Is Exness the right broker for South African traders? Our Exness South Africa Review examines licensing, account types, and user experiences to help you decide. See why traders rate this broker highly for transparency and reliability.

Is Exness regulated in South Africa?

Yes. Exness is regulated in South Africa by the Financial Sector Conduct Authority (FSCA) under FSP number 51024. The broker operates locally as Exness ZA (PTY) Ltd, holds an ODP license, and complies with South African client fund protection and fair-trading regulations.

Exness South Africa Review– Key Facts

Feature |

|

|---|---|

Broker Name |

Exness |

Regulated in South Africa |

Yes |

Regulator |

FSCA |

FSP Number |

51024 |

Local Entity |

Exness ZA (PTY) Ltd |

ODP License |

Yes |

Founded |

2008 |

Minimum Deposit |

~200 ZAR |

Withdrawals |

98% processed in seconds |

Platforms |

MT4, MT5, Web, Mobile |

Negative Balance Protection |

Yes |

What Is Exness?

Exness is a global multi-asset forex and CFD broker founded in 2008 by Petr Valov, who also serves as the company’s Founder and Chief Executive Officer (CEO).

Over the years, Exness has grown from a small trading startup into one of the largest and most recognized brokers globally, serving both retail and professional traders—including a rapidly growing base of South African clients.

Today, Exness operates with more than 2,000 employees representing over 100 nationalities, reflecting its strong international presence and diverse leadership structure. The broker maintains 13 offices worldwide, spread across five continents, including key financial hubs in Europe, Africa, Asia, the Middle East, and Latin America. This global scale allows Exness to provide localized services, regulatory compliance, and multilingual support tailored to regions like South Africa.

As you will see in our Exness South Africa review, the broker offers access to a wide range of financial markets, including forex, commodities, indices, stocks, and crypto CFDs, through industry-standard platforms like MetaTrader 4 and MetaTrader 5.

What makes Exness stand out—especially for both beginners and experienced traders—is its clear focus on fair trading conditions. The broker is widely known for low and stable spreads (particularly on gold), flexible leverage options, and execution speeds that appeal to active traders.

Before evaluating spreads, platforms, or features, the most important question remains trust. That leads us directly to the issue traders care about most: regulation and legitimacy.

Is Exness Broker Legitimate?

Yes—Exness is a legit broker operating under multiple well-known financial authorities worldwide. One of the strongest trust signals is that Exness publicly displays all its license numbers at the bottom of its website, allowing traders to independently verify each authorization directly on the regulator’s official website. This level of transparency is uncommon in the industry and strongly supports Exness’ legitimacy.

Rather than operating under a single license, Exness runs through separate legal entities, each regulated according to the laws of the region it serves. This approach ensures that traders receive protections aligned with their local regulatory framework, whether they are trading from Africa, Europe, or other global markets.

Some of Exness’ notable global regulatory licenses include:

- United Kingdom – Regulated by the Financial Conduct Authority (FCA)

- Kenya – Regulated by the Capital Markets Authority (CMA)

- Cyprus / EU – Regulated by CySEC

- Multiple offshore jurisdictions – Used strictly for international operations under regulatory oversight

This multi-layered regulatory structure significantly reduces counterparty risk and shows that Exness operates as a serious, long-term financial institution, not a fly-by-night broker.

With that foundation established, the next step is to answer the most important question for local traders.

Is Exness Regulated in South Africa?

Yes, Exness is regulated in South Africa through its local entity, Exness ZA (PTY) Ltd, which is officially registered and authorized by the Financial Sector Conduct Authority (FSCA)—the country’s primary financial regulator.

Here are the verified regulatory details for Exness in South Africa:

- Registered company name: Exness ZA (PTY) Ltd

- Company registration number: 2020/234138/07

- FSCA authorization: Financial Services Provider (FSP) No. 51024

- ODP authorization: Approved Over-the-Counter Derivatives Provider

- Registered address:

1st and 2nd Floor, Merchant House

19 Dock Road, V & A Waterfront

Cape Town, 8001

This license can be verified on the FSCA website. Exness publicly displays its license numbers. The registered office in Cape Town can be independently verified.

With regulation and legitimacy firmly established, the next step is to examine how safe Exness really is, including fund security, account protection, and cybersecurity measures.

Is Exness Safe to Trade With in South Africa?

Beyond regulation, Exness invests heavily in technical and operational security, ensuring that South African traders’ accounts, funds, and personal data remain protected at all times.

Account-Level Security

Exness accounts use multiple verification layers to prevent unauthorized access:

- Phone or email verification for account actions

- Time-based One-Time Passwords (TOTP) (available in certain regions)

- Six-digit confirmation codes required for sensitive actions

- Unique Support PIN, used as the highest level of identity verification when contacting customer support

Only one security method can be active at a time, but it can be changed under strict conditions, reducing the risk of account compromise.

Platform and Infrastructure Security

At the infrastructure level, Exness applies enterprise-grade protections, including:

- Web Application Firewall (WAF) to block malicious attacks

- DDoS protection, ensuring platform stability during high traffic or attack attempts

- Zero Trust security model, meaning every access request is verified

- Bug Bounty program, encouraging ethical hackers to report vulnerabilities

- Regular internal security audits and ongoing cybersecurity training for staff

Payment and Trading Protections

To further protect traders, Exness implements:

- Segregated client accounts

- 3D Secure payment verification

- Real-time monitoring of transactions

- Negative Balance Protection, even during extreme volatility

For South African traders, these measures collectively ensure that both capital and personal information are safeguarded, even when trading actively or using leverage.

Exness Reputation and Transparency

Reputation is one of the strongest long-term trust indicators—and this is where Exness performs particularly well. Unlike brokers that operate quietly behind offshore registrations, Exness maintains a visible, verifiable, and public presence, including in South Africa.

Exness employs over 2,000 professionals globally, with many listed openly on LinkedIn—something scam brokers typically avoid. The company also maintains physical offices, including its registered South African office in Cape Town, which traders can independently verify.

In terms of public engagement, Exness maintains an active presence across multiple social media platforms, where it:

- Shares market updates and trading insights

- Communicates platform changes and product updates

- Engages with traders during major market events

- Participates in industry conferences and financial expos

This consistent visibility builds long-term trust and signals that Exness is operating as a serious, regulated financial company, not a short-term brokerage.

Combined with verifiable regulation, fast withdrawals, and strong security infrastructure, Exness’ reputation supports one clear conclusion for South African traders: this is a broker that prioritizes transparency, accountability, and trader protection.

Awards and Industry Recognition

One of the strongest signals of a broker’s industry standing and credibility is the awards and recognitions it receives from reputable organizations. Exness has accumulated several noteworthy accolades that reinforce its position as a serious global player—not just a small or obscure broker.

Recent Industry Awards

Exness has been recognized across multiple international events and fintech expos, reflecting its performance and reputation:

- 🏆 Best Broker – MEA 2025 (iFX EXPO Dubai) – a key regional award for excellence in service and trust within the Middle East and Africa.

- 🏆 Most Trusted Broker – MEA 2025 (iFX EXPO Dubai) – highlights consistent trust signals and client confidence.

- 🏆 Best Broker in LATAM 2025 at the UF Awards (iFX Expo LATAM) – showing global reach and recognition beyond Africa.

- 🏆 Best Multi-Asset Broker & Most Trusted Broker in Africa (FMAS 2024) – recognised for strong multi-asset offerings and reliability in African markets.

These awards demonstrate Exness’ consistent performance, industry respect, and regional relevance, especially in markets comparable to South Africa’s active trading community.

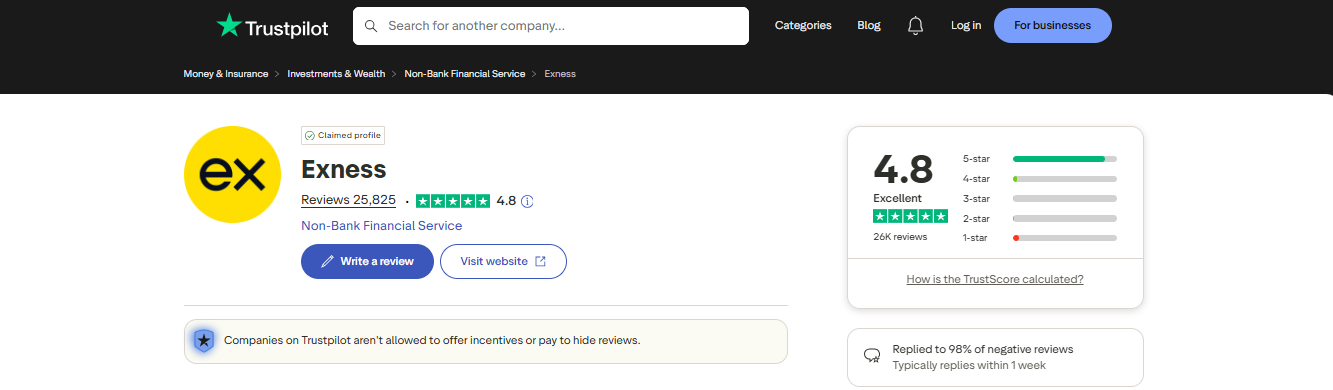

Exness Trustpilot Rating and User Reviews

Exness has a large footprint on review platforms, with thousands of trader reviews offering insight into real experiences.

Trustpilot Snapshot

- 4.8 / 5 TrustScore based on over 25,000 reviews on Trustpilot.

- High percentage of 5-star ratings, with users frequently highlighting fast deposits/withdrawals and user-friendly platforms.

What Traders Praise

Many reviews highlight positive elements such as:

- Fast execution and reliable price feeds.

- Instant deposit and withdrawal processing with minimal delays.

- Clean and intuitive user interface, suitable even for beginners.

- Low cost and tight spreads compared to other brokers.

Constructive Feedback and Caveats

Like all large brokers, Exness also has users reporting issues (which is common in online CFD trading):

- Occasional experiences with platform quirks or technical delays.

- Some traders comment on price charting limitations or outdated features relative to advanced third-party tools.

Overall take for South African traders: the Trustpilot consensus leans strongly positive, indicating high satisfaction with execution quality, service, and transparency—especially withdrawal experience, which is a key trust metric in the region.

Trading Platforms Available on Exness

Exness offers a range of platforms designed to suit both new traders and seasoned pros, from mobile apps to powerful desktop software. As a South African trader, platform choice is critical—whether you trade forex, gold (XAUUSD), indices, or other CFDs.

Core Platforms Supported

Exness supports multiple platforms, each with its unique strengths:

- MetaTrader 4 (MT4) – classic trading platform popular with beginners and expert advisors (EAs).

- MetaTrader 5 (MT5) – upgraded platform with advanced charting tools, more timeframes, and additional analytical indicators.

- Exness Trade App – mobile-first platform that lets you trade, manage accounts, and withdraw funds on the go.

- Exness Terminal (WebTrader) – browser-based platform with TradingView charting, no download required.

- Web and Mobile Versions of MT4/MT5 – full trading capabilities accessible across devices.

Platform Features at a Glance

- 📊 MT5 is ideal if you want deep technical analysis, multi-asset access, and automated trading (EAs).

- 💼 MT4 remains excellent for straightforward forex strategies and community Expert Advisors.

- 📱 Exness Trade App makes managing positions and funds easy from smartphones.

- 🌐 Exness Terminal provides convenient web-based trading with real-time charts.

For South African traders who value flexibility, Exness’ platform suite covers desktop, mobile, and web experiences, making it easy to switch between devices without losing functionality.

Trading Instruments and Markets

Exness offers South African traders access to a broad, well-balanced range of CFD markets, suitable for both short-term traders and longer-term speculators. This variety allows traders to diversify strategies without needing multiple broker accounts.

Forex Market

Forex is Exness’ strongest offering and where most South African traders begin.

- Major pairs (EUR/USD, GBP/USD, USD/JPY, etc.)

- Minor and cross pairs

- Selected exotic pairs

Liquidity is deep, execution is fast, and spreads remain competitive even during active trading sessions—key for day traders and scalpers.

Commodities (Strong Focus on Gold)

Gold (XAUUSD) is one of the most actively traded instruments among South African traders, and Exness is widely known for low and stable spreads on gold.

- Gold (XAUUSD)

- Silver (XAGUSD)

- Oil and other energy products

This makes Exness particularly attractive for traders who focus on precious metals and macro-driven strategies.

Indices

Traders can access major global indices, allowing exposure to broader market movements without trading individual stocks.

- US, European, and Asian indices

- Suitable for swing trading and news-based strategies

Stocks (CFDs)

Exness provides access to selected global equities via CFDs, allowing traders to speculate on price movements without owning the underlying shares.

Crypto CFDs

Crypto trading is available as CFDs, allowing traders to speculate on price movements without owning digital assets directly.

- Bitcoin

- Ethereum

- Other major cryptocurrencies

⚠️ As with all leveraged products, crypto CFDs carry higher risk and are better suited to experienced traders.

Spreads, Commissions, and Trading Costs

Trading costs directly impact profitability, especially for active traders. Exness is known for maintaining transparent and competitive pricing, which is a major reason it remains popular in South Africa.

Spreads

Exness offers both spread-only and raw spread pricing models, depending on the account type.

- Tight spreads on major forex pairs

- Low and stable spreads on gold (XAUUSD), even during volatile periods

- Minimal spread widening compared to many competitors

Stable spreads are particularly important for scalpers and gold traders, where small price differences matter.

Commissions

- Some professional account types charge a fixed commission per lot, paired with raw spreads

- Standard accounts typically include costs within the spread, with no separate commission

This flexibility allows traders to choose pricing that fits their trading style.

Swap Fees (Overnight Charges)

- Swap fees apply when positions are held overnight

- Swap-free (Islamic) options are available, which is relevant for many traders in South Africa

Fees Transparency

One notable trust signal is that Exness:

- Does not charge hidden deposit or withdrawal fees

- Clearly displays trading costs within the platform

- Allows traders to review real-time pricing and tick history

For South African traders, this transparency reduces unpleasant surprises and improves long-term cost control.

What leverage does Exness offer in South Africa?

Exness offers up to 1:Unlimited leverage on forex, up to 1:2000 on gold (XAUUSD), up to 1:200 on indices, and up to 1:400 on crypto CFDs, depending on account equity and market conditions.

What Leverage Does Exness Offer to South African Traders?

Leverage is one of Exness’ most talked-about features, and unlike many brokers that cap leverage strictly, Exness offers clearly defined, instrument-based leverage limits that South African traders should understand before trading.

Forex Leverage

For forex trading, Exness offers very high leverage, depending on account equity and market conditions:

- Up to 1:Unlimited leverage on major and minor forex pairs

- Available when account equity is below certain thresholds

- Automatically reduced as equity increases to manage risk

This makes Exness particularly attractive to experienced traders, scalpers, and intraday traders who rely on small price movements. However, beginners should approach high leverage cautiously, as it magnifies both profits and losses.

Gold and Metals Leverage

Gold (XAUUSD) is one of the most traded instruments in South Africa, and Exness provides competitive leverage here as well:

- Gold (XAUUSD): up to 1:2000 leverage

- Other metals generally offer lower but still flexible leverage

This combination of tight spreads and high leverage on gold is one of the key reasons Exness is popular among gold-focused traders.

Indices Leverage

Leverage on indices is more conservative due to higher volatility:

- Typically up to 1:200 on major global indices

- May be reduced during high-impact news events or market stress

Crypto CFDs Leverage

Due to extreme volatility, crypto leverage is intentionally limited:

- Up to 1:400 on major crypto CFDs (varies by asset)

This protects traders from excessive risk while still allowing exposure to crypto price movements.

Margin Requirements (How Much Capital You Need)

Margin requirements at Exness are calculated in real time and depend on:

- Instrument traded

- Leverage selected

- Trade size (lot volume)

- Current market volatility

Before placing any trade, Exness displays:

- Required margin

- Free margin

- Margin level after execution

This transparency allows South African traders to plan positions accurately and avoid unnecessary stop-outs.

Risk Controls and Protection

To balance high leverage, Exness enforces strict protection mechanisms:

- Negative Balance Protection (you cannot lose more than your deposit)

- Automatic leverage reduction during major news events

- Stop-out protection to prevent account wipeouts

- Real-time margin monitoring

For South African traders, this means Exness offers one of the most flexible leverage structures in the market, but with clear safeguards in place to prevent catastrophic losses.

Execution Speed and Order Quality

Execution quality is where many brokers quietly fail—and where experienced traders quickly notice the difference. For South African traders who scalp, trade gold (XAUUSD), or enter during volatile sessions, execution speed and price accuracy matter just as much as spreads.

Exness uses a market execution model, meaning trades are filled at the best available market price without dealer intervention. There are no requotes—orders are either filled or experience slippage based on real market conditions.

What This Means in Practice

- Orders are executed in milliseconds, even during high-liquidity periods

- Both positive and negative slippage are possible (a key fairness signal)

- No manual trade manipulation or price freezing

Exness also provides real-time tick history, allowing traders to verify price movements and execution accuracy independently. This level of transparency is especially valuable for South African traders who want proof that pricing aligns with the broader market.

Because of this execution model, Exness is well-suited for:

- Scalpers

- Gold traders

- Day traders

- Automated trading (EAs)

For a broker offering high leverage and tight spreads, the execution quality at Exness is consistently reliable, which reinforces its credibility as a serious trading platform.

How Do Exness Deposits and Withdrawals Work in South Africa?

Deposits and withdrawals are one of the clearest real-world tests of a broker’s trustworthiness. Exness performs exceptionally well here, particularly for speed and transparency, which is why it has built strong loyalty among South African traders.

Deposits

Exness supports multiple deposit methods accessible to South African clients, including:

- Bank cards

- Electronic payment methods

- Other region-supported instant options

The minimum deposit is $50 (often around 800 ZAR), making Exness accessible to beginners while still suitable for professionals.

Deposits are typically:

- Instant

- Free of internal broker fees

- Credited automatically to the trading account

Withdrawals (Where Exness Truly Stands Out)

Exness is widely known for its near-instant withdrawals, processing approximately 98% of withdrawal requests in seconds.

Key withdrawal highlights:

- Most withdrawals complete in under one minute

- No hidden withdrawal fees charged by Exness

- Funds are returned using the same method used for deposit

- Requests are processed 24/7, including weekends

This level of withdrawal efficiency is rare in the industry and strongly supports Exness’ reputation for financial transparency. Many South African traders test this by making a small deposit and withdrawal—and quickly understand why Exness’ withdrawal system is so highly rated.

How to Open an Exness Account in South Africa (Step-by-Step)

Opening an Exness account from South Africa is straightforward and can be completed in minutes.

Step 1: Register an Account

- Visit the official Exness website

- Click Sign Up

- Enter your email address and create a password

- Select South Africa as your country of residence

Step 2: Verify Your Identity (KYC)

To comply with FSCA regulations, Exness requires verification:

- Upload a valid ID (passport, national ID, or driver’s license)

- Provide proof of address (utility bill or bank statement)

Verification is usually completed quickly, often within the same day.

Step 3: Choose an Account Type

Select an account based on your trading needs:

- Standard accounts for beginners

- Professional accounts for advanced traders

- Swap-free options if required

Step 4: Set Up Your Trading Platform

- Download MetaTrader 4 or MetaTrader 5, or

- Use Exness Terminal (web-based), or

- Install the Exness Trade App on mobile

Step 5: Make Your First Deposit

- Choose a payment method

- Deposit the minimum required amount

- Funds are credited instantly in most cases

Once funded, you can begin trading immediately.

Exness Account Types Explained (Which One Is Best?)

Exness offers multiple account types, each designed for a specific trading style. Choosing the right account matters, as it directly affects spreads, commissions, execution, and leverage.

Standard Account (Best for Beginners)

The Standard account is the most commonly used option by new South African traders.

- No commission (costs included in spreads)

- Stable spreads across major forex pairs and gold

- Low minimum deposit (method-dependent, often around 800 ZAR)

- Suitable for manual trading and learning strategies

This account is ideal if you’re starting out or trading smaller position sizes.

Professional Accounts (For Experienced Traders)

Exness offers several professional-grade accounts designed for active and high-volume traders.

Raw Spread Account

- Raw spreads starting from 0.0 pips

- Fixed commission per lot

- Preferred by scalpers and intraday traders

Zero Account

- Zero spread on selected instruments during most trading hours

- Commission applied instead of spread

- Popular with precision traders and EA users

Pro Account

- No commission

- Very tight spreads

- Fast execution for high-volume traders

Swap-Free (Islamic) Accounts

- Available to South African traders who require swap-free trading

- No overnight interest charges on eligible instruments

Each account type is clearly structured, allowing traders to match costs and execution style to their strategy.

Education, Trading Tools, and Market Analysis

While Exness is not positioned as a full trading academy, it provides practical tools and resources that support decision-making—especially useful for traders who already understand the basics.

Trading Tools

South African traders have access to:

- Economic calendar

- Margin and pip calculators

- Real-time price feeds

- Tick history for price verification

These tools help traders plan entries, manage risk, and understand market conditions more clearly.

Market Analysis

Exness regularly publishes:

- Market insights

- Trading ideas

- Commentary around major economic events

These resources are particularly useful for traders who want context and confirmation, rather than step-by-step lessons.

Beginner Learning Curve

While Exness does not overwhelm beginners with theory-heavy courses, its clean platform design, transparent pricing, and low minimum deposit make it a practical environment for learning through real market exposure.

Customer Support for South African Traders

Reliable customer support is often overlooked until something goes wrong. Exness performs well here, offering fast, accessible, and knowledgeable support.

Support Channels

South African traders can reach Exness via:

- Live chat

- Email support

- In-platform messaging

Support Quality

- Quick response times

- Clear explanations of technical and account-related issues

- Assistance with verification, withdrawals, and platform setup

Support is available 24/7, which is especially helpful for traders who operate outside standard market hours or trade international sessions.

Pros and Cons of Trading With Exness

No broker is perfect, and a credible review must show both strengths and limitations. Here’s a balanced breakdown for South African traders.

Pros

- FSCA regulated in South Africa (FSP 51024, ODP licensed)

- Fast withdrawals (≈98% processed in seconds)

- Low and stable spreads, especially on gold (XAUUSD)

- High leverage availability, including up to 1:Unlimited on forex

- Negative Balance Protection

- Multiple trading platforms (MT4, MT5, Web, Mobile)

- Transparent pricing with no hidden deposit or withdrawal fees

- Strong security infrastructure and segregated funds

Cons

- High leverage may be risky for beginners without proper risk management

- Education resources are practical but not academy-level

- Some advanced features vary by region and account type

Overall, the pros significantly outweigh the cons—especially for traders who value speed, regulation, and pricing transparency.

Who Should Use Exness in South Africa?

Exness is not designed for one type of trader—it caters to a wide range of experience levels. That said, it clearly suits certain profiles more than others.

Exness Is Ideal For:

- South African traders who prioritize FSCA regulation

- Forex and gold (XAUUSD) traders

- Scalpers and intraday traders who need fast execution

- Traders who want quick access to their funds

- Experienced traders who can responsibly use high leverage

Exness May Not Be Ideal If:

- You want structured, classroom-style trading education

- You are uncomfortable managing risk with leverage

- You prefer a broker focused solely on long-term investing rather than CFDs

Understanding who the broker is built for helps set realistic expectations—and avoids misuse of features like high leverage.

- Exness vs Octa: Which Should You Choose?

-

FSCA Regulated Forex Brokers in South Africa (2026 Verified List)

AI Summary: Is Exness Legit in South Africa?

-

FSCA regulated (FSP 51024)

- Licensed ODP provider

- Local registered entity in Cape Town

- Fast withdrawals (98% in seconds)

- Strong security & fund protection

- Suitable for beginners and advanced traders

Final Verdict: Is Exness a Good Broker for South African Traders?

Yes—Exness is a legitimate, regulated, and safe broker for South African traders.

With FSCA authorization, a verifiable local presence, strong security systems, fast withdrawals, and competitive trading conditions, Exness meets the core criteria that serious traders look for. Its transparency around licensing, pricing, and execution further strengthens its credibility.

Exness is not just “popular”—it is operationally solid, technically reliable, and financially transparent. For traders in South Africa who want a broker that combines local regulation with global scale, Exness stands out as one of the better options available today.

FAQs

Is Exness regulated in South Africa?

Yes. Exness is regulated by South Africa’s FSCA under FSP 51024 and operates locally as Exness ZA (PTY) Ltd.

Is Exness a real broker or a scam?

Exness is a real broker that has been operating since 2008. It has verifiable licenses, physical offices, publicly listed employees, and millions of active traders worldwide.

Is Exness safe for beginners in South Africa?

Yes. Exness offers FSCA oversight, segregated funds, negative balance protection, and fast withdrawals.

What is the minimum deposit on Exness in South Africa?

The minimum deposit is $50—often around 800 ZAR.

How fast are Exness withdrawals?

Approximately 98% of withdrawals are processed in seconds, making Exness one of the fastest brokers in the industry.