FBS is an international broker and a well-recognized brand in the Forex and CFD trading industry. Headquartered in Cyprus, FBS serves over 27 million clients across 150 countries including Nigeria.

While FBS does not have a localized office in Nigeria yet, traders can open an account, deposit funds, and access global markets easily with them. But questions around regulation status, legal compliance, and security arise on how suitable FBS truly is for your trading needs against local broker options.

In this detailed review, we evaluate if FBS checks all aspects such as licensing, trading features, payments and customer service desired by Nigerian traders – to determine if its a recommended choice over other top brokers in Nigeria.

Is FBS Regulated & Licensed in Nigeria?

As a global broker, FBS holds regulation licenses from CySEC and IFSC which allows it to offer trading instruments to most jurisdictions legally.

However, when it comes to Nigeria, FBS is not regulated nor has a license from regulators like the Securities and Exchange Commission of Nigeria (SEC) or Nigerian Investment Promotion Commission (NIPC).

But from our checks, FBS adheres to all local Anti-Money Laundering (AML) protocols and Know Your Customer (KYC) policies for Nigerian clients during onboarding and transactions. This ensures compliance from a regulation standpoint.

Additionally, under the CySEC license, FBS is permitted to take international clients from countries classified as “third countries” by European MiFID regulation. Nigeria falls under such a safe third country category.

Thus, in essence, FBS operations remain legal for Nigerian traders to consider its services on a legitimate basis comparable to locally regulated entities.

Now that the regulation angle is covered in this FBS Nigeria review, next, we evaluate if the actual trading conditions like fees, platforms, and payments also fit Nigerian trader requirements.

Trading Conditions

FBS offers three account types suitable for traders of all skill levels. Importantly for Nigeria, local Naira funding is supported now for deposits between 1,300 NGN to 4,000,000 NGN as well as withdrawals from 1,200 NGN to 2,000,000 NGN via bank transfers.

The minimum trading size is 0.01 lots allowing traders with even modest capital to open positions across forex, indices, commodities etc. Maximum leverage permitted is 1:3000 with no hidden fees or requotes.

The average EUR/USD spread on Standard account is around 1.2 pips suitable for both high volume and casual traders. For habitual traders, zero-spread accounts are available where spreads start from 0 pips during periods of high market liquidity.

With Naira funding capability and generally favorable trading conditions, FBS offers a compelling proposition for Nigerian retail traders to consider over locally regulated brokers as well.

Security & Protection

From a security standpoint for Nigerian clients, FBS implements required identification checks, personal information verification and screening procedures as mandated locally for KYC and AML compliance.

User data is encrypted using 128 SSL bit protection and kept on secure cloud servers. Two-factor authentication is also facilitated as an added account protection layer against unauthorized access along with option of setting trading session limits, deal cancellation etc.

At the financial level, FBS maintains segregated accounts in European banks to store client funds separately from company funds which allows easier withdrawal tracing and governance against defaults or misuse as required by CySEC policies.

The security protocols guarantee privacy and fund protection – though lack of registration implies a relatively lower recourse in extremely rare cases of broker disputes versus domestically regulated brokers.

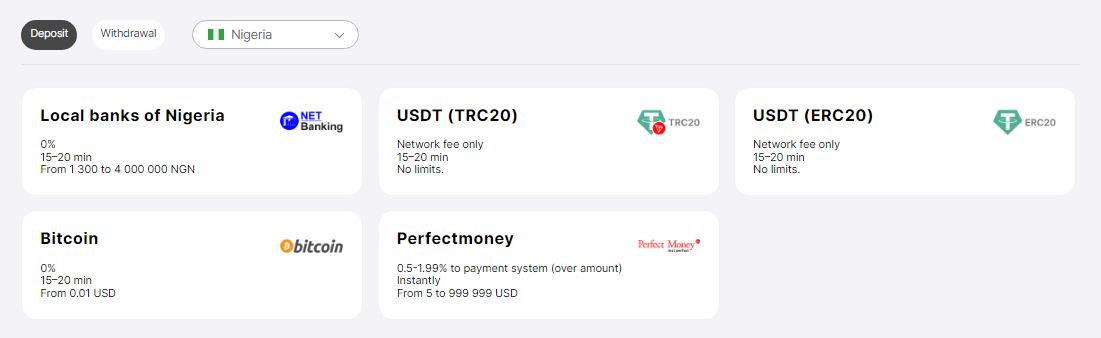

Deposits & Withdrawals

For Nigerian traders, FBS now facilitates Naira deposits between 1,300 NGN and 4,000,000 NGN via local bank transfers with processing times between 15-20 minutes.

Withdrawals are also possible in Naira currency with amount limits of 1,200 NGN to 2,000,000 NGN with standard processing duration of max 7 business days. FBS charges 2.5% fee plus 150 NGN on Naira withdrawals – which is comparable to other brokers.

For Nigerian clients, available deposit and withdrawal methods with FBS include – Bank Transfer, Debit/Credit Cards, Neteller, Skrill, Perfectmoney, and Bitcoin. Nearly all options facilitate Naira funding without conversion fees. No deposit fees are applied while typical withdrawal charges range from 2% to 5% depending upon the method chosen.

The payments landscape seems to adequately cater to the needs of the Nigerian retail trading community across both deposits and withdrawals.

Trading Platforms

FBS offers the globally popular MetaTrader 4 & 5 platforms for Nigerians with advanced charting, technical indicators, EA integration, and risk management tools. Access is provided via user-friendly web, Windows, and mobile apps.

For rookie traders, FBS also provides a simpler proprietary web platform with one-click trading execution and basic analytics functionality such as live quotes, intraday charts, configurable indicators, etc.

The backtesting feature facilitates checking the viability of custom strategies on historical data before committing real capital. While platform research capabilities are quite strong, a lagging aspect is the absence of any locally relevant news/analysis within platforms to guide trading decisions.

Overall, technology infrastructure for trade execution and analysis for Nigerians matches offerings from domestic brokers. Significantly, prior experience of platforms like MT4/5 allows an easier transition for traders moving to FBS.

Education & Support

FBS offers a selection of educational materials under its Trading Academy portal including video courses, ebooks, glossary and webinars covering forex basics to technical/fundamental analysis to strategy building.

While these resources are more generic rather than localized for Nigeria, they still provide a strong foundation for beginners to get started.

For customer assistance, FBS provides 24X7 multilingual Live Chat, Email and Phone support. Nigerian traders can get quick resolution around account queries, deposits/withdrawals, technical issues etc aided by the localized payments capabilities.

FBS Nigeria Review – Conclusion

To conclude this review, FBS comes across as a well-regulated international broker catering adequately to the needs of retail traders from Nigeria seeking forex, CFDs, crypto, and share trading.

The account types, platforms technology, educational content, and multilingual customer service matches offerings from domestic brokers. Local Naira funding and low trading costs give it an extra edge.

We can comfortably recommend FBS for both novice Nigerian traders and seasoned investors looking for a reliable but cost-effective alternative to homegrown players. It finds a balance between security and localized access one expects as a Nigerian trader exploring international brokers.

As the next steps, getting direct licenses from Nigerian agencies in the future would further boost trust and coverage of local market intricacies beyond just payments. But overall FBS clears the bar to merit consideration among the best forex brokers for Nigeria.

FAQs

- Is FBS allowed to offer trading services to Nigerians?

Yes. While not directly regulated in Nigeria, FBS abides by local financial laws under its CySEC license. Nigerian clients can legally trade forex, CFDs, crypto, stocks etc with FBS in a compliant manner.

- Does FBS feature Naira account funding and withdrawals?

FBS supports Naira deposits between 1,300 to 4 million NGN via bank transfers with no fees. Withdrawals up to 2 million NGN per week can be made to local Nigerian bank accounts attracting small 2.5% charges as per market standards.

- What is the minimum deposit and average spread for Nigerians on FBS?

You can open an account with FBS with deposit as little as $5. Average EUR/USD spreads for Standard accounts is around 1 pip or lower suitable even for high frequency traders after best pricing.

- How is Nigerian customer data protected and funds secured at FBS?

FBS implements the highest encryption standards for securing client data and privacy along with segregated bank accounts as per regulations to store trader deposits separately.

- What platforms and account types does FBS offer for Nigerian clients?

FBS provides access to MT4/MT5 platforms along a simpler proprietary web trader for beginners. Account offerings include Cent, Standard and Zero accounts catering to traders of all capital and skills levels with maximum 1:3000 leverage.