Proprietary (prop) trading firms have become one of the fastest-growing pathways for skilled traders to access institutional capital without risking their own money. Instead of trading with your own capital, you prove your skill through an evaluation and — once funded — keep a portion of the profits you generate. Prop firms differ in assets offered, fee structure, risk rules, payout frequency, and scaling potential, so choosing the right one can make a huge difference for your trading career.

In this article, we compare the top 10 prop firms used by Canadian traders and beyond — focusing on the key trader-friendly metrics:

🔹 Assets traded

🔹 Platforms supported

🔹 Maximum allocation & account sizes

🔹 Evaluation steps & profit targets

🔹 Daily & max loss limits

🔹 Profit split, payout frequency & price

10 Best Prop Trading Firms in Canada in 2026

We have ranked and reviewed the following 10 top-tier proprietary firms accepting US traders,

- The5ers.com,

- FTMO,

- FundingPips

- FundedNext

- Maven Trading

- SeacrestFunded (formerly MFFX)

- Apex Trader Funding

- OANDA Prop Trader,

- E8 Markets

- Bright Funded

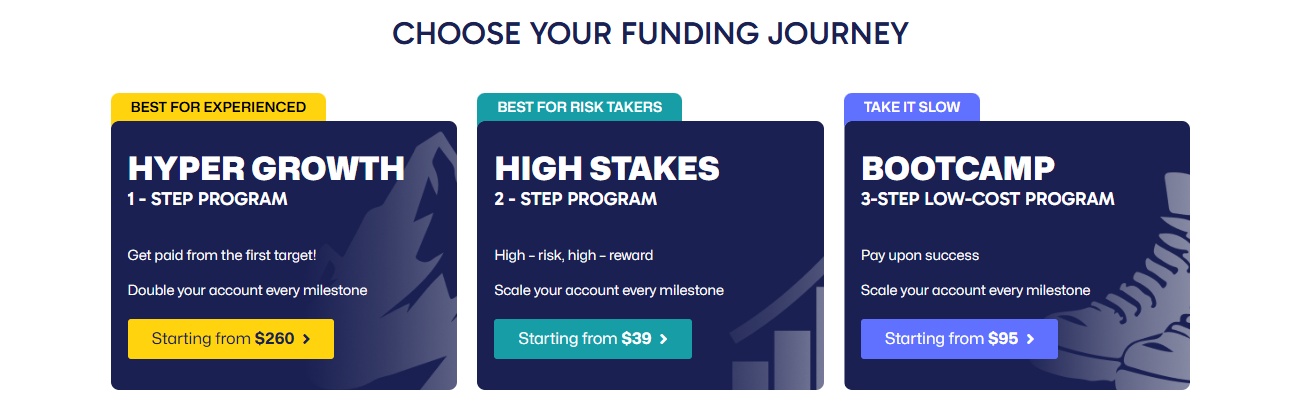

1. The5ers.com

Overview: One of the most flexible and beginner-friendly prop firms with high scaling potential — up to $4,000,000 funded capital.

📊 Key Metrics

- 🌍 Country / Founded: Global (est. 2016)

- 📈 Assets: Forex, metals, indices, commodities, crypto, stocks

- 💻 Platforms: MetaTrader 5 (MT5)

- 📊 Maximum Allocation / Account Size: Up to $4,000,000 funded capital

- 🔁 Steps / Evaluation:

- Instant Funding: Direct funded account (no lengthy challenge)

- Bootcamp: Multi-phase challenge on demo

- High Stakes: For elite traders, scalable up to millions

- 🎯 Profit Target: Typically around 10% on eval challenges (varies by program)

- 📉 Daily Loss: Generally around 3–5% depending on challenge type

- ❌ Max Loss: Around 6–10% drawdown — program dependent

- 💰 Profit Split: Up to 100% as you scale and meet milestones

- 📆 Payout Frequency: Payouts typically processed within 1–3 business days once you’re profitable

- 💵 Price: Varies by program (e.g., Bootcamp ~$95; Instant Funding ~$235; High Stakes ~$495 for typical account tiers)

📌 Why Traders Choose The5ers

✔ No strict time limits on evaluation — trade at your pace.

✔ High scaling potential from small to very large accounts.

✔ Flexible trading allowed — EAs, weekend holds, news trading.

👉 Check out the full The5ers review for detailed rules, pros & cons.

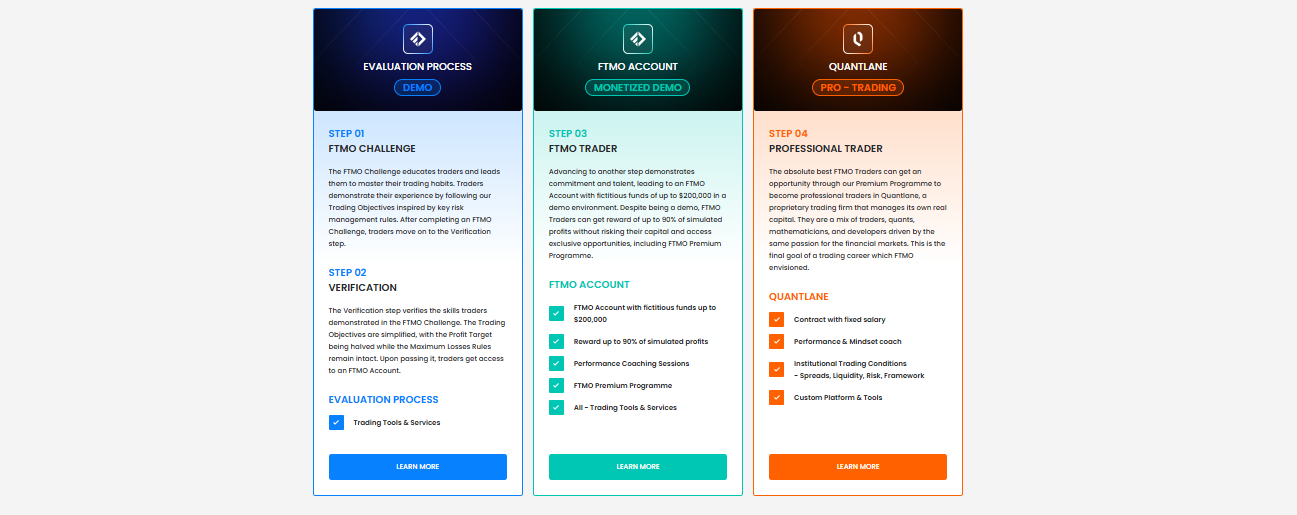

2. FTMO

Overview: One of the longest-standing and most reputable prop firms worldwide, known for its structured 2-phase evaluation and steady profit split program.

📊 Key Metrics

- 🌍 Country / Founded: Czech Republic (Global reach since 2015)

- 📈 Assets: Forex, indices, commodities, crypto, stocks (via CFDs)

- 💻 Platforms: Multi-platform support including MT4, MT5, cTrader

- 📊 Maximum Allocation / Account Size: Up to $400,000 standard (Premium up to $1M+)

- 🔁 Steps / Evaluation:

- Phase 1 — FTMO Challenge (10% profit target on demo)

- Phase 2 — Verification (5% profit target on demo)

- 🎯 Profit Target: Phase 1: ~10%; Phase 2: ~5%

- 📉 Daily Loss: ~5% of initial balance

- ❌ Max Loss: ~10% of initial balance

- 💰 Profit Split: Up to 90% once funded

- 📆 Payout Frequency: Monthly/bi-monthly (varies by payout request cycle)

- 💵 Price: Evaluation fees vary by account size (e.g., ~$129 USD for a $10K entry challenge; higher for bigger accounts)

📌 Why Traders Choose FTMO

✔ Highly structured evaluation builds strong discipline.

✔ Trusted brand with millions of users and huge payouts worldwide.

✔ Fees refundable upon first reward after passing evaluation.

👉 Check out the full FTMO review for detailed rules, pros & cons.

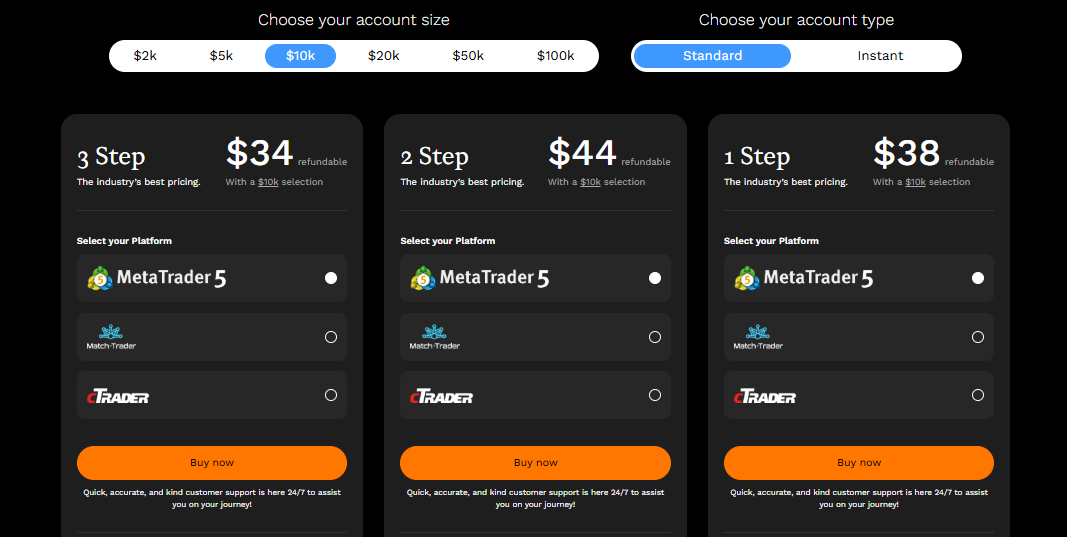

3. FundingPips

Overview: A rapidly growing prop firm (founded in 2022) known for multiple challenge paths, low entry costs, and flexible reward schedules.

📊 Key Metrics

- 🌍 Country / Founded: Dubai-based, global reach since 2022

- 📈 Assets: Forex, indices, commodities/energies, crypto (via CFDs)

- 💻 Platforms: MT5, cTrader, Match-Trader (varies by program)

- 📊 Maximum Allocation / Account Size: Challenge accounts up to $100,000, with scaling potential toward $2M+

- 🔁 Steps / Evaluation:

- 1-Step Evaluation

- 2-Step Standard Evaluation

- 2-Step Pro Evaluation

- Zero / Instant Funding

- 🎯 Profit Target: Varies by challenge type — often ~8% + 5% (2-Step) or ~10% (1-Step)

- 📉 Daily Loss: ~5% depending on challenge rules

- ❌ Max Loss: ~10% total drawdown

- 💰 Profit Split: Typically 80–100% depending on performance and reward cycle

- 📆 Payout Frequency: Flexible — weekly, bi-weekly, monthly, or on-demand

- 💵 Price: Very low entry fees on smaller challenge accounts (e.g., ~$29–$59 for $5K) — varies with challenge type

📌 Why Traders Choose FundingPips

✔ Low cost to start and flexible evaluation options.

✔ Diverse payout cycles; not locked into monthly only.

✔ Multiple platforms supported.

👉 Check out the full FundingPips review for detailed rules, pros & cons.

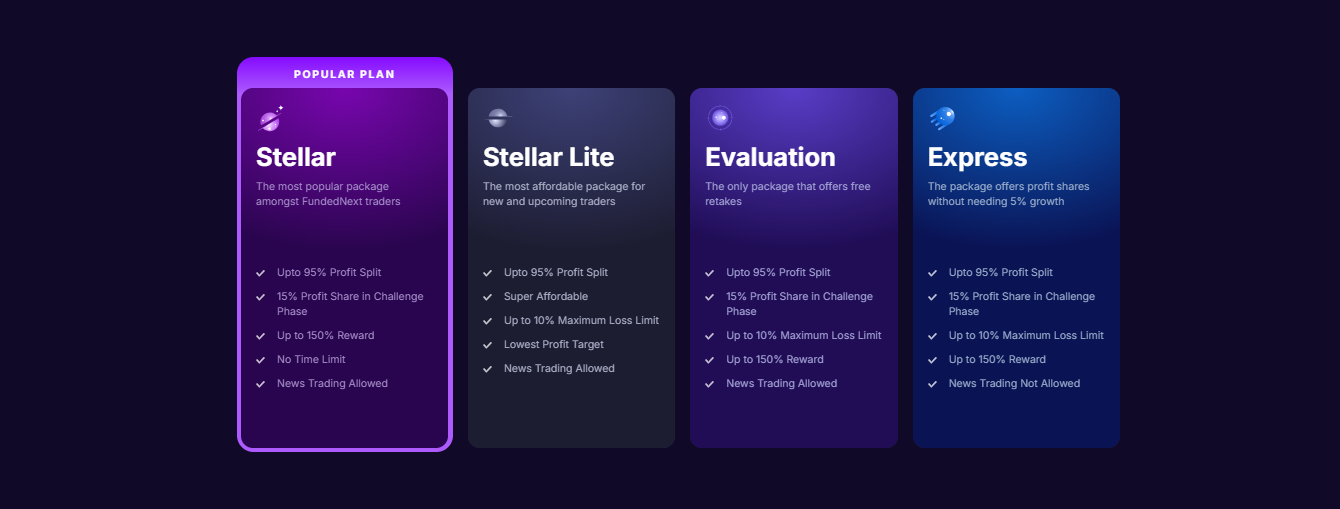

4. FundedNext

Overview: A fast-growing prop trading firm with flexible challenge options, high profit splits, and wide global adoption. Known for transparent rules and comparatively low start fees.

📊 Key Metrics

- 🌍 Country / Founded: UAE & Cyprus; launched 2018/2019 (global service).

- 📈 Assets: Forex, indices, commodities, cryptocurrencies, (CFDs; some futures products available).

- 💻 Platforms: MT4, MT5, cTrader & Match-Trader (varies by challenge).

- 📊 Maximum Allocation / Account Size: $5,000 – $200,000 (scaling beyond via programs).

- 🔁 Steps / Evaluation: Multiple models: One-Step & Two-Step challenges (Stellar), Express, Instant options.

- 🎯 Profit Target: ~4% – 10% (varies by challenge type).

- 📉 Daily Loss: ~3.5% – 5% max daily loss, depending on challenge rules.

- ❌ Max Loss: ~10% total drawdown.

- 💰 Profit Split: Up to 95% (including up to 15% during challenge phase).

- 📆 Payout Frequency: Fast payouts — often within 24 hours of request.

- 💵 Price: $32 – ~$1,099 depending on account size & challenge type.

📌 Why Traders Consider FundedNext

✔ High profit share — up to 95% of profits go to you.

✔ No time limits on many challenges, allowing you to trade at your pace.

✔ Low entry costs relative to big prop firms.

👉 Check out the full FundedNext review for detailed rules, pros & cons.

5. Maven Trading

Overview: A budget-friendly prop firm with one, two, and three-step challenge options and solid profit splits — particularly attractive for traders with limited funds.

📊 Key Metrics

- 🌍 Country / Founded: Global firm operating since ~2022.

- 📈 Assets: Forex, indices, commodities, crypto CFDs.

- 💻 Platforms: cTrader, Match-Trader, MetaTrader 5 (MT5 re-introduced).

- 📊 Maximum Allocation / Account Size: $2,000 – $100,000 (scales up to ~$1 million in some programs).

- 🔁 Steps / Evaluation: Multiple challenge models: 1-Step, 2-Step, 3-Step, Instant & Mini.

- 🎯 Profit Target:

- 1-Step: ~8%

- 2-Step: ~8% (phase 1), ~5% (phase 2)

- 3-Step: ~3% each step

- Mini/Instant: ~3%+ targets

- 📉 Daily Loss: ~3–5% depending on challenge type.

- ❌ Max Loss: ~5–8% (varies by challenge).

- 💰 Profit Split: Typically 80% of profits to the trader.

- 📆 Payout Frequency: Payouts available every ~10 business days; refunded fees after a few withdrawals.

- 💵 Price: Starts low — around $15–$379 depending on challenge selection.

📌 Why Traders Consider Maven Trading

✔ Very affordable challenge fees — one of the lowest in 2025.

✔ No time limits on challenges — trade without rushing.

✔ Fast payouts relative to industry average.

⚠ Some traders report mixed experiences with support and execution — always review the fine print before purchasing.

👉 Check out the full Maven Trading review for detailed rules, pros & cons.

6. SeacrestFunded (formerly MyFundedFX)

Overview: A broker-backed prop firm that evolved from MyFundedFX — now integrated with Seacrest Markets’ regulated infrastructure, offering tighter spreads and solid execution quality.

📊 Key Metrics

- 🌍 Country / Founded: Global with FSCA-regulated broker backing (Seacrest Markets).

- 📈 Assets: Forex, indices, commodities, crypto CFDs.

- 💻 Platforms: MetaTrader 5 (MT5), Match-Trader, DXtrade.

- 📊 Maximum Allocation / Account Size: Up to $1,000,000+ (scalable).

- 🔁 Steps / Evaluation: One-Step, Two-Step, Three-Step models available.

- 🎯 Profit Targets:

- 1-Step: ~10%

- 2-Step: ~8% first, ~5% second

- 3-Step: ~6%, ~4%, etc. depending on tier.

- 📉 Daily Loss: ~4–5% depending on evaluation type.

- ❌ Max Loss: ~8–10% total drawdown.

- 💰 Profit Split: ~80% base — can reach ~90% with VIP add-ons.

- 📆 Payout Frequency: ~14 days from funded activation.

- 💵 Price: $50 – ~$950+ one-time evaluation fees.

📌 Why Traders Consider SeacrestFunded

✔ Broker-backed execution, often meaning better spreads and execution than some virtual-capital firms.

✔ Unlimited time limits on reaching profit targets.

✔ Supports popular platforms including MT5 and modern alternatives like DXtrade.

👉 Check out the full SeacrestFunded review for detailed rules, pros & cons.

7. Apex Trader Funding

Overview: A popular futures-focused prop firm that’s gained attention for its simple evaluation rules, high contract limits, and wide platform support in 2025 — though community feedback is mixed on payouts and rule enforcement.

📊 Key Metrics

- 🌍 Country / Founded: U.S.-based global prop firm, founded 2021.

- 📈 Assets: Primarily futures (CME, COMEX, NYMEX, CBOT), suitable for futures traders.

- 💻 Platforms: Rithmic, NinjaTrader, Tradovate, WealthCharts (varies by account).

- 📊 Maximum Allocation / Account Size: $25,000 up to $300,000 funded accounts (contract limits vary with size).

- 🔁 Steps / Evaluation: One-step evaluation leading to a paid/funded account; evaluation profit target is a fixed profit amount tied to account size.

- 🎯 Profit Target: e.g., $6,000 on a $100,000 account (fixed target, not %).

- 📉 Daily Loss: Varies with size; draws are rigid with trailing & fixed drawdown rules.

- ❌ Max Loss: Drawdown limits specific to account size (e.g., ~$10,000 for a $100K account).

- 💰 Profit Split:

- 100% on first $25,000 of profits

- 90% on profits above $25,000 (typical structure).

- 📆 Payout Frequency: Usually available once funded & risk rules are met (5 profitable days minimum) — payouts may take several days to process.

- 💵 Price: Evaluation/pricing varies by account size (discounts common); ongoing fees can apply.

📌 Why Traders Consider Apex

✔ Futures specialization with high contract allowances.

✔ Simple evaluation process compared with multi-phase competitors.

✔ Strong community footprint with global reach.

⚠ Some traders report rule enforcement or payout delays, so read the fine print and community feedback carefully before signing up.

👉 Check out the full Apex Trader Funding review for detailed rules, pros & cons.

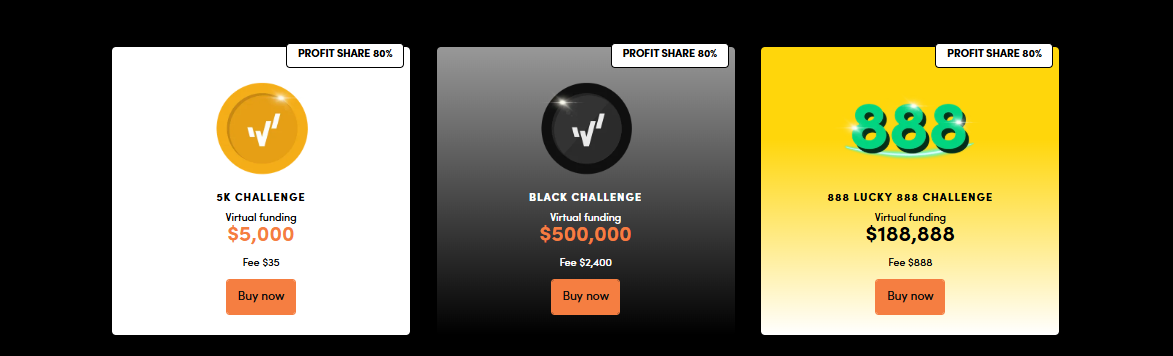

8. OANDA Prop Trader

Overview: A broker-backed prop challenge from a well-established forex broker, letting traders prove skill through a two-step challenge and earn up to 80% profit share on funded accounts.

📊 Key Metrics

- 🌍 Country / Founded: Part of OANDA with decades of brokerage experience.

- 📈 Assets: Forex, indices, commodities, metals, CFDs.

- 💻 Platforms: MetaTrader 5 (MT5).

- 📊 Maximum Allocation / Account Size: Up to $500,000 virtual funding across Challenge sizes.

- 🔁 Steps / Evaluation: Two-phase challenge (Phase 1 → Phase 2).

- 🎯 Profit Target: ~5% per phase (basic structure).

- 📉 Daily Loss: 5% of initial balance.

- ❌ Max Loss: 10% overall drawdown.

- 💰 Profit Split: 80% for funded traders.

- 📆 Payout Frequency: Flexible on request once funded; challenge fee refunded on first payout.

- 💵 Price:

- ~$35 for $5K challenge

- ~$299 for $50K

- ~$599 for $100K

- ~$2,400 for $500K.

📌 Why Traders Choose OANDA Prop Trader

✔ Backed by a regulated global broker with strong execution quality.

✔ Unlimited trading periods (no time pressure).

✔ Fee refund on first payout adds value.

👉 Check out the full OANDA Prop Trader review for detailed rules, pros & cons.

9. E8 Markets

Overview: A modern and flexible prop firm that has grown quickly and positioned itself as a transparent, trader-centric alternative — offering multiple evaluation paths, fast payouts, and wide asset access.

📊 Key Metrics

- 🌍 Country / Founded: E8 Markets Ltd, licensed in Saint Lucia (est. 2021).

- 📈 Assets: Forex, futures, crypto, indices, commodities.

- 💻 Platforms: MT5, MatchTrader, cTrader, TradeLocker (availability depends on region).

- 📊 Maximum Allocation / Account Size: Up to $1,000,000 (varies by evaluation and scaling).

- 🔁 Steps / Evaluation: One-step, two-step, and structured evaluation plans available.

- 🎯 Profit Target: Typically ~8–10% in initial phases (varies).

- 📉 Daily Loss: Fixed limits depending on challenge rules.

- ❌ Max Loss: Drawdown limits set per challenge (commonly ~10%).

- 💰 Profit Split: Up to 100% depending on program/performance tier.

- 📆 Payout Frequency: Rapid payouts — often within hours to one day once funded.

- 💵 Price: Challenge fees depend on account size and evaluation type (custom pricing).

📌 Why Traders Like E8 Markets

✔ Strong trader feedback on payouts and support.

✔ Flexible challenge options plus analytics dashboard tools.

✔ Wide range of asset classes including crypto.

👉 Check out the full E8 Markets review for detailed rules, pros & cons.

10. Bright Funded

Overview: A newer prop firm with a 2-step challenge model, low entry cost and scalable profit share, appealing especially to newer traders looking for affordability and flexibility.

📊 Key Metrics

- 🌍 Country / Founded: Netherlands-based/global prop firm, launched 2023.

- 📈 Assets: Forex, indices, metals, cryptocurrencies.

- 💻 Platforms: MT4 / MT5.

- 📊 Maximum Allocation / Account Size: $5,000 up to $200,000.

- 🔁 Steps / Evaluation: Two-phase challenge: Phase 1 → Phase 2.

- 🎯 Profit Target:

- 8% in Phase 1

- 5% in Phase 2.

- 📉 Daily Loss: 5%.

- ❌ Max Loss: 10% overall drawdown.

- 💰 Profit Split: Up to 80% (can increase with add-ons/performance).

- 📆 Payout Frequency: Typically bi-weekly, with add-on options for weekly.

- 💵 Price: Challenge fees range roughly:

- $55 for $5K

- $195 for $25K

- $495 for $100K

- $975 for $200K.

📌 Why Traders Choose Bright Funded

✔ Low entry cost and friendly risk rules.

✔ Scalable profit split through performance tiers/add-ons.

✔ Fast payouts and flexible trading pace.

⚠ Being newer than some competitors, traders should do due diligence on execution conditions and rule clarity before committing.

👉 Check out the full Bright Funded review for detailed rules, pros & cons.

Top Prop Trading Firms in Canada — Quick Comparison (2026)

Firm |

Assets |

Platforms |

Daily Drawdown |

Max Drawdown |

Profit Split |

Payout Frequency |

|---|---|---|---|---|---|---|

|

FX, Indices, Metals, Crypto, Stocks |

MT5 |

3–5% |

6–10% |

Up to 100% |

On-demand / Monthly |

|

FX, Indices, Stocks, Crypto, Commodities |

MT4, MT5, cTrader |

5% |

10% |

Up to 90% |

Monthly |

|

FX, Indices, Commodities, Crypto |

MT5, cTrader, MatchTrader |

5% |

10% |

Up to 100% |

Weekly / On-demand |

|

FX, Indices, Commodities, Crypto |

MT4, MT5, cTrader |

3.5–5% |

10% |

Up to 95% |

On-demand (24h) |

|

FX, Indices, Commodities, Crypto |

MT5, cTrader, MatchTrader |

3–5% |

5–8% |

80% |

~10 Days |

|

FX, Indices, Commodities, Crypto |

MT5, MatchTrader, DXtrade |

4–5% |

8–10% |

80–90% |

Bi-weekly |

|

Futures only (CME) |

NinjaTrader, Tradovate, Rithmic |

Trailing DD |

Fixed DD |

100% first $25K, then 90% |

On request |

|

FX, Indices, Metals, Commodities |

MT5 |

5% |

10% |

80% |

On-demand |

|

FX, Futures, Crypto, Indices, Commodities |

MT5, cTrader, TradeLocker |

Fixed |

~10% |

Up to 100% |

Same-day / On-demand |

|

FX, Indices, Metals, Crypto |

MT4, MT5 |

5% |

10% |

Up to 80% |

Bi-weekly |

⚡ Quick Takeaways

✅ Best for beginners: Maven Trading, FundingPips

✅ Best for scaling big capital: The5ers, E8 Markets

✅ Best for futures traders: Apex Trader Funding

✅ Best broker-backed prop firm: OANDA Prop Trader

✅ Best profit splits: The5ers, E8 Markets, FundedNext

Which Prop Trading Firm Should You Choose?

The best prop trading firm for you depends on what you trade, how you trade, and your risk tolerance — not just pricing or popularity. If you’re a forex-focused trader, firms like FTMO, The5ers, FundingPips, and FundedNext offer strong platforms, deep liquidity, and structured evaluations.

If you trade futures, Apex Trader Funding stands out as the most suitable option. For traders who want broker-backed execution and tighter spreads, OANDA Prop Trader is a solid choice.

Meanwhile, E8 Markets and Bright Funded appeal to traders seeking faster payouts and simpler rules. The good news is that every firm on this list is accessible to Canadian traders — meaning your best choice comes down to assets offered, drawdown rules, payout speed, and profit split rather than geography alone.

Related!

- Best CFD Brokers In Canada (2026) | Top 12 Platforms Compared

- Best Forex Brokers in Canada: Top 15 Compared Side by Side

Conclusion

Prop trading continues to be one of the most practical ways for Canadian traders to access large capital without risking personal funds — and the firms on this list represent the best options available in 2026. Whether you prioritize fast payouts, high profit splits, flexible rules, or professional platforms, there’s a prop firm here that fits your trading style.

👉 Before choosing, explore our full individual reviews to compare rules, pricing, and trader experiences — and pick the firm that aligns best with your goals.

❓ Frequently Asked Questions

1. Are prop trading firms legal in Canada?

Yes. Canadians can legally join most international prop trading firms. These firms operate globally and typically provide simulated trading environments rather than managing retail client deposits, which allows Canadian traders to participate without regulatory restrictions.

2. Do Canadian traders need to pay taxes on prop trading profits?

Yes. Profits earned from prop firms are generally considered taxable income in Canada. Depending on your situation, they may be treated as business income or investment income. It’s best to consult a Canadian tax professional for proper reporting.

3. Which prop firm is best for beginners in Canada?

For beginners, firms like FundingPips, Maven Trading, and Bright Funded are popular because they offer low entry costs, flexible rules, and simpler evaluations, making it easier to gain experience without large upfront fees.

4. Can Canadians withdraw profits to Canadian bank accounts?

Yes. Most prop firms support bank transfers, Wise, Skrill, PayPal, or crypto, which Canadians can easily convert to CAD and deposit into local bank accounts.

5. Do I trade real money or demo accounts with prop firms?

Most prop firms use simulated (demo) accounts, even after funding. However, payouts are real, and some broker-backed firms (like OANDA Prop Trader) may route trades to live liquidity depending on their structure.

6. What’s more important — profit target or drawdown rules?

For most traders, drawdown rules matter more than profit targets. Tight daily or max drawdowns cause more failures than difficulty reaching profit targets, so choosing a firm with risk rules that match your trading style is critical.