Thinking about starting with FTMO in 2026? This February, FTMO expanded its product lineup by launching a new 1-Step Challenge, giving experienced traders a faster route to a funded account while maintaining its original 2-Step model for those who prefer a more gradual evaluation.

In this FTMO review, we examine everything you need to know before you start prop trading.

What Is FTMO?

FTMO is a proprietary trading firm designed to bridge the gap between skilled traders and the capital they need to succeed. Its unique model offers traders the opportunity to prove their skills through a structured evaluation process. Once traders demonstrate their ability to trade consistently and responsibly, FTMO provides them with a funded account to trade with zero personal financial risk.

The concept is simple but powerful: FTMO takes on the financial risk while traders focus on what they do best—trading. By combining strict risk management rules with innovative tools and resources, FTMO has created a pathway for traders to transition from retail trading to managing professional-level accounts.

History and Mission

FTMO started in 2014 in a small office in Prague, initially under the name Ziskejucet.cz. It was born out of a shared frustration among a group of day traders who recognized that success in trading required more than just skill—it demanded discipline, structure, and access to capital. This realization led the founders to create a solution for traders who wanted to refine their strategies, manage risks better, and access more funding.

In 2017, the project expanded internationally and rebranded as FTMO. Since then, it has grown into a globally recognized firm with the mission to help traders achieve their full potential. FTMO’s approach is rooted in the idea that when traders succeed, so does the firm. This alignment of interests drives FTMO to provide tools, education, and guidance that empower traders to thrive in the markets.

FTMO is available in most countries worldwide, including recent re-openings for traders in the United States and India, following regulatory adjustments and partnerships. (We cover regional access in detail below.)

Read Also:

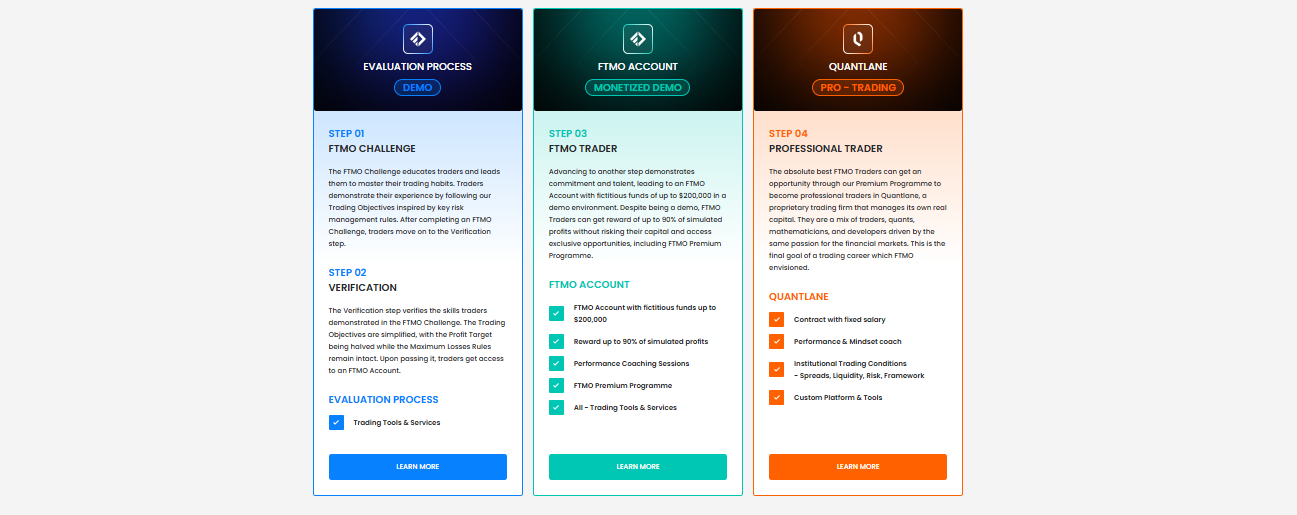

How FTMO Works

The FTMO Challenge is the first step in becoming an FTMO Trader and is designed to test a trader’s skill, discipline, and adherence to specific trading rules. This step ensures that traders possess the risk management abilities and consistency needed to handle capital responsibly. The process consists of two main stages: the FTMO Challenge and the Verification, followed by earning an FTMO Account.

FTMO Review: Challenge and Verification Process

As of 2026, FTMO offers two evaluation models: the traditional 2-Step Challenge and the newer 1-Step Challenge, designed for more experienced traders who want a faster path to funding.

FTMO Challenge: 2-Step (Classic Model)

This is FTMO’s original evaluation structure and remains popular among traders who prefer a gradual qualification process.

Step 1 – FTMO Challenge

- Profit target: 10%

- Maximum daily loss: 5%

- Maximum total loss: 10%

- Time limit: Typically 30 days

Step 2 – Verification

- Profit target: 5%

- Maximum daily loss: 5%

- Maximum total loss: 10%

- Time limit: Typically 60 days

Once both steps are passed, traders receive an FTMO Account with profit splits starting at 80% and scaling to 90%.

FTMO Challenge: 1-Step (New in 2026)

The FTMO 1-Step Challenge is designed for experienced traders who want a faster and more direct route to funding.

Key rules include:

- Single evaluation phase (no second step)

- Profit target: 10%

- Maximum loss: 10% end-of-day trailing balance-based limit

- No time limit to reach the profit target

- Profit split: 90% from the first payout

- Best Day Rule: No single trading day can account for more than 50% of total profits

Once traders meet these requirements, they receive an FTMO Account immediately, without a verification stage.

Comparing FTMO 1-Step vs 2-Step Challenge

FTMO 1-Step |

FTMO 2-Step |

|

|---|---|---|

Evaluation Phases |

1 |

2 |

Profit Target |

10% |

10% + 5% |

Maximum Loss |

10% (EOD trailing) |

10% static |

Daily Loss Limit |

No |

Yes (5%) |

Time Limit |

None |

Yes |

Profit Split |

90% from start |

Starts at 80%, scales to 90% |

Best For |

Experienced traders |

Beginners to intermediate traders |

Verification Process

Once traders successfully complete the FTMO Challenge, they move to the Verification stage, which serves as the final evaluation phase. The Verification process maintains most of the rules from the Challenge but with reduced demands:

- Trading Objectives:

- Profit Target: The profit target in the Verification stage is typically half that of the Challenge (e.g., $500 for the $10,000 account).

- Maximum Daily Loss and Maximum Loss: These limits remain the same as in the Challenge stage.

- Minimum Trading Days: Similar to the Challenge, traders must trade for at least 4 days during Verification.

- The reduced profit target allows traders to demonstrate consistency without feeling excessive pressure.

Becoming an FTMO Trader

After successfully completing both the FTMO Challenge and Verification, traders are granted an FTMO Account. With this account, traders gain access to company capital and can begin trading without any profit target. Traders must still adhere to FTMO’s risk management principles, such as the Maximum Daily Loss and Maximum Loss limits, ensuring a sustainable and responsible trading environment.

The FTMO Challenge and Verification process is designed to filter out undisciplined traders while equipping determined traders with the opportunity to trade professionally under ideal conditions.

FTMO Review: Account Types

The FTMO Account is the ultimate destination for traders who successfully complete the FTMO Challenge and Verification phases. This account is a professional trading account funded by FTMO, allowing traders to operate with significantly larger capital than they may have access to personally. The structure of the FTMO Account is designed to align the interests of both FTMO and the trader, fostering a mutually beneficial relationship where both parties profit from successful trading outcomes.

Account Types and Currencies

FTMO Accounts are available in various balance sizes to suit different trading needs. Traders can choose from account balances of $10,000, $25,000, $50,000, $100,000, or even $200,000. These accounts are denominated in multiple currencies, including USD, GBP, EUR, CZK, CAD, AUD, and CHF, ensuring flexibility for traders worldwide.

Trading Periods and Objectives

Once a trader gains access to an FTMO Account, the trading period becomes unlimited, giving traders the freedom to focus on long-term profitability rather than short-term gains. While the profit target requirement is removed at this stage, risk management objectives such as the Maximum Daily Loss and Maximum Loss limits remain in place to ensure disciplined trading. This approach encourages sustainable growth and helps traders maintain consistency in their performance.

Scaling Plan

FTMO offers a unique Scaling Plan for traders who demonstrate consistent profitability and effective risk management. Under this plan, traders’ account sizes can grow by 25% every four months, provided they meet specific criteria. This scaling mechanism allows traders to handle larger capital progressively and increase their earnings potential while maintaining their trading discipline.

FTMO Review: Trading Platforms

FTMO offers flexibility when it comes to the platforms available for trading, allowing traders to choose the platform they are most comfortable with.

You can access your FTMO Challenge, Verification, and FTMO Account via some of the most popular retail trading platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- DXtrade

- cTrader

These platforms are known for their user-friendly interfaces, powerful charting tools, and extensive market access, making them ideal for both beginner and professional traders alike. Traders can choose the platform that best suits their trading style and needs during the FTMO Challenge Configurator.

Please note, however, that US nationals and residents of US overseas territories (including Guam, American Samoa, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands) are not allowed to use MetaTrader or cTrader platforms.

FTMO also allows the use of VPN and VPS services for improved connectivity and performance, except when accessing MetaTrader and cTrader accounts from the United States geolocation. Traders traveling to the US should refrain from logging into these accounts from there.

Risk Management

FTMO’s foundation is built on robust risk management principles. These principles are not only the cornerstone of FTMO’s operations but also a critical aspect of a trader’s journey to long-term success. The rules in place ensure that traders develop disciplined habits and minimize unnecessary risks, protecting both the trader and FTMO’s capital.

Maximum Daily Loss

One of the key components of FTMO’s risk management system is the Maximum Daily Loss limit. This rule ensures that traders cannot lose more than 5% of their account balance in a single day. This includes both realized and unrealized losses, as well as any commissions or fees. By adhering to this limit, traders are encouraged to manage their positions prudently and avoid emotional decision-making during periods of volatility.

Maximum Loss

The Maximum Loss rule sets a hard stop for the total drawdown a trader can incur on their FTMO Account. Typically capped at 10% of the account balance, this rule safeguards the account from excessive losses and ensures that traders operate within a controlled risk framework. This guideline reinforces the importance of a sound trading strategy and disciplined execution.

Encouraging Disciplined Trading

The risk management rules are designed to foster disciplined trading habits, which are crucial for long-term success in the markets. By adhering to these guidelines, traders learn to approach the markets with a strategic mindset, focusing on consistency rather than chasing unrealistic profits.

Tools to Support Risk Management

FTMO provides a range of tools to help traders adhere to these risk management principles. Tools like the Account MetriX and Mentor App allow traders to monitor their progress, set custom alerts, and ensure compliance with the trading objectives. These tools empower traders to maintain discipline and refine their strategies over time.

In summary, FTMO’s risk management principles are not just rules to follow; they are essential practices that help traders navigate the challenges of the financial markets. By incorporating these principles into their trading routines, traders can build a foundation for sustainable success.

Coaching

Trading is as much a mental game as it is about strategy and analysis. The ability to maintain emotional control under pressure is crucial to long-term success. FTMO recognizes this and provides dedicated resources to help traders overcome psychological challenges.

One of the standout features of FTMO’s offering is its Performance Coaches. These certified professionals work with traders to address undesirable habits such as overtrading, revenge trading, and succumbing to fear or greed. The coaches use tailored questions and guidance to help traders identify the root causes of their behaviors, fostering a deeper understanding of their psychological tendencies. This collaborative approach leads to actionable solutions, enabling traders to cultivate discipline and resilience.

Additionally, the Mentor App is a unique tool designed to strengthen discipline and enforce adherence to trading rules. It monitors trading objectives, provides real-time feedback, and acts as a safeguard against impulsive decisions. Whether you’re struggling with overtrading, chasing losses, or breaking risk-limits, the Mentor App ensures that you remain focused and disciplined.

FTMO Review: Tools and Resources

FTMO provides a wide range of tools and resources designed to help traders enhance their performance, improve risk management strategies, and build the mental resilience needed for consistent success. These resources are divided into bundles tailored to various stages of a trader’s journey.

Starter Bundle

The Starter Bundle includes essential tools that are perfect for both beginners and experienced traders entering the world of FTMO. Upon registration, the following tools are unlocked:

- Economic Calendar:

FTMO’s Economic Calendar, sourced from Forex Factory, highlights significant market-moving events. It also identifies restricted trading events for FTMO accounts. Regular use of the calendar helps traders anticipate market responses to key announcements, fostering informed decision-making. - FTMO Academy:

The FTMO Academy offers foundational knowledge on financial markets, trading instruments, and risk management. Through comprehensive materials, traders can refine their strategies and avoid common pitfalls, all while practicing in a risk-free environment. - FTMO Discord Community:

A vibrant online space where traders can collaborate, share insights, and learn from one another. With dedicated channels for education, strategy discussion, and motivation, the FTMO Discord ensures traders are always connected to a supportive network.

Free Trial Bundle

For those exploring the FTMO platform, the Free Trial Bundle provides a hands-on experience of the evaluation process. This bundle includes tools to analyze trades and strategies:

- Account Analysis:

Gain an objective perspective on your trading results with detailed metrics and indicators. FTMO’s Account Analysis identifies strengths and areas for improvement, helping traders optimize their strategies. - Account MetriX:

A web-based application that provides an overview of your progress during the FTMO Challenge, Verification, or Free Trial. It tracks trading objectives, displays key statistics, and ensures you stay on target. - Timezone Converter:

Designed to prevent confusion over time zones, this tool aligns trading objectives with Central European Time (CE(S)T), helping traders comply with FTMO rules.

If you succeed in multiple Free Trial attempts, you may have what it takes to conquer the complete FTMO Challenge. Let this motivate you to begin your path toward joining our elite trading team.

However, keep in mind that performing well in Free Trials does not guarantee automatic approval for an FTMO Account. Even with strong Free Trial results, you must still successfully complete the full Evaluation Process to become an official FTMO Trader.

FTMO Challenge Bundle

For traders undertaking the FTMO Challenge, this bundle includes advanced tools to simplify trading and enhance performance:

- Equity Simulator:

Simulate potential equity curve scenarios and prepare for market uncertainties. This tool provides insights into drawdowns and probabilities, enabling traders to manage expectations and refine risk management. - Live MetriX:

Similar to Account MetriX, Live MetriX tracks progress in real time during the FTMO Challenge and Verification phases. It offers a comprehensive view of trading objectives and key performance statistics. - News Indicator:

Avoid trading during restricted macroeconomic news events with this MetaTrader platform indicator. It highlights events directly on your charts, ensuring compliance with FTMO guidelines. - Quick Trade Manager:

This app simplifies trade execution by allowing traders to set parameters like Take Profit, Stop Loss, and Trailing Stop before entering a trade. It promotes efficient risk management and precise order execution. - FTMO Renko:

A custom indicator that integrates Renko charts into the MetaTrader platform. Unlike traditional charts, Renko focuses solely on price movement, helping traders identify trends more effectively.

FTMO Trader Bundle

Once traders graduate to becoming FTMO Traders, they gain access to specialized tools and support to further their development:

- Mentor App:

Strengthen your trading discipline with the Mentor App. It enforces adherence to your trading rules, monitors risk limits, and provides valuable feedback to prevent overtrading or impulsive decisions. - Performance Coaches:

Certified coaches work with traders to address emotional challenges, cognitive biases, and undesirable habits. By fostering self-awareness and offering tailored strategies, these coaches help traders improve decision-making and trading outcomes.

Additional Tools

FTMO also offers several standalone tools that are beneficial for all traders:

- Trading Journal: Automatically logs trades and allows traders to add comments, screenshots, and reflections to refine their strategies over time.

- Statistical App: Provides data-driven insights into market behavior, enabling traders to make more informed decisions.

- Calculators: Simplify the calculation of position sizes, pip values, and margins to ensure accurate trade entries.

These tools and resources collectively make FTMO a well-rounded platform that prioritizes trader growth and success.

Deposit and Withdrawal at FTMO

FTMO offers flexible and secure payment methods for both deposits and withdrawals to ensure a smooth trading experience for its users. Below are the key options available:

Deposit Methods

- Bank Transfer:

Time: 2-5 business days

Fee: Varies by country

The traditional and widely-used option, suitable for those who prefer standard banking channels. - Credit/Debit Card (Nuvie & Checkout):

Time: Instant

Fee: Free

Quick and easy payment through major credit cards like VISA, Mastercard, Maestro, and Discover. - Skrill:

Time: Instant

Fee: 3%

A popular e-wallet for instant transactions with a minimal fee. - Cryptocurrencies (CONFIRMO & LetKnow Pay):

Time: Up to 24 hours

Fee: 3%

For those who prefer using digital currencies like Bitcoin and Ethereum, crypto payments offer an efficient way to deposit.

Withdrawal Methods

Withdrawals are processed within 1-2 business days, and you can choose from:

- Bank Wire Transfer:

Withdraw your reward directly to your bank account with no additional commission fees, ensuring a reliable transfer method. - Skrill:

Fast and straightforward with no extra fees for processing. - Cryptocurrency:

Quick crypto withdrawals with the same 3% fee as deposits.

Reward Payouts

Once you’ve reached a profit on your FTMO Account, you can request your 80% profit payout (90% with the Scale-Up plan). There are no hidden fees; however, minimum profit requirements are set to cover transaction costs:

- Bank Wire: $20 minimum

- Crypto Withdrawals: $50 minimum

The one-time fee for the FTMO Challenge (which covers all services and platforms) will be reimbursed when you successfully complete the Evaluation and make your first withdrawal.

Note: Payments via bank transfer are unavailable for residents of Venezuela, Cuba, Sudan, and Ukraine due to regulatory restrictions. Always check the current status for your country.

FTMO Review: Fees

FTMO has a transparent and simple fee structure that is designed to cover the operational costs associated with their services. One of them is the refundable fee structure for its challenges.

FTMO Challenge Fee: The fee you pay for participating in the FTMO Challenge is a one-time payment. It varies based on the account balance they choose. For example:

- $10,000 Account: €89.

- $25,000 Account: €155.

- Higher account sizes (e.g., $50,000, $100,000, or $200,000) come with corresponding fees.

Upon successful completion of the FTMO Challenge and Verification, the fee is fully refunded to the trader along with their first profit split. This approach minimizes financial risk while motivating traders to meet the outlined objectives.

Other fees includes:

- Payment Methods: You can pay via bank transfer, credit/debit cards, cryptocurrencies, and Skrill. Payment options cater to various preferences, ensuring flexibility for traders across the globe.

- Transaction Fees: While FTMO does not charge hidden or additional fees, there are transaction costs associated with withdrawals:

- Bank Wire: A minimum closed profit of $20 is required to cover the transaction cost.

- Cryptocurrencies: A minimum closed profit of $50 is required for crypto withdrawals.

- No Recurring Fees: FTMO does not charge any recurring fees. Once you pay the initial Challenge fee, that’s all. There are no ongoing costs unless you decide to make withdrawals or use additional services.

- Scaling Plan: If you reach the Scaling Plan, not only will your account balance grow by 25%, but your reward split increases to 90%!

I particularly like the refundable fees because it demonstrates FTMO’s commitment to creating a cost-effective and supportive trading environment.

Customer Support

FTMO prides itself on offering exceptional customer support to cater to traders from all over the globe. With services available in 18 languages, including English, Spanish, French, Arabic, and more, FTMO ensures accessibility and convenience for a diverse clientele.

Traders can reach out to FTMO through various channels:

- Email: Available 24/7 for inquiries at support@ftmo.com.

- Live Chat: Real-time assistance for immediate concerns.

- WhatsApp: A convenient platform for quick responses.

- Phone: Contactable at +420 910 920 310 during business hours.

FTMO’s dedication to client satisfaction extends beyond standard support, providing swift responses, personalized solutions, and guidance through every step of the trading journey. Whether you’re facing technical issues, need clarification about the Trading Objectives, or require help with FTMO tools, the support team is always ready to assist.

FTMO Review: Advantages and Disadvantages

Advantages

- Offers both 1-Step and 2-Step challenges, catering to different trader experience levels

- FTMO allows traders to manage significant capital without risking their own funds, making it a safe and accessible entry point into professional trading.

- 90% profit split available from the first payout on the 1-Step model

- From Account MetriX to the Mentor App, FTMO offers a wide array of tools designed to support traders’ growth and enhance their trading performance.

- Wide platform support including MT4, MT5, and cTrader

- The Scaling Plan enables traders to grow their accounts over time, rewarding consistent performance with access to more significant capital.

- FTMO’s Discord and customer support in 18 languages create a collaborative environment where traders can connect, learn, and thrive.

- The initial fees for the FTMO Challenge are refundable upon successful completion, making it a cost-effective option for aspiring traders.

Disadvantages

- The 1-Step Challenge can be harder to pass due to a single evaluation phase

- FTMO’s risk management rules, such as the Maximum Daily Loss limit, can be challenging for traders who struggle with discipline or overtrading.

- While traders retain up to 90% of profits, they must adhere to FTMO’s terms without customizable options for profit allocation.

- Traders need a solid foundation in trading strategies and risk management to succeed in the FTMO Challenge and Verification stages.

Despite these limitations, FTMO’s advantages overwhelmingly make it a preferred platform for traders looking to advance their skills, manage substantial capital, and build a professional trading career.

Read also: Top 5 FTMO Alternatives for US Traders

Helpful Tips for When Trading with FTMO

When trading with FTMO, you need to focus on a few key factors that can increase your chances of becoming a successful FTMO Trader. Here are the essential tips:

Mastering Risk Management

Risk management is the cornerstone of long-term success in trading. FTMO places significant emphasis on trading with discipline, and a major part of this involves managing your risk effectively. To succeed, always adhere to the trading objectives, especially the daily loss limits and overall maximum loss rules. Stick to your predefined stop losses and position sizes, and avoid making impulsive decisions driven by emotions. By consistently applying proper risk management techniques, you’ll not only meet FTMO’s criteria but also develop a strong foundation for sustainable trading.

Using FTMO Tools Effectively

FTMO offers a variety of tools to help traders refine their strategies and maintain discipline. Tools such as the Equity Simulator are perfect for preparing yourself mentally for potential drawdowns, while the Live MetriX provides real-time insights into your trading performance and progress towards becoming an FTMO Trader. The Account MetriX offers detailed metrics that allow you to evaluate your trading strategies objectively. Utilizing these tools will help you make more informed decisions, understand the nuances of your trading, and ultimately enhance your performance.

Developing and Testing a Robust Trading Strategy

Before entering the FTMO Challenge, it’s important to have a well-tested trading strategy. This should include clear entry and exit rules, along with a risk management plan. FTMO allows you to trade using your own strategy, but remember that sticking to your plan without deviation is crucial to avoid emotional decision-making. Consider backtesting your strategy using demo accounts or small-scale live trading before committing to the FTMO Challenge. Having a clear and tested approach will help you remain consistent and disciplined throughout the challenge.

Maintaining Emotional Discipline and Consistency

The ability to manage emotions is one of the most vital aspects of being a successful FTMO trader. It’s natural to feel pressure, especially when trading with real capital, but allowing fear, greed, or excitement to dictate your decisions can lead to costly mistakes. FTMO encourages traders to follow strict self-discipline, and tools like the Mentor App and Performance Coaches can help you develop a strong mindset. Consistency is key — it’s not about making big wins but rather about executing your strategy with precision and emotional control every single day.

FTMO Review: Verdict

FTMO presents an excellent opportunity for traders who want to prove their skills in a professional trading environment without risking their own capital. The platform offers structured challenges, clear trading objectives, and a range of resources and tools that support traders throughout their journey. By participating in the FTMO Challenge and Verification, traders can access real trading capital and scale their accounts while benefiting from valuable coaching and advanced tools.

FTMO is ideal for traders who:

- Have solid trading skills and want to test them without risking personal funds.

- Are disciplined and committed to following a risk management plan.

- Appreciate the opportunity to grow into a professional trader through training and feedback.

- Are looking for a community of like-minded traders to share insights and experiences.

However, FTMO might not be suitable for traders who are still learning the basics of trading or those who struggle with emotional control and risk management. The rules are strict, and while the potential rewards are high, the path to success requires dedication and discipline.

If you’re ready to commit to improving your trading discipline, taking advantage of the educational resources available, and working towards becoming a professional trader, FTMO is a great choice.

FAQs

- Is FTMO regulated?

No, FTMO is not a regulated financial institution. It operates as a proprietary trading firm offering educational services and simulated trading environments. - What is FTMO 1-Step Challenge?FTMO 1-Step is a single-phase evaluation that allows traders to qualify for an FTMO Account without completing a second verification stage, provided they meet the profit and risk rules.

- What payment methods does FTMO accept?

FTMO accepts payments via bank wire transfer, debit/credit cards, PayPal, Skrill, and cryptocurrencies. Some methods, like bank transfers, are unavailable in specific countries (e.g., Venezuela, Cuba, Sudan, and Ukraine) due to regulatory reasons. - How do I withdraw my reward from FTMO?

Rewards are processed monthly by default, with an option to withdraw after 14 days of trading. Withdrawals can be made via bank transfer, Skrill, or cryptocurrency and are typically processed within 1–2 business days. - What profit share does FTMO offer?

FTMO offers an 80% profit share on all trading profits. Traders who meet Scaling Plan conditions are eligible for a 90% profit share and a 25% increase in account balance. - What trading platforms does FTMO support?

FTMO supports MetaTrader 4, MetaTrader 5, DXtrade, and cTrader. However, US nationals and residents cannot access MetaTrader or cTrader due to regulatory restrictions. - Is FTMO available to US traders?

Yes! As of August 2025, US nationals and residents, including those in US territories, can now participate in the FTMO Challenge. - Is FTMO available in India?

Yes. FTMO has reopened access for Indian traders after earlier restrictions. You can read the full breakdown here.