If you’re a consistent profitable trader looking to scale up in 2025, then this OANDA Prop Trader review is for you. As a skilled trader who values steady, risk-controlled results, you deserve to know how OANDA measures up. By the time you finish reading this review about OANDA prop trading, you will be able to make an informed decision about partnering with them.

What Is OANDA Prop Trader?

OANDA Prop Trader is a proprietary trading program that gives a unique opportunity to traders seeking funding to amplify their trading strategies. Launched in 2024, OANDA Prop Trader allows you to trade with company-provided funds, unlike traditional trading, where you risk your own capital. Though the capital is virtual, you can earn a share of any profits you generate.

With access to advanced trading technology and OANDA’s market relationships, successful traders can grow their skills while potentially earning from their trades. So if you are a disciplined traders looking to grow without risking your own capital, this program is for you.

But is the OANDA Prop Trader program legit and trustworthy? Let us find out!

Is OANDA Prop Trader Legit?

Yes, OANDA Prop Trader is legit. OANDA has been a trusted name in the trading industry for over 25 years. As a fully regulated broker, OANDA holds licenses in eight different jurisdictions, including the British Virgin Islands, ensuring that they operate under strict financial regulations.

Their long-standing reputation in the market, along with multiple industry awards, such as Broker of the Year in 2023 and Most Popular Broker from 2020 to 2022, highlights their credibility and trustworthiness. This solid track record proves that OANDA is a reliable partner for traders looking to succeed in the prop trading world.

Is OANDA Prop Trader Safe?

Yes, OANDA Prop Trader is safe. The program guarantees the security of your funds by transferring all payouts to a regulated client account, giving you direct access to your earnings. As a fully self-sufficient prop trading firm, OANDA operates without relying on third-party brokers, reducing the risk for traders.

With state-of-the-art technology and a focus on trader education through OANDA Labs, the company provides everything you need to trade with confidence. By offering a transparent structure and high-level support, OANDA ensures that your trading journey is both secure and rewarding.

OANDA Prop Trader Review: Trading challenges

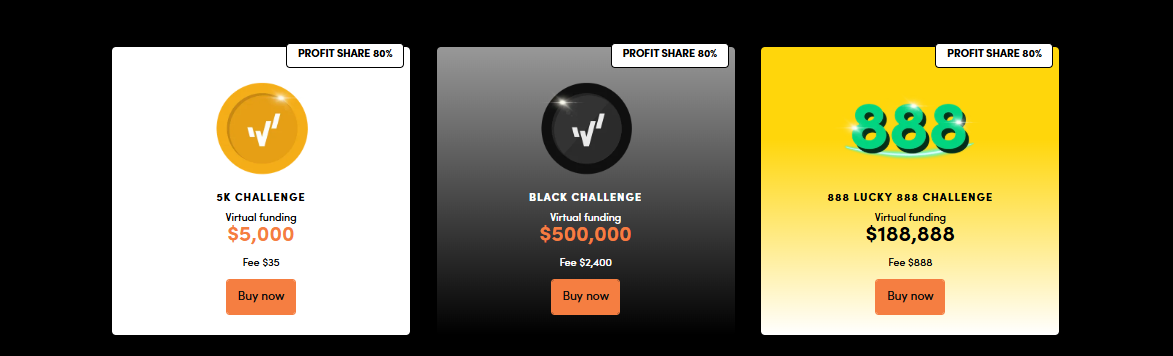

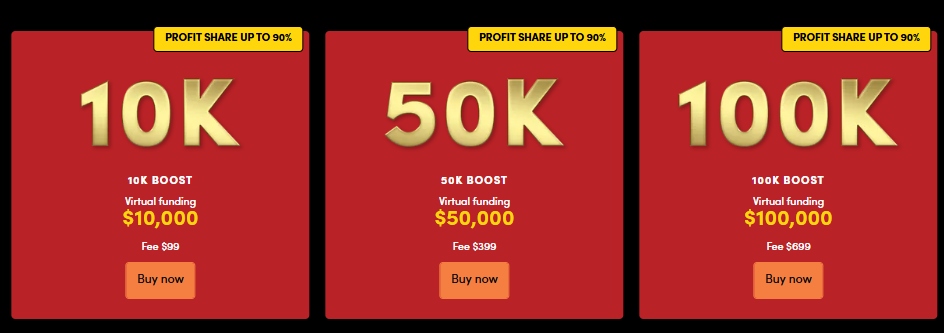

OANDA Prop Trader offers two distinct types of trading challenges: Classic and Boost. These challenges cater to different trading styles, risk preferences, and capital goals. Here’s a closer look at what each offers:

Classic Challenges |

Boost Challenges |

|

|---|---|---|

Account Sizes |

$5K to $500K |

$10K, $50K, $100K |

Profit Share |

80% |

Up to 90% |

Drawdown System |

Dynamic |

Static |

Phase 1 Target |

8% |

10% |

Fees |

$35 to $2,400 |

$99 to $699 |

Classic Challenges

The Classic Challenges are ideal for traders seeking flexibility and scalability. This option provides account tiers ranging from $5,000 to $500,000 in virtual funding. A key feature of this challenge is its dynamic drawdown system, which adjusts as your account grows, giving you more room to maneuver while managing risk.

- Profit Share: 80%

- Fees:

- $5,000 account: $35

- $50,000 account: $400

- $500,000 account (Black Challenge): $2,400

This structure makes the Classic Challenges accessible for beginners while still offering high-tier options for experienced traders. Whether you’re just starting or looking for a serious opportunity to grow, this category has something for everyone.

Boost Challenges

The Boost Challenges are designed for confident traders who prioritize higher payouts and a clear risk framework. With account sizes of $10,000, $50,000, and $100,000, the Boost option uses a static drawdown system, creating a predictable and straightforward risk structure.

- Profit Share: Up to 90%

- Fees:

- $10,000 account: $99

- $50,000 account: $349

- $100,000 account: $699

Boost Challenges require more precision in risk management due to their stricter targets but reward successful traders with a larger share of the profits. This plan is perfect for those ready to leverage their skills in a high-stakes environment.

⇒ OANDA Prop Trader lets traders take on multiple challenges, meaning you can have several accounts in the assessment phase. However, after successfully passing the challenge and receiving a funded account, you can manage only one Prop Trader account at a time. This rule ensures traders focus fully on managing a single account responsibly.

Fees

Let’s now clearly explain the fees and benefits associated with the Classic and Boost Challenges.

Challenge Type |

Tier |

Fee (USD) |

Virtual Capital |

Profit Share |

|---|---|---|---|---|

Classic |

5K |

$35 |

$5,000 |

80% |

10K |

$60 |

$10,000 |

80% |

|

25K |

$199 |

$25,000 |

80% |

|

50K |

$299 |

$50,000 |

80% |

|

100K |

$599 |

$100,000 |

80% |

|

188K |

$888 |

$188,888 |

80% |

|

250K |

$1,200 |

$250,000 |

80% |

|

500K |

$2,400 |

$500,000 |

80% |

|

Boost |

10K |

$99 |

$10,000 |

80% (first payout), 90% (subsequent) |

50K |

$399 |

$50,000 |

80% (first payout), 90% (subsequent) |

|

100K |

$699 |

$100,000 |

80% (first payout), 90% (subsequent) |

With this break down in fees, I hope you can now choose a challenge that matches your goals and budget.

Who Can Join the Prop Trading Challenge?

The OANDA Prop Trading Challenge is open to individuals aged 18 and older residing in approved countries. To qualify, participants must successfully complete a two-phase Challenge using a demo trading account. During the Challenge, traders must adhere to specific trading rules and meet predefined objectives.

After passing the Challenge, participants enter a verification stage where they must provide proof of identity and pass a liveness check. Additionally, an active OANDA Global Markets account is required to receive the profit-and-loss (P&L) share. For those who do not already have an account, OANDA provides a link to apply for one upon successful completion of the Challenge.

How to Become an OANDA Prop Trader

Becoming an OANDA Prop Trader is a straightforward process that involves completing a challenge, verifying your identity, and setting up an OANDA Global Markets account. Follow these steps to start trading as a signal provider and sharing in the profits:

1. Complete the OANDA Prop Trader Challenge

Begin your journey by selecting and successfully completing one of OANDA’s Prop Trader Challenges. These challenges test your trading skills and strategies in a simulated environment. Choose a challenge that fits your goals, complete the two phases by meeting the profit targets and risk management rules, and proceed to the next stage.

Phase 1 caps daily max profit at 5%. If you reach this limit, the system automatically closes your positions, and you must wait until the next day to resume trading. Phase 2 reduces this limit to 2%.

2. Verification Stage

Once you pass the challenge, you must verify your identity to proceed. The verification stage ensures the safety of the OANDA Prop Trader program and complies with legal requirements in many countries.

3. Verification Checks

Log into your dashboard and complete the Know Your Customer (KYC) verification. Provide the required identification documents and pass a liveness check.

Here’s what you’ll need to submit:

- Accepted ID: Passport, government-issued ID card, driver’s license, or residence permit.

- Requirements for ID:

- Valid for at least one month from the upload date.

- Free from damage, scratches, stains, or tears.

- Legible details, including full name, date of birth, and MRZ (Machine-Readable Zone).

- Consistent identity across all submitted documents.

These checks verify your identity and minimize the risk of fraud, ensuring a secure environment for all participants.

4. Open an OANDA Global Markets Account

To receive your payouts, you need an active OANDA Global Markets account. After passing the challenge, OANDA will send you an exclusive invite to set up your account if you don’t already have one.

Provide the following details during the account setup:

- Country of residence

- Full name (as per your ID)

- Date and country of birth

- Email address and mobile number

- Residential address

- Employment status and financial information

Processing typically takes 1–2 business days. After approval, you’ll receive your account details via email.

5. Start Trading

With your verification complete and OANDA Global Markets account set up, review and accept the signal provider terms and privacy policy. OANDA will then issue your Prop Trader credentials, enabling you to trade and earn as a signal provider.

A signal provider is a trader who shares access to the data on their trading platform. In this Prop Trader program, the trader shares their trading data with OANDA. OANDA uses these trading signals as an input to help make decisions in their proprietary trading.

In Which Countries Is the OANDA Prop Trader Program Available?

As mentioned earlier, the OANDA Prop Trader program is currently not accessible to everyone. So before you start trading, you need to check whether the program is available in your country:

Continent |

Countries |

|---|---|

|

Algeria, Angola, Benin, Botswana, Burundi, Cape Verde, Central African Republic, Chad, Comoros, Côte D’Ivoire, Djibouti, Egypt, Eswatini, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mauritania, Mauritius, Morocco, Niger, Rwanda, Sao Tome & Principe, Senegal, Seychelles, Sierra Leone, South Africa, Sudan, Tanzania, Togo, Tunisia, Uganda, Zambia |

|

Armenia, Azerbaijan, Bahrain, Bangladesh, Brunei, Georgia, Hong Kong, Indonesia, Israel, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Laos, Lebanon, Macau, Malaysia, Maldives, Mongolia, Philippines, Saudi Arabia, Sri Lanka, Taiwan, Tajikistan, Thailand, Turkmenistan, United Arab Emirates, Uzbekistan, Vietnam |

|

Bosnia & Herzegovina, Iceland, Kosovo, Macedonia, Moldova, Montenegro, Serbia, Ukraine |

|

Antigua & Barbuda, Bahamas, Belize, Bermuda, Costa Rica, Curaçao, Dominica, Dominican Republic, El Salvador, Grenada, Guatemala, Honduras, Jamaica, Saint Kitts & Nevis, Saint Lucia, Saint Vincent & Grenadines |

|

Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname, Uruguay |

|

Australia, Fiji, Kiribati, Marshall Islands, Micronesia, Nauru, New Caledonia, Palau, Papua New Guinea, Samoa, Solomon Islands, Tonga, Tuvalu, Vanuatu |

Other Regions |

Antarctica, Bouvet Island, Cocos (Keeling) Islands, Pitcairn, Saint Helena, Ascension & Tristan da Cunha, Wallis & Futuna, Western Sahara |

If your country is eligible to participate in this program, congratulations! So what exactly can you trade?

Which Assets Can You Trade?

OANDA Prop Trader gives you access to a wide range of instruments, including Forex (FX), Gold, and CFDs on major indices and commodities. This variety allows you to diversify your strategy and trade according to your preferences, whether that’s focusing on currency pairs or more volatile assets like commodities. The flexibility in choosing your instruments is a huge plus for those looking to experiment with different markets.

What Is the Available Leverage?

When it comes to leverage, OANDA offers competitive ratios. For FX and Gold, the leverage can go as high as 100:1, while for CFDs on Indices and Commodities, it’s capped at 50:1. This means you can control larger positions with a smaller capital outlay, but it also amplifies the potential for both gains and losses. Understanding how leverage works within your risk tolerance is important, as overleveraging can lead to significant drawdowns if not properly managed.

Trading Platforms

OANDA Prop Trader uses MetaTrader 5 (MT5), one of the most popular platforms in the trading world. MT5 is packed with features, including advanced charting tools, multiple timeframes, and a variety of technical indicators, making it a versatile platform for traders of all levels. The ability to use Expert Advisors (EAs) allows you to automate your trading strategies, which is a huge advantage for traders who prefer systematic approaches.

However, there are some restrictions. While EAs are permitted, OANDA does not allow copy trading, particularly from third-party platforms or other OANDA accounts. Additionally, strategies based on arbitrage techniques, such as price or latency arbitrage, are prohibited. This ensures that all traders operate on a level playing field. So, if you prefer automation and technical analysis, MT5 is an excellent choice, but make sure your trading strategies align with OANDA’s rules.

Now, let’s look into the key risk management rules that you’ll need to follow to protect your account and stay compliant with OANDA’s policies.

Risk Management Rules

One of the most critical aspects of trading with OANDA Prop Trader is its emphasis on risk management. There are several rules in place to protect both the trader and the firm, and adhering to them is essential for success.

The Daily Loss Limit is one such rule, designed to prevent excessive losses in a single day. For the Classic Plan, this limit is dynamic, meaning it adjusts based on your account’s end-of-day equity. This gives you flexibility, as your loss limit increases if your account grows. For example, if your equity is $150,000, a 5% Daily Loss Limit would give you a $7,500 cushion for the next day. However, if you breach this limit, all positions are closed, and trading is halted for the day.

In contrast, the Boost Plan has a Fixed Daily Loss Limit set at 5% of your initial account balance. If you start with $100,000, your daily loss limit will always be $5,000, regardless of your account growth. This provides more predictability and makes risk management simpler, but you’ll need to be strategic to ensure you don’t hit this threshold too quickly.

These loss limits are paired with the Maximum Drawdown Limit, which further secures your account from deep losses. For the Classic Plan, the drawdown is trailing—meaning it adjusts based on your highest account balance (High Water Mark). So, as you grow your account, your drawdown limit moves up, offering more room to trade. But if your balance drops, the drawdown limit won’t decrease below the highest point reached, which is a nice safeguard.

For the Boost Plan, the drawdown is static, set at 90% of your starting balance. This offers more stability and less room for fluctuation, making it a good choice for those who prefer more predictable risk management.

As a trader, mastering these rules is key to navigating OANDA Prop Trader successfully.

Profitability and Consistency Rules

One of the key components of OANDA Prop Trader’s evaluation process is the emphasis on consistent profitability. During the assessment phases, traders are expected to follow daily maximum profit limits to ensure stability in their trading.

In Phase 1, the daily max profit is capped at 5%. If you reach this limit, your positions will automatically close, and you’ll have to wait until the next day to resume trading. In Phase 2, this limit is reduced to 2%, reinforcing the need for steady, controlled gains rather than relying on big, risky wins. This is a crucial step to demonstrate that you’re not just lucky but capable of maintaining consistent, sustainable profits.

Once you pass these phases and move into a funded account, these daily profit rules no longer apply, giving you the freedom to trade without such restrictions. The focus shifts entirely to risk management and adherence to the other account rules. OANDA values traders who can grow accounts steadily while managing risks effectively—a mindset that sets you up for long-term success.

How Do I Deposit for the Challenge?

You can pay for the OANDA Prop Trader Challenge using a credit or debit card, Apple Pay, Google Pay, cryptocurrency, or Union Pay, depending on your location.

Once you make the payment, OANDA will create your Challenge account and send the login details to your email. Be sure to check all your email folders, including spam and junk. Keep your login details secure and don’t share them with anyone.

How Do I Withdraw My Profits?

You can request your profit share directly from your User Portal. To process your request, you’ll need to close all open trades. Once you make the request, trading on your MetaTrader account will temporarily stop until OANDA processes your payout.

You can make a withdrawal request every 14 days, and the funds will be sent to your OANDA Global Markets account. From there, you can withdraw the money to your bank or preferred method. Keep in mind that you cannot withdraw the virtual capital used for trading, only your earned profit share.

Support and Resources

OANDA provides comprehensive support and resources to help traders navigate the Prop Trader program. If you encounter any issues, you can reach out to their customer support team via email at support-proptrader@oanda.com. They are responsive and provide valuable assistance for both technical and account-related inquiries.

In addition to direct support, OANDA offers a range of educational materials, including detailed guides for using the MetaTrader 5 platform. They also provide a useful Economic Calendar in the trader dashboard, giving you insights into key financial events that could affect your trading decisions. Whether you’re new to trading or an experienced pro, these resources are essential for staying informed and compliant with the firm’s rules.

OANDA Prop Trading Rules: What You Need to Know

You must understand the rules and guidelines that will shape your experience before you start your journey with OANDA Prop Trading. Understanding what OANDA allows and prohibits will help you trade confidently while you avoid unnecessary setbacks. Let us break down everything you need to know.

What You’re Allowed to Do

- Overnight and Weekend Positions: Feel free to hold your trades overnight, during weekends, or even through news events.

- Multiple Challenges: You can take as many Challenges as you want. After passing, accounts with the same profit share can be merged up to $500,000 for Classic Challenges. Boost Challenges cannot be merged.

- Hedging: You can hedge your positions without restrictions.

- Expert Advisors (EAs): You can use EAs, scripts, and indicators for your trades, as long as they don’t involve prohibited tactics like price or latency arbitrage.

- Copy Trading Outwards: You can copy trades from your OANDA Prop account to external platforms or other brokers.

What’s Prohibited

- News Trading: Trading two minutes before or after major news events is not allowed. Any trades during this time will be closed, and this is marked as a soft breach. Repeated violations may result in stricter consequences.

- Copy Trading Into OANDA: You cannot copy trades into your OANDA Prop account from other platforms, including OANDA Brokerage accounts. This is a hard breach and will result in account closure.

- Multiple Signal Provider Accounts: You may open only one Prop Trader account at a time. OANDA strictly prohibit multiple accounts or opposite trades (hedging) between accounts.

- Prohibited EAs: Avoid using EAs that engage in price or latency arbitrage or any other banned strategies.

Breaking any of these rules could result in penalties, including account closure or the removal of profits. Always trade responsibly and follow the guidelines to make the most of your journey with OANDA Prop Trading.

OANDA Prop Trading Review: Pros and Cons

Pros:

- Flexible Account Plans: With both Classic and Boost plans, you can choose the one that best fits your trading style and risk tolerance. The dynamic nature of the Classic plan allows for growth, while the Boost plan offers predictable risk management.

- Strong Risk Management Framework: OANDA’s Daily Loss Limit and Maximum Drawdown rules are clear, effective, and protect your capital from large losses. The system encourages disciplined, consistent trading.

- Use of MetaTrader 5 (MT5): OANDA supports MT5, a powerful platform widely used by traders. It allows for automated trading, backtesting strategies, and full customization of your trading environment.

- Expert Advisor Support: You can use Expert Advisors (EAs) and indicators, as long as they adhere to the firm’s terms. This flexibility is ideal for algorithmic traders.

- No Account Fees: There are no hidden fees or commissions for using the OANDA Prop Trader program. You trade with company-provided funds, so there’s no out-of-pocket cost for setting up an account.

- Educational Resources: OANDA provides a range of educational materials and guides, which is helpful, especially for traders new to prop trading or those using MetaTrader for the first time.

Cons:

- Strict Daily Max Profit Rule During Assessment: OANDA caps your daily profit at 5% in Phase 1 and 2% in Phase 2 during the assessment phase.. This can be limiting for traders who rely on larger, more aggressive profits.

- No News Trading: OANDA has stringent rules about trading during major news events, which can be frustrating for traders who thrive on volatility and news-based strategies.

- Limited Platform Choice: OANDA only offers MetaTrader 5, meaning you’re restricted to that platform for all your trading. While MT5 is robust, some traders may prefer more diverse options.

- Multiple Account Limitation: Once you pass the challenge, you can only have one Prop Trader account at a time. This could be restrictive for traders who want to diversify their strategies across several accounts.

- Copy Trading Restrictions: OANDA Prop accounts don’t allow copy trading, which may disadvantage you if you prefer to mirror other successful traders or use external signals.

OANDA Prop Trader Review: Conclusion

As you have seen in this OANDA Prop Trader review, this platform is recommended for traders looking to access funding and scale their trading without risking personal capital.

OANDA Prop Trader is definitely worth considering if you’re a trader who values a predictable risk profile and the potential for steady growth. However, if you prefer more aggressive trading strategies or the freedom to trade news events, you may want to weigh the program’s rules against your trading style. In any case, the transparent rules and clear risk management framework offer a good foundation for traders willing to adhere to a disciplined approach.

FAQs

- Is OANDA regulated?

Yes, OANDA Global Markets Limited is authorized and regulated by the British Virgin Islands (BVI) Financial Services Commission (registration number 2026433). - How many times can I take the Challenge?

There is no limit to the number of times you can take the Challenge. You may attempt it as often as you like. - Is there a discount for retrying the Challenge?

Yes, discounts are available for retries:- Classic plans: 20% discount on 5k–50k plans, 10% discount on 100k–500k plans.

- Boost plans: 10% discount on all plans.

- What leverage is available?

- Up to 100:1 for FX and Gold.

- Up to 50:1 for CFD indices and commodities.

- Is copy trading allowed?

No, OANDA prohibits copy trading within the OANDA Prop Trader program. Copying trades into OANDA Prop accounts from external or OANDA brokerage accounts is also not allowed. Copying from OANDA Prop accounts to external platforms is permitted. - Can I trade news?

No, OANDA prohibits trading during major financial news events. Participants must avoid trading within a four-minute window (2 minutes before and 2 minutes after) around flagged events. Violations may result in profit removal or account termination. - Is hedging allowed?

Yes, hedging is allowed, but margin requirements vary depending on the instrument and exposure level. - What platform can I trade on?

You can trade on MetaTrader 5 (MT5). Guides for using MT5 are available to help with any issues.