Thinking about starting to trade with FXCM in 2025? Before you dive in, it’s important to understand how their services, fees, and platform stack up. This FXCM review highlights the key aspects of this forex broker to help you make an informed choice, ensuring that you’re not just getting into trading but doing so with a trustworthy broker.

FXCM Review – What Is FXCM Broker?

FXCM, also known as Forex Capital Markets, is perhaps the best known forex broker in the world and one of the most important, having been founded back in 1999.

In 2010 FXCM was able to acquire the UK group ODL. The acquisition resulted in an increase in assets to $800 million; in addition, over 200,000 customers have been “transferred”. This was also the reason why FXCM could suddenly become one of the largest retail forex brokers in the world. In 2012, the broker acquired the majority stake in Lucid Markets. A London-based trading group specializing in foreign exchange trading.

On January 15, 2015, however, FXCM lost approximately $225 million due to very large fluctuations in the Swiss franc exchange rate. Subsequently, the broker was granted a $300 million loan from Leucadia, a large financial group to which the Jefferies group belongs, in order to meet the capital requirements – as a result, the acquisition took place.

Due to losses suffered, FXCM had to restructure its operations and move to the UK. FXCM is now based in the UK. Its headquarters are at 20 Gresham Street 4th Floor, London EC2V 7JE, UK.

In addition to the UK office, FXCM has offices in Canada, South Africa, Australia, France, Germany, Italy, Greece, Israel and Hong Kong.

Before January 15, FXCM was the world’s third largest forex broker, behind only the Japanese behemoths GMO and DMM.

FXCM is one of the first forex brokers to hit the market in the United States, in 1999, and one of the few that managed to survive independently and eventually achieve world leadership.

Is FXCM Legit? – Regulation

Regulation is a very important part of this FXCM review, and yes, this broker stands out with its commitment to maintaining compliance across multiple jurisdictions. FXCM operates under the umbrella of the Stratos Group, a global holding company that ensures regulatory adherence in key markets.

For instance, Stratos Markets Limited is authorized by the Cyprus Company Registration Department, holds authorization from CySEC under license number 392/20. The company’s registered office is located in Nicosia, Cyprus, and it freely offers its services to the states within the European Economic Area (EEA), which notably includes Spain.

On the other hand, the FXCM Group, headquartered in London, United Kingdom, oversees Forex Capital Markets Limited, which operates under the regulatory oversight of the FCA, with registration number 217689.

Additionally, FXCM Australia Pty. Limited operates under the supervision of the Australian Securities and Investments Commission, bearing AFSL number 309763. FXCM South Africa, on the other hand, holds a license from the Financial Sector Conduct Authority, identified by number FSP 46534.

To enhance security, client funds are kept in segregated accounts and are maintained in globally recognized banks. This measure ensures that, in the unfortunate event of a company default, client funds remain safeguarded and cannot be used to settle debts with other creditors.

So, is FXCM safe? With all the facts mentioned above, we can say a resounding yes to the fact that FXCM is legit and not a scam.

Is FXCM Safe? – Trust

Is FXCM a safe platform? Suffice to say that our FXCM review found several reasons that made FXCM one of the safest forex brokers. This brokerage firm has been in existence for over 20 years. Although the broker has suffered some setbacks in 2015 only a small number of accounts were affected and all client funds were refunded.

What is more, FXCM is also a part of the Investor Compensation Fund (ICF), a program that extends compensation to clients of licensed investment firms in Cyprus. This investor compensation scheme in Europe guarantees balances of up to £85,000 in case of insolvency.

FXCM also protects against negative balance for Forex spot and CFD trading. This feature is currently only available to retail accounts registered in the UK and EU, although the platform also provides up to $50,000 per account registered in Australia and South Africa.

This protection measures and ensures that companies are capable of providing compensation when necessary.

Another reason why we consider FXCM safe is the sheer number of awards it has won over the years.

FXCM Awards

Over the years, FXCM has established itself as a leading brokerage by consistently prioritizing innovation, customer satisfaction, and transparency. This commitment to excellence has earned FXCM numerous industry awards and accolades, reinforcing its reputation as a trusted choice for both retail and institutional traders.

Highlights of FXCM’s Recent Achievements

- FOREXBROKERS.COM:

- 2024: Best in Class for Platforms & Tools, Social Copy Trading, Professional Trading, and Algo Trading.

- 2023: Best in Class for Algo Trading, MetaTrader, Professional Trading, Social Copy Trading, and Platforms & Tools.

- International Business Awards:

- 2023: Most Trusted Trading Platform in the Middle East.

- Global Forex Awards:

- 2022: Most Transparent Forex Broker – Global.

- TradingView Broker Awards:

- 2022: Social Champion Award for fostering community-driven trading and insights.

- ADVFN International Financial Awards:

- 2022: Best Zero Commission Broker, recognizing FXCM’s cost-efficient trading solutions.

Had FXCM not been a safe platform it would not have amassed such a collection of trophies, which continue to increase every year.

FXCM Review – Trading Platform

FXCM offers four robust trading platforms, each designed to cater to different trading styles and needs. Whether you’re looking for simplicity or seeking advanced tools, FXCM has something for everyone:

- Trading Station

- TradingView Pro

- Metatrader 4

- Capitalise AI

1. Trading Station

FXCM’s proprietary Trading Station is a comprehensive platform packed with features for forex and CFD trading.

- All-in-One Solution: Perfect for forex, stocks, and indices CFDs, Trading Station combines ease of use with powerful features.

- Customizable: Tailor your trading experience with features like chart overlays, customizable indicators, and periodicity adjustments.

- Desktop Version: Ideal for serious traders, it supports custom indicators, strategy optimization, backtesting, and robust charting tools. You can even automate strategies to remove emotional bias from trading decisions.

- Web 3.0 Version: Designed for seamless performance across browsers, Trading Station Web 3.0 delivers an intuitive interface with advanced functionality to keep traders at their best.

- Mobile App: For those on the go, the Trading Station mobile app offers a streamlined experience, allowing you to manage trades and analyze markets directly from your smartphone.

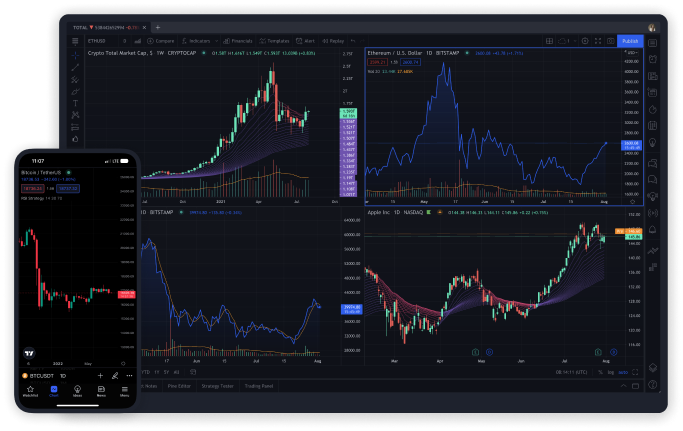

2. TradingView Pro

FXCM integrates with TradingView, giving traders access to world-class charting and analysis tools.

- Interactive Charts: With over 15 chart types and 90+ drawing tools, TradingView offers unparalleled customization for technical analysis.

- Community Insights: Join a global network of traders, share insights, and learn from top-performing community members.

- Alerts and Analysis: Never miss a trade with 12 alert conditions and a suite of screening tools for stocks and forex.

- Strategy Testing: Test your setups using historical data, and refine strategies with detailed performance reports.

Additionally, FXCM clients can upgrade to TradingView Pro, Plus, or Premium for free by meeting deposit requirements, ensuring access to premium features.

3. MetaTrader 4 (MT4)

MT4 remains a favorite for traders worldwide, and FXCM offers seamless access to this classic platform.

- Versatile and Familiar: As one of the most popular platforms globally, MT4 on FXCM supports scalping, Expert Advisors (EAs), and flexible lot sizes down to 0.01 micro lots.

- Cross-Device Compatibility: Available on Mac, Windows, Android, and web browsers, it ensures you can trade from virtually anywhere.

- Enhanced Features: Set Stop Loss (SL) and Take Profit (TP) pre-execution, partially close positions, and access VPS hosting for uninterrupted trading.

- Copy Trading: With MT4 signals, traders can automatically copy successful strategies, filter signal providers by performance, and monitor their activity in real time.

4. Capitalise AI

This cutting-edge platform makes automated trading simple and accessible, even for non-coders.

- Code-Free Automation: Create strategies in plain English, and let Capitalise.ai execute them.

- 24/7 Monitoring: The platform watches real-time market data and triggers trades without emotional influence.

- Backtesting and Simulation: Test strategies risk-free and analyze historical performance for optimized results.

- Real-Time Control: Get mobile notifications and manage strategies on the go with the Capitalise.ai app.

Each platform stands out in its unique way, ensuring that traders of all levels have the tools they need to succeed. Whether it’s the feature-rich Trading Station, the community-driven TradingView, the trusted MT4, or the AI-powered Capitalise, FXCM provides an unparalleled trading experience.

FXCM Broker Review: Trading Instruments

We went straight to the source for our FXCM review and found that the list of tradable assets on FXCM is quite extensive, with the major world markets. Here’s a closer look at what’s available:

1. Forex

Forex trading at FXCM offers access to the world’s largest and most liquid market, with over $6.6 trillion traded daily. Trade top currency pairs like EUR/USD and GBP/USD with competitive spreads, advanced tools, and support for all trading styles. Whether you’re new or experienced, the forex market provides a dynamic environment for active trading.

- Forex Baskets: Simplify your forex trading with pre-built baskets like the USDOLLAR, EMBasket, and JPYBasket, which let you speculate on groups of currencies in a single trade.

2. Commodities

Speculate on the price movements of key commodities like gold, oil, and natural gas. With competitive spreads, FXCM ensures your transaction costs remain low. The platform provides intuitive access to the commodity market, letting you trade with ease by focusing on symbols and contract sizes.

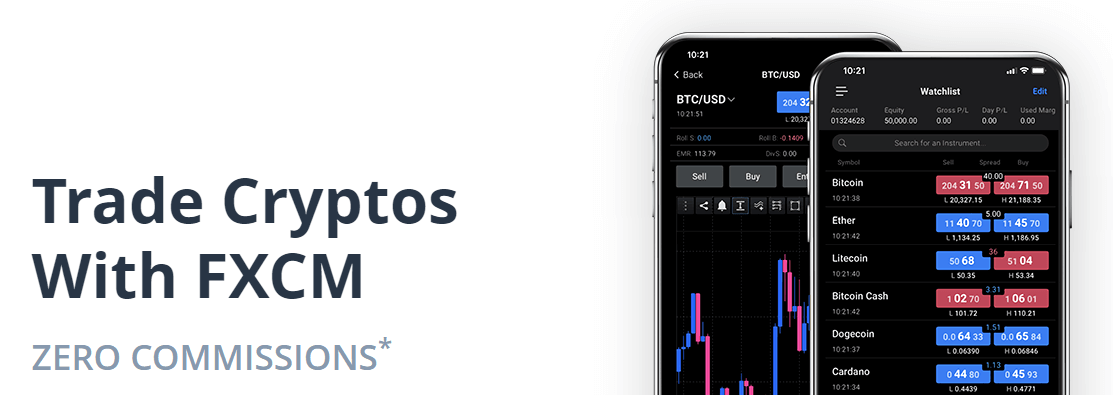

3. Cryptocurrencies

Trade popular cryptocurrencies like Bitcoin (BTC/USD), Ethereum (ETH/USD), and Litecoin (LTC/USD) with FXCM’s crypto offerings. Using blockchain technology, these digital assets are secure, traceable, and decentralized. FXCM provides a streamlined experience for trading major crypto pairs in a growing market.

4. Shares & Stock Baskets

- Individual Shares: Access top global companies like Apple, Tesla, and Meta Platforms in CFD form, commission-free. Mini Shares allow traders to start with smaller positions, offering flexibility in managing risk and capital.

- Stock Baskets: Invest in entire sectors like FAANG, Biotech, or US Auto through curated baskets of stocks. This innovative approach saves time while providing exposure to broader market trends.

5. Indices

FXCM lets you trade major global indices, enabling you to express views on entire economies without selecting individual stocks. With tight spreads and unique benefits of CFDs, indices remain a favorite for traders seeking strategic opportunities.

6. Treasury Markets

Gain access to global money markets and government bonds with FXCM’s treasury products. Trade over 10 instruments with leverage, tight spreads, and no rollover fees, giving you greater control over your bond market investments.

With this diverse array of markets, FXCM ensures there’s something for every trader, regardless of their interests or expertise. Whether you’re diversifying your portfolio or focusing on a specific market, FXCM delivers the tools and access you need to succeed.

Crypto Trading on FXCM

FXCM offers a seamless and flexible way to trade cryptocurrencies, allowing traders to engage with this dynamic market without the complexities of owning physical assets. Through its Tradu Crypto product, provided by Stratos Tech Limited, FXCM caters to crypto enthusiasts with a focus on transparency, affordability, and convenience.

Why Trade Cryptocurrencies with FXCM?

- Start Small: FXCM allows you to control your exposure with small contract sizes. For example, one BTCUSD contract is equivalent to just 1% of the underlying Bitcoin price, making it accessible to traders with varying levels of capital.

- Leverage Opportunities: Trade popular cryptocurrencies like Bitcoin and Ethereum with up to 4:1 effective leverage. This means you can amplify your market exposure, though it’s essential to keep in mind that leverage can increase both profits and losses.

- Go Long or Short: Speculate on crypto price movements in either direction. Whether the market rises or falls, FXCM’s CFD trading enables you to take advantage of volatility with just a click.

- No Wallet Hassles: Unlike buying and holding physical cryptocurrencies, FXCM eliminates the need for crypto wallets or hardware storage. You’re simply betting on price movements, sparing you the concerns of safeguarding your digital assets.

Tradu Crypto Perks

For high-volume orders above $5,000, FXCM sweetens the deal with instant rebates of up to 50% and a clear, no-nonsense pricing structure. Traders can also choose between zero commissions or raw spreads, reflecting FXCM’s commitment to offering customizable, trader-friendly solutions.

FXCM’s crypto trading is designed to simplify access to the crypto market while providing flexible trading options. Whether you’re starting small or seeking a leveraged edge, FXCM’s platform delivers the tools and transparency you need to trade confidently.

FXCM Broker Review: Account Types

Our FXCM review research found that the broker offers four types of trading accounts to cater to the diverse needs of traders. The account types offered by FXTM include:

- Standard Account: Ideal for everyday traders, this account offers competitive spreads, no commissions on forex trading, and flexible lot sizes starting from micro lots (0.01). It’s perfect for those looking to manage risk effectively while enjoying a straightforward trading experience.

- Active Trader Account: Tailored for high-volume traders, this account provides reduced spreads, exclusive market insights, and access to premium services. With a minimum deposit requirement, it’s designed to reward frequent trading with added cost-efficiency.

- Demo Account: For beginners or those testing new strategies, FXCM’s demo account offers a risk-free environment with virtual funds. You can trade forex, Bitcoin, gold, and CFDs using live market data to practice and refine your skills.

- Islamic Account: FXCM caters to traders observing Sharia law with swap-free accounts. These accounts exclude rollover interest charges while maintaining the same features and benefits as standard accounts.

No matter the account type, FXCM ensures transparency, robust execution, and access to innovative trading tools, making it easy for clients to choose the option that best fits their trading goals.

Deposit and Withdrawal Methods

During our FXCM review, we looked at the deposit and withdrawal methods and found that they are very convenient and there are no transaction commissions whatsoever.

Deposit Methods:

- Bank Wire Transfer: You can fund your FXCM trading account by transferring funds directly from your bank account to FXCM’s bank account. This method is known for its reliability but may take some time for the funds to reflect in your trading account.

- Debit/Credit Cards: FXCM usually accepts major credit and debit cards like Visa and MasterCard. Deposits via cards are often processed quickly.

- Online Payment Services: Some online payment services like PayPal, Skrill, and Neteller might be accepted for depositing funds. These options are known for their convenience and speed.

- Checks: In some cases, you may be able to fund your FXCM account using checks. However, this method can take time for processing.

Withdrawal Methods:

- Bank Wire Transfer: You can withdraw funds from your FXCM account to your bank account via wire transfer. This is a common method for withdrawing larger amounts.

- Debit/Credit Cards: Withdrawals to the same card used for depositing funds are often allowed, up to the deposited amount. Any additional funds are usually withdrawn via other methods.

- Online Payment Services: If you deposited funds via services like PayPal, Skrill, or Neteller, you can typically withdraw funds back to the same account.

- Checks: FXCM may provide the option to send you a check for your withdrawal. This method may take longer due to postal delivery and processing times.

- ACH (Automated Clearing House) Transfer: If you’re in the United States, you may have the option to withdraw funds via ACH transfer.

FXCM Review: Fees

During our FXCM broker review, we looked at the fees of trading at FXCM. The broker claims to be fair in their trading fees, but is that correct? Yes. For forex, cryptocurrency, shares, and index CFDs, the trading costs are seamlessly included in the spread—meaning no additional commission fees when opening or closing positions. Unlike many brokers, FXCM imposes no minimum commission levels, which allows traders to avoid extra costs on smaller trades.

Calculating spread costs is simple on FXCM’s Trading Station platform. You can view real-time spreads and pip costs (in your account’s base currency) before entering a trade. For example:

Spread Cost Formula: (Pip Cost) x (Number of Contracts) x (Spread) = Total Transaction Cost

When it comes to cryptocurrency trading via Tradu Crypto, FXCM offers competitive pricing. Deposits are free, and withdrawals are charged a low fee of 0.08% (minimum $10). For context, withdrawing 1 Bitcoin costs $30, compared to as much as $600 with other exchanges. Traders can also enjoy instant rebates of up to 50% on order costs and choose between zero commissions or raw spreads.

This transparent fee structure, coupled with competitive rates, is what makes FXCM one of the best brokers on the market.

FXCM Review: Leverage and Margin

Leverage is one of the most powerful tools in trading, and FXCM allows you to trade forex and CFDs with significant leverage, giving you the potential to maximize your profits from even small market movements. When you trade with leverage, you’re essentially borrowing money to increase the size of your position.

For example, with 100:1 leverage, you can control a $10,000 position with just $100 in your account as a security deposit. This allows you to access larger market opportunities than you would with your own capital alone.

However, it’s important to note that while leverage can amplify potential profits, it can also magnify losses. This means that while leverage gives you the ability to make larger trades, you must manage risk carefully to avoid significant losses, especially in volatile markets.

At FXCM, new accounts are set by default with leverage up to 1000:1, which can be adjusted based on your account balance and the type of instruments you’re trading. Specifically, if your account is funded with over 5,000 CCY, the leverage will be reduced to a maximum of 400:1. For accounts exceeding 50,000 CCY, the leverage is further reduced to 100:1 for FX trades and 200:1 for CFDs. These adjustments help ensure that leverage remains aligned with the equity in your account. FXCM reserves the right to change your leverage settings at its discretion.

Here’s a breakdown of leverage based on account equity:

- Less than $5,000: Up to 1000:1 leverage for both FX and CFDs

- Between $5,000 and $50,000: Up to 400:1 leverage for both FX and CFDs

- Greater than $50,000: Up to 100:1 leverage for FX and up to 200:1 for CFDs

Understanding leverage and margin is essential for controlling your risk, and FXCM provides flexible options depending on the size of your account.

Education and Research

FXCM provides a wide range of free online courses and resources to enhance your trading journey. One standout feature is the live market updates and trading sessions hosted by Senior Market Specialist, Russell Shor. Available five days a week, these live sessions provide valuable insights into major economic events and their potential impact on the markets, giving traders a deeper understanding of how global factors influence currency movements.

For those who prefer a more self-paced learning experience, FXCM offers a comprehensive suite of Trading Tools. These include the Market Scanner, which helps you identify trading opportunities, and FXCM Plus, a premium resource designed to give traders real-time market data and research. Additionally, eFXplus Access provides advanced analytics, and a range of Trading Apps is available to streamline your trading process.

On the Research front, FXCM goes above and beyond by providing tools to stay informed and make better decisions. The Economic Calendar helps you track important events and announcements, while Trade Volatility provides valuable insights into market conditions. With Live Forex Charts available on the platform, traders can easily monitor and analyze price movements in real-time, ensuring they’re always ahead of the curve.

With these resources, FXCM ensures that you have everything you need to continuously improve your trading skills and stay up to date with market trends.

FXCM Broker Review: Customer support

Is FXCM good when it comes to customer service? When it comes to communicating with the broker and getting the information you need, FXCM offers email, phone, and live chat support.

These platforms are all very helpful in their own way, as our FXCM broker review shows. If you want an immediate response to your questions or concerns, you should definitely use the live chat or phone support. However, if your goal is a more official interaction, then you can use email or in-person support. Either way, the FXCM customer support is exceptionally friendly and they are available 24 hours a day, 5 days a week. Customer support is available in several languages: English, German, French, Spanish, Italian, Malay, Mandarin, Tagalog, Bahasa.

In addition, the institution publishes educational and instructive articles about forex and the market on its website. These articles contain very useful information for both forex newbie traders and experienced traders who have been trading in this market for years.

How Much Money Do You Need to Start Trading?

The minimum deposit you need to make to start trading is $50. This small amount makes FXCM an ideal option for retail traders with limited resources. This low entry threshold opens the door to the same dynamic markets that institutional participants access, allowing anyone with risk capital to explore the world of forex.

Unlike other financial markets that require substantial capital, FXCM ensures that beginners and seasoned traders alike can engage without needing a hefty investment. As you gain experience and your trading goals evolve, FXCM offers a variety of account types to suit your changing needs. Whether you’re just testing the waters or ready to scale your strategies, there’s an option tailored to enhance your trading experience.

How to Open an Account with FXCM

Opening an account with FXCM is a simple process, even for beginners. Here’s a step-by-step guide to help you get started:

- Visit the FXCM Website

Start by visiting the official FXCM website. Click on the “Open Account” button, usually located on the homepage, to begin the registration process. - Fill in Your Personal Information

You’ll need to provide basic personal details, such as your full name, email address, phone number, and country of residence. FXCM also asks for some additional information to comply with regulatory requirements, including your date of birth and residential address. - Choose Your Account Type

FXCM offers different types of accounts. Select the account type that suits your trading needs and financial goals. - Complete the Risk Assessment

To ensure that you fully understand the risks involved in trading, FXCM will ask you to complete a brief questionnaire about your trading experience and financial situation. This helps them determine the most suitable products and leverage for your profile. - Upload Required Documents

As part of the verification process, you’ll need to upload documents to confirm your identity and address. This typically includes a government-issued ID (like a passport or driver’s license) and a recent utility bill or bank statement. - Fund Your Account

Once your documents are verified, you can fund your account. FXCM offers several deposit options mentioned above. - Download Your Trading Platform

After funding your account, you can choose from several trading platforms, such as FXCM’s Trading Station, MetaTrader 4, or TradingView. - Start Trading

With your account funded and platform set up, you’re now ready to start trading! Begin by placing small trades and using a demo account to practice without risk.

By following these simple steps, you can open your FXCM account and start exploring the world of forex and CFDs with a trusted broker.

Comparing FXCM vs Forex.com vs Oanda vs eToro

When comparing FXCM to other major brokers like Forex.com, OANDA, and eToro, it’s clear that each has its strengths and specific offerings.

|

|

|

||

|---|---|---|---|---|

Regulation |

FCA (UK), CySEC (Cyprus), ASIC (Australia), FSCA (South Africa) |

CFTC (USA), FCA (UK), ASIC (Australia) |

CFTC (USA), FCA (UK), ASIC (Australia) |

FCA (UK), ASIC (Australia), CySEC (Cyprus) |

Trading Platform |

Trading Station, MetaTrader 4, TradingView Pro, Capitalise AI |

MetaTrader 4/5, TradingView, Web Trading |

MetaTrader 4/5, OANDA Platform, TradingView |

eToro Platform (Web, Mobile) |

Fees and Costs |

Spread-based (varies by instrument), Commission (on certain accounts) |

Spread-based, Commission for certain accounts |

Spread-based, Commission on certain accounts |

Spread-based, No commissions on stock trading |

Leverage and Margin |

Leverage up to 30:1 (varies by instrument and jurisdiction) |

Leverage up to 50:1 (USA), 200:1 (outside USA) |

Leverage up to 50:1 (USA), 30:1 (Europe) |

Leverage up to 30:1 (EU), 400:1 (outside EU) |

Minimum Deposit |

$50 |

$50 |

$0 (but recommended minimum varies) |

$200 |

FXCM Broker Review: Conclusion

I hope you have seen from this FXCM review that this forex broker is legit. You can trust FXCM knowing that they are regulated and your funds are kept safe in separate (segregated) bank accounts. In this way, investors’ money is secured even if the company goes bankrupt.

Although they faced financial problems in 2015, FXCM has paid its debts and is back in the race to regain the prestige and place in the market lost by past mistakes.

By and large, FXCM is a good broker choice for an average active trader and anyone looking for FX trading without a conflict of interests should be sure to give FXCM a try.

FAQs

- Is FXCM legit?

Yes, FXCM is a legitimate, regulated forex and CFD broker. It operates under strict regulatory oversight in multiple jurisdictions, including the UK, Australia, and Cyprus, ensuring high standards of transparency and security for its clients. - What is FXCM’s minimum deposit?

FXCM’s minimum deposit requirement is $50, making it accessible for traders with limited initial capital. However, keep in mind that your trading style and risk tolerance may influence how much you choose to deposit. - Is FXCM available in Nigeria?

Unfortunately, FXCM does not offer accounts for residents of Nigeria due to local regulations. Traders in Nigeria will need to explore alternative brokers like Exness, and Octa that accept clients from the region. - Does FXCM accept US clients?

No, FXCM does not offer accounts for residents of the United States due to regulatory restrictions. US clients will need to look for other brokers like eToro, and Forex.com that are compliant with US regulations. - Is FXCM a good broker?

FXCM is considered a reputable broker with a long track record since 1999. It offers a wide range of trading tools, excellent customer support, and competitive spreads. However, like all brokers, it’s important to consider your trading needs and preferences before choosing. - Where is FXCM based?

FXCM is headquartered in London, United Kingdom. It also has offices in other locations such as New York, Melbourne, and Johannesburg, with global regulatory oversight ensuring it meets international trading standards. - What trading platforms does FXCM offer?

FXCM offers several platforms including Trading Station, MetaTrader 4, TradingView, and Capitalise AI. These platforms cater to different trading styles, from beginners to advanced algorithmic traders. - What leverage does FXCM offer?

FXCM offers leverage up to 1000:1 on forex and CFDs. However, leverage is adjusted based on your account balance, with higher balances receiving lower leverage to manage risk appropriately.