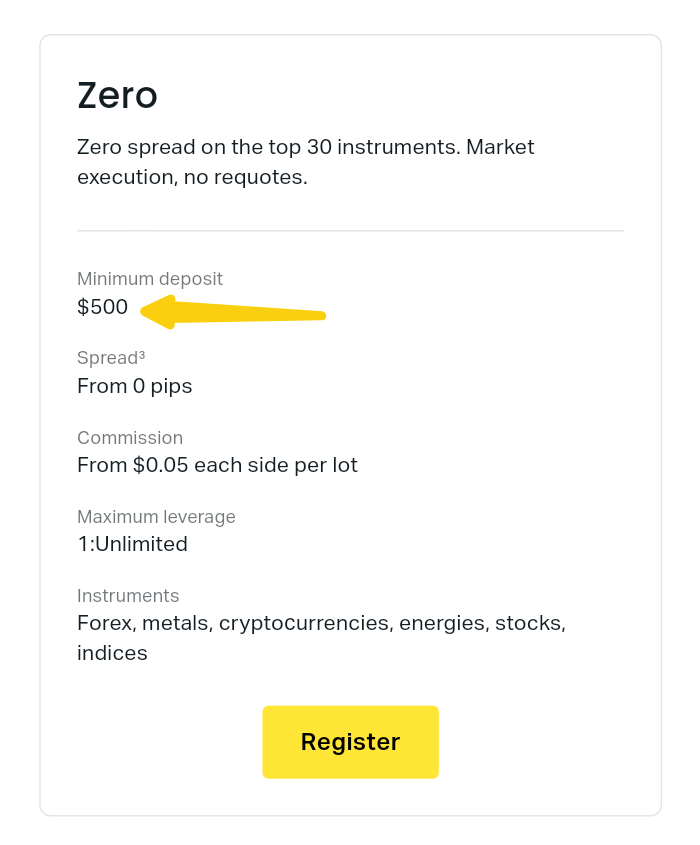

Zero

You pay no spread on the top 30 things you can trade.

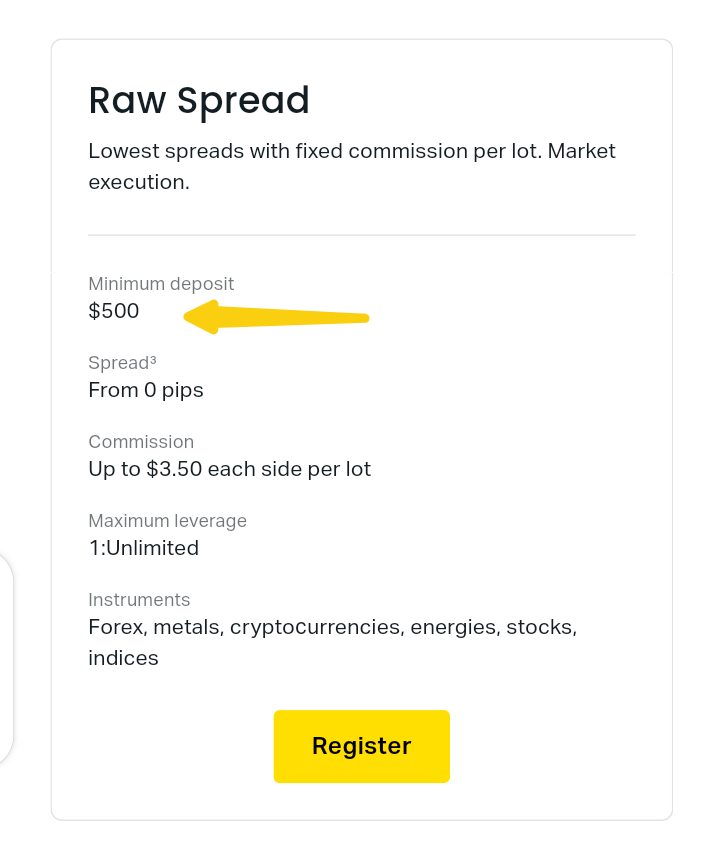

Raw Spread

This gives you the lowest spreads, but you pay a set fee for each trade.

Update: These accounts used to need $500 to start, but now you can open them with just $200.

3. Demo Trading Account

This is like a practice account. You get $10,000 of virtual money to learn with. You can’t withdraw it.

4. Social Trading Accounts:

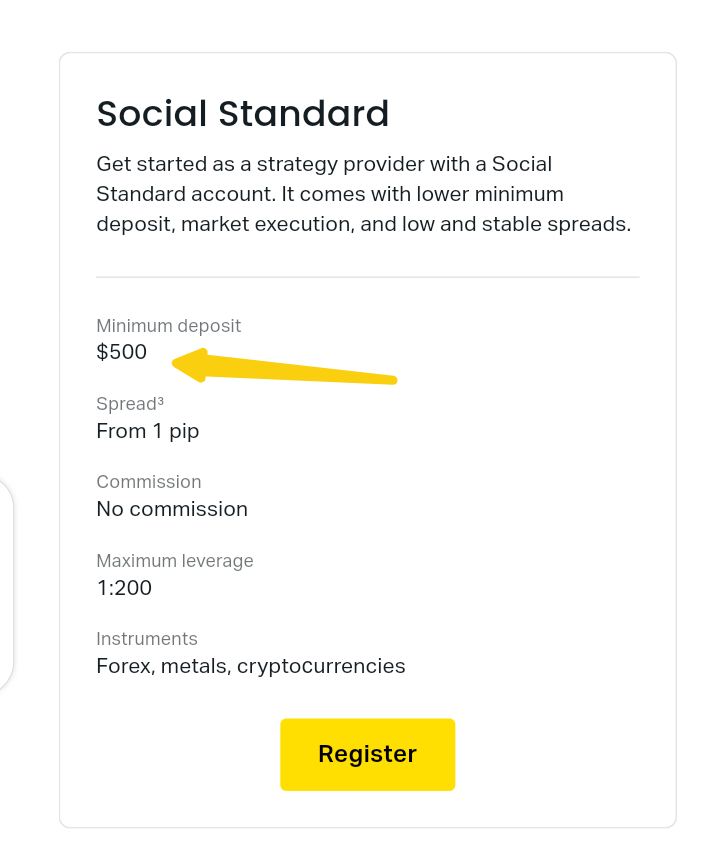

Social Standard

This is for people who want to share their trading ideas. You need $500 to start.

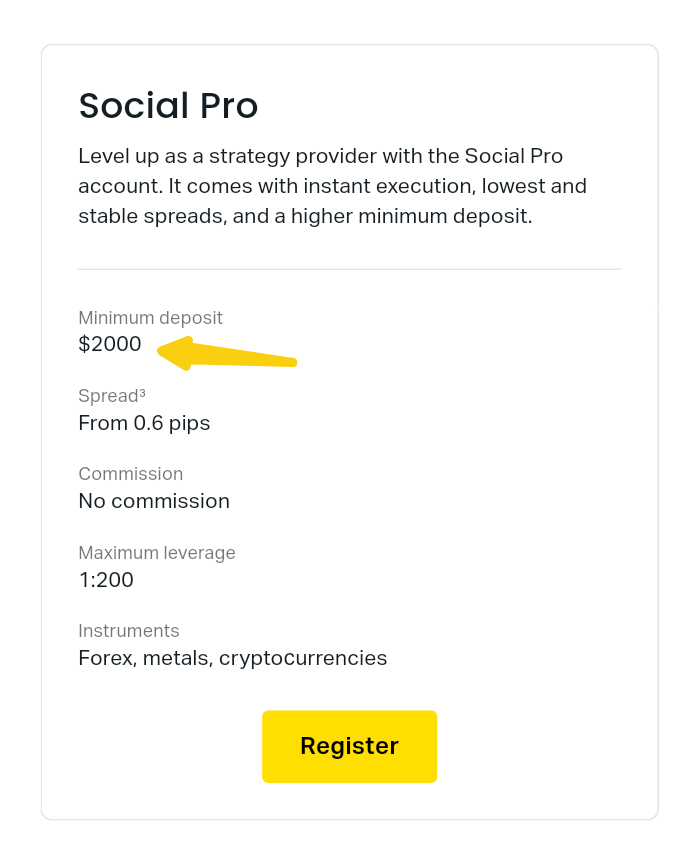

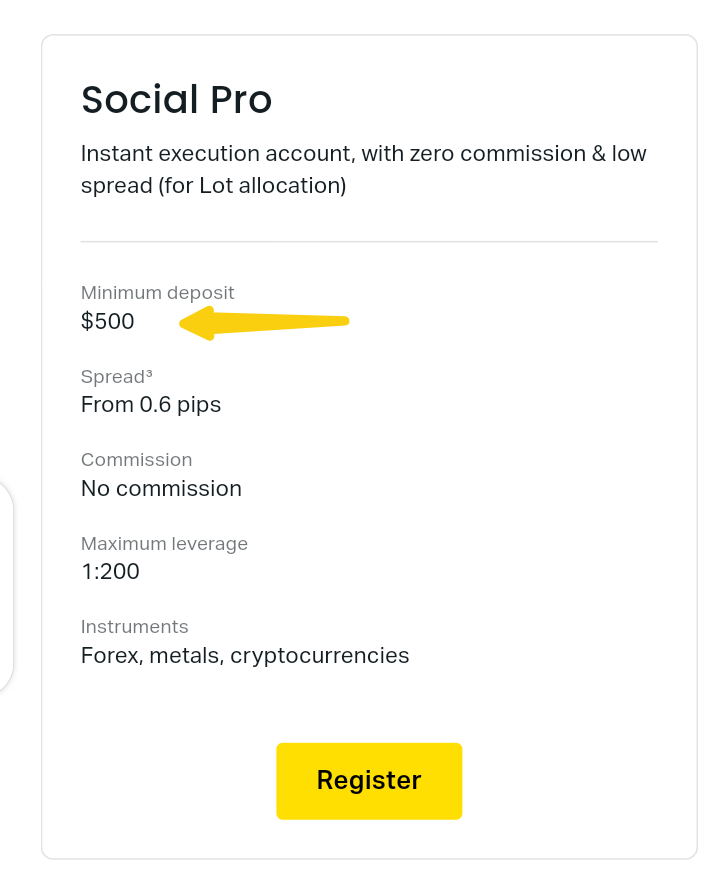

Social Pro

This is for more experienced traders who share ideas. You need $2000 to start.

5. Portfolio Management Accounts:

Social Pro (Lot allocation)

For managing other people’s trades. Needs $500 to start.

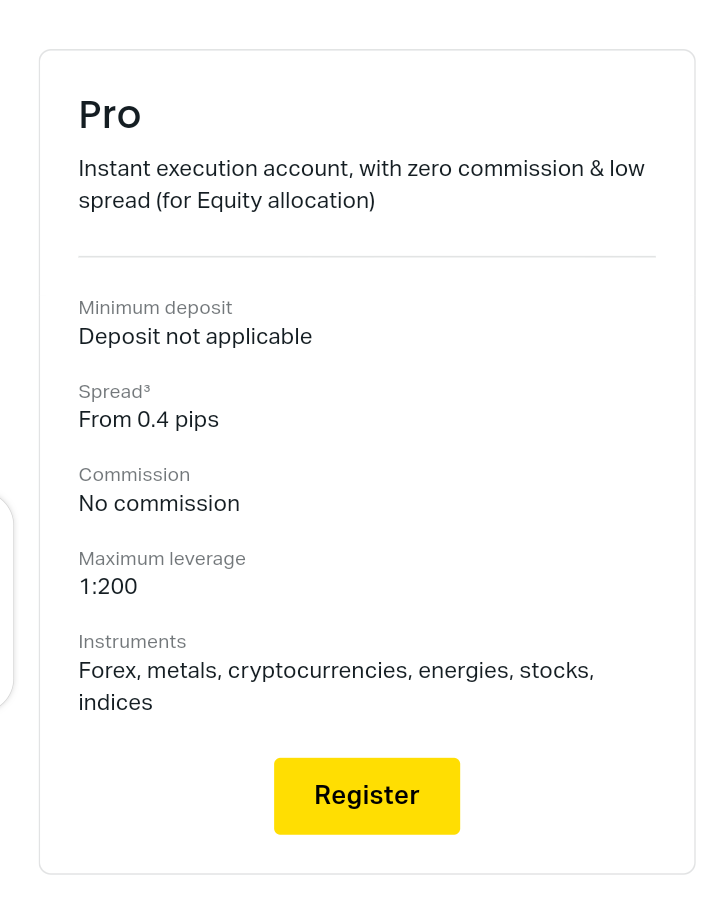

Pro (Equity allocation)

Also for managing trades, but you don’t need to put in your own money.

Remember, the amount you need to start depends on which account you pick. We’ll show you pictures of each account type to prove these numbers are real.

Exness makes it easy to start trading, even if you don’t have a lot of money. You can begin with as little as $10 on some accounts, or practice for free with a demo account. As you get better at trading, you might want to try the more advanced accounts that need more money to start.

Now that you know about the minimum deposits, you might be wondering which Exness account type we recommend.

Which Exness Account Type Should You Choose?

If this is your first time of trading of trading Forex, here’s the account type i’d recommend for you:

👉 Standard Cent Account

-

- Why? You can start with just $10

- Trade with very small amounts (cents)

- Great for learning without risking much

If you have some trading experience:

👉 Standard Account

-

- Also starts at $10

- Regular lot sizes

- Good balance of features for most traders

If you’re already a professional trader or you trade all the time, go for the following accounts:

👉 Pro Account

-

- Minimum deposit of $200

- Faster execution

- Lower spreads (costs) for frequent traders

If you want to copy other traders:

👉 Social Trading Account

-

- Start with $500

- Follow and copy successful traders

Remember, you can always start with a Demo Account to practice for free before putting in real money.

Comparing Exness Minimum Deposit

Let’s see how Exness compares to two top forex brokers in Nigeria, HFM and Octa. Here’s a simple table showing the minimum deposit for each broker:

Broker |

Minimum Deposit |

|---|---|

$10 (₦10,600) for Standard accounts |

|

|

$0 (₦0) for Cent, Zero, and Premium accounts |

$100 (₦50,000) for PRO account |

|

$250 (₦200,000) for PRO PLUS account |

|

|

$25 (₦26,500) for all account types |

$100 (₦106,000) recommended |

Looking at these numbers, we can see that HFM offers some accounts where you can start with no money at all – their Cent, Zero, and Premium accounts have a ₦0 minimum deposit. This is great for absolute beginners or those who want to test the waters without any risk. Exness comes in next, asking for just $10 (about ₦10,600) to get started with their Standard accounts. Octa technically allows you to start with $25 (about ₦26,500) on all their account types, including OctaTrader, MetaTrader 5, and MetaTrader 4, but they recommend starting with $100 (about ₦106,000).

Here’s what I think about this: HFM’s ₦0 minimum for some accounts is fantastic for new traders or those on a very tight budget. It lets you start trading with almost no financial risk. Exness’s $10 minimum is still very low and gives you a bit more flexibility when you start trading. Both are great for beginners.

Octa’s situation is interesting. While you can start with just $25, they recommend $100. This might be because $25 doesn’t give you much room to trade, especially if the market moves against you. Their recommendation of $100 probably allows for more comfortable trading.

Exness Deposit Methods

When its time to fund your Exness account, plenty of options are available to you. Here are the ways you can deposit money in your account:

- Bank Cards: You can use your Visa or Mastercard to add money to your account. It’s quick and easy – the money usually shows up in your account right away.

- Bank Transfer: If you prefer using your bank, you can send money directly from your bank account to Exness. This might take a bit longer (1-5 business days), but it’s a good choice if you’re moving larger amounts of money.

- E-Wallets: Exness works with several online payment systems. You can use Skrill, Neteller, or Perfect Money. These are fast – your deposit will show up in your account almost instantly.

- Local Payment Methods: For Nigerian traders, Exness offers some specific options:

- Paystack: This is a popular choice in Nigeria. It’s quick and lets you use your local bank card.

- Flutterwave: Another good option for Nigerians, allowing for easy local transfers.

- Cryptocurrencies: If you’re into digital currencies, you can deposit using Bitcoin or Tether (USDT). These transfers are usually very quick.

How to Deposit Money on Exness

Putting money into your Exness account is very easy. Here’s a step-by-step guide on how to do that:

- Log in to your Exness account: Go to the Exness website and click on “Personal Area” to log in.

- Go to the Deposits section: Once you’re logged in, look for a button or tab that says “Deposit” or “Fund Account”.

- Choose your deposit method: Pick how you want to add money from the list of options we talked about earlier.

- Enter the amount: Type in how much money you want to deposit. Remember, you can start with as little as $10 for Standard accounts.

- Follow the instructions: Depending on which method you chose, you’ll see different instructions. For example, if you’re using a bank card, you’ll need to type in your card details.

- Confirm the transaction: Double-check all the information and click the button to confirm your deposit.

- Wait for confirmation: Exness will let you know when your deposit has gone through. With most methods, this happens pretty quickly.

A few tips to make things smoother:

- Make sure you’re using a payment method that’s in your name.

- Double-check all the details before you confirm. It’s easier to get it right the first time than to fix mistakes later.

- If you run into any problems, Exness has a support team available 24/7 to help you out.

Remember, the exact steps might look a bit different depending on which deposit method you choose, but these are the general steps you’ll follow. Exness tries to make it as easy as possible to get your account funded so you can start trading.

Wrapping Up Exness Minimum Deposit for Nigerians

As a Nigerian trader, getting started on a global platform like Exness is now more accessible than ever. With the ability to open a Standard account from just 10,600 Naira, or approx $10, the barriers to entering the markets are low.

We covered the range of account options available, as well as the specific minimum deposits for both Naira or foreign currency bases. While the Pro-level accounts require $500, Standard lets you test the markets risk-free from NGN 10,600 only.

So why wait? Register an account to experience these benefits today and pursue your trading aspirations!

Read also ↓

FAQs

- What is the Exness minimum deposit in Nigeria?

With the current exchange rate, the minimum deposit to open an Exness Standard account is 10,600 NGN.

- Can I open an Exness account with $1?

Yes, the Exness Standard account has a minimum deposit of $1 or approx 1,650 NGN. This allows easy market access.

- What deposit options does Exness offer Nigerians?

Payment options include local bank transfers, cards, cash deposits, cryptocurrency, and eWallets like Neteller & Skrill.

- Are there fees for making deposits on Exness?

Deposits through most channels are free, but some payment gateways like eWallets charge transaction fees. Bank cash handling charges may apply too.

- How long do Exness account deposits take to reflect?

Digital transfers through cards and crypto are reflected almost instantly while bank transfers can take 1-3 days to show.

- What is the highest deposit I can make on my Exness Naira account?

There are no set maximum limits for deposits. You can fund any amount based on account limits and trading needs.

- Can I use my GTBank account to fund Exness?

Yes, you can directly deposit or transfer from a GTBank Naira account to your Exness wallet seamlessly.

- Is Skrill good for Exness deposits from Nigeria?

Yes, Skrill eWallet allows cheap, convenient Exness deposits for Nigerians with near-instant transfers.

- Which Exness account has the highest minimum deposit?

The Pro, Raw, and Zero accounts require a $500 minimum deposit, compared to just $1 for the Standard account.

- What is the best deposit method for Exness from Nigeria?

Local bank transfers offer the optimal balance of affordability, speed, and reliability for Nigerian Exness customers.