Before you open an account, read this Seacrest Markets review—it could save you from hidden fees, slow withdrawals, and bad trading conditions. Not all brokers are created equal, and choosing the wrong one can cost you time and money. This guide breaks down everything you need to know—account types, fees, leverage, platform features, and more—so you can start trading with confidence in 2025.

Seacrest Markets Review: Quick Overview

Founded / Headquarters |

February 2025 / Umhlanga, South Africa |

Regulation |

FSCA (South Africa), FSP License 53315 |

Minimum Deposit |

$50 |

Trading Platforms |

MetaTrader 5 (MT5) |

Available Assets |

100+ Forex, Indices, Commodities, Cryptocurrencies, Shares & CFDs |

Leverage |

Dynamic leverage (adjusts automatically based on market conditions) |

Deposit & Withdrawal Fees |

$0 (No fees from Seacrest Markets, but payment providers may charge fees) |

What is Seacrest Markets?

Seacrest Markets is a newly launched online trading broker that officially entered the financial markets in February 2025. It was founded as part of a major rebranding and expansion strategy by MyFundedFX, a well-known proprietary trading firm based in Dallas, Texas. As part of this transition, MyFundedFX rebranded its proprietary trading business to SeacrestFunded while simultaneously launching Seacrest Markets, a separate CFD brokerage. This shift allowed the company to expand beyond prop trading and offer retail and institutional traders direct access to global financial markets.

Seacrest Markets now operates as a fully-fledged broker, providing a range of trading instruments that are available on the advanced trading platform. Unlike its predecessor, which focused on funding traders with company capital, Seacrest Markets caters to traders who wish to trade with their own funds. By leveraging deep liquidity, fast execution speeds, and competitive trading conditions, the broker aims to establish itself as a reliable and trader-focused platform.

Is Seacrest Markets Regulated?

Regulation is a key consideration when choosing a broker, and Seacrest Markets ensures compliance by being fully licensed and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. The company operates under the legal entity Seacrest Markets (PTY) Ltd, with FSP License Number 53315 and registration number 2023/703336/07. Its headquarters is located at 2 Ocean Way, Umhlanga, Durban, KwaZulu-Natal, South Africa.

Being regulated by the FSCA provides traders with a layer of credibility and investor protection, as the authority enforces strict guidelines on financial transparency and client fund security. At the moment, Seacrest Markets is not regulated in major jurisdictions like the U.S., UK, or EU. However, its FSCA license indicates that it meets regulatory standards within South Africa’s financial system. For traders seeking a balance between flexibility and oversight, this regulation ensures that the broker operates within a structured legal framework while still offering competitive trading conditions.

Trading Instruments

Seacrest Markets offers a 100+ diverse range of tradable assets, giving traders access to some of the world’s most liquid and volatile markets. Clients can trade across multiple asset classes, including:

- Forex – Major, minor, and exotic currency pairs with tight spreads and high liquidity

- Indices – Trade leading global indices like the S&P 500, NASDAQ 100, DAX 40, and FTSE 100

- Commodities – Precious metals like gold and silver, as well as energy markets like crude oil and natural gas

- Stocks & CFDs – Trade shares of some of the world’s largest publicly traded companies

- Cryptocurrencies – Popular digital assets like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP)

With 24/5 market access, Seacrest Markets ensures that traders can take advantage of global market movements at any time. The broker’s deep liquidity pools, coupled with hyperfast order execution, allow traders to enter and exit positions with minimal slippage, making it a suitable platform for both short-term and long-term trading strategies.

Seacrest Markets Review: Types of Accounts

Seacrest Markets offers two main account types, designed to suit different trading styles and experience levels:

- Classic Account – A zero-commission account with slightly wider spreads, ideal for beginner traders or those who prefer an all-in-one pricing structure.

- VIP Spread Account – A low-spread, ECN-style account with a $7 per lot commission, catering to professional traders who require tighter spreads and deeper liquidity.

Traders can open an account with a minimum deposit of just $50, making Seacrest Markets an accessible option for beginners. The broker also offers dynamic leverage, meaning traders’ leverage adjusts automatically based on market conditions. This flexibility helps optimize risk management while maximizing trading opportunities.

Other key trading conditions include:

- Spreads from 0.0 pips on VIP accounts

- Fast execution speeds (from 1 millisecond)

- Scalping, day trading, and news trading allowed

- No deposit or withdrawal fees

Seacrest Markets Review: Trading Platforms

Seacrest Markets provides traders with access to the MetaTrader 5 (MT5) platform, one of the most advanced and widely used trading platforms in the industry. Developed by MetaQuotes Software, MT5 is known for its fast execution speeds, powerful analytical tools, and multi-asset trading capabilities. Whether you’re trading Forex, stocks, commodities, indices, or cryptocurrencies, the platform offers a seamless and efficient trading experience.

MT5 comes equipped with advanced charting tools, over 80 technical indicators, multiple timeframes, and an economic calendar, making it an excellent choice for both beginners and experienced traders. The platform also supports algorithmic trading via Expert Advisors (EAs), allowing traders to automate their strategies with precision. Additionally, traders can access MT5 through desktop, web, and mobile applications, ensuring full flexibility and convenience.

Seacrest Markets has invested heavily in infrastructure and liquidity aggregation, allowing for ultra-fast execution speeds with a 99.8% fill rate on orders. This means traders can enter and exit positions with minimal slippage, even during volatile market conditions. The broker also offers dynamic leverage, which automatically adjusts based on market conditions, giving traders greater flexibility in managing their risk.

Deposits & Withdrawals

Seamless deposits and withdrawals are very important when choosing a broker for a smooth trading experience. Seacrest Markets shines here as they ensure fast and hassle-free transactions. The broker supports a wide range of funding methods, including bank transfers, credit/debit cards, and various e-wallets. Cryptocurrency deposits are also available, catering to traders who prefer decentralized payment options.

One of the key advantages of trading with Seacrest Markets is the $0 deposit and withdrawal fees, ensuring that traders can move their funds without unnecessary charges. Deposit processing times are typically instant, while withdrawals are processed efficiently within 24 hours, depending on the payment method used.

Security is a top priority, and Seacrest Markets employs strict anti-fraud measures and encryption protocols to safeguard financial transactions. The broker also adheres to anti-money laundering (AML) and know-your-customer (KYC) regulations, ensuring a secure and compliant environment for all traders.

Is Seacrest Markets Safe?: Security

When trading online, security and transparency are two of the most important factors to consider, and Seacrest Markets prioritizes both to ensure a safe trading environment. The broker adheres to strict financial standards as required by its FSCA regulation, which includes maintaining segregated client accounts. This means that trader funds are kept separate from the company’s operational funds, reducing the risk of misuse and enhancing overall fund protection.

In addition, Seacrest Markets has partnered with top-tier liquidity providers to offer fair pricing and reliable execution. The broker is committed to transparency by ensuring that spreads, commissions, and fees are clearly outlined without hidden costs. Furthermore, traders can expect a 99.8% fill rate and fast execution speeds, minimizing slippage and order delays.

However, it’s important to note that Seacrest Markets does not provide services to residents of the United States or Canada, likely due to regulatory restrictions in these regions. Traders from other countries should still verify local regulations before signing up.

Seacrest Markets Review: Customer Support

Reliable customer support is essential for any broker, and Seacrest Markets prioritizes accessibility and trader satisfaction. The broker offers 24/5 multilingual customer support. This ensures that you can get help whenever the markets are open. Whether you need assistance with account setup, technical issues, or trading inquiries, the support team is available through live chat, email, and phone.

One of Seacrest Markets’ strengths is its commitment to responsive and knowledgeable support. Traders can expect quick response times and well-trained representatives who understand trading concepts and platform functionality. Additionally, the broker provides an extensive FAQ section and self-help resources, allowing clients to find answers to common questions without waiting for a support agent.

Pros & Cons

Like any broker, Seacrest Markets has strengths and limitations. Here’s a breakdown:

✅ Pros:

- FSCA-regulated broker ensuring compliance and fund protection

- Competitive spreads starting from 0.0 pips with deep liquidity

- Fast execution speeds with a 99.8% fill rate

- MetaTrader 5 (MT5) platform with advanced trading tools

- Low minimum deposit ($50), making it accessible to beginners

- Supports multiple asset classes (Forex, CFDs, indices, commodities, crypto, stocks)

- No deposit or withdrawal fees

- 24/5 multilingual customer support

❌ Cons:

- Not available to traders in the U.S. and Canada

- Limited regulatory oversight outside of South Africa

- No MetaTrader 4 (MT4) option for those who prefer it

Despite a few limitations, Seacrest Markets positions itself as a strong choice for traders looking for competitive trading conditions, security, and transparent pricing.

How to Get Started with Seacrest Markets

Trading with Seacrest Markets is quick and straightforward. The broker offers a fast, three-step account opening process, allowing you to start trading in minutes.

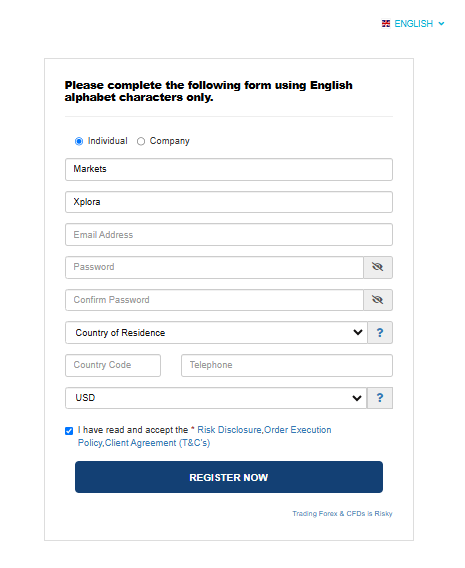

1. Register – First, visit the Seacrest Markets website and sign up for an account. Choose between a Classic or VIP Spread account, then complete the secure online application form.

2. Fund – After your account is approved, deposit funds using a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets. With a low $50 minimum deposit, you can start trading without a large upfront investment.

3. Trade – Once your funds are available, access 100+ trading instruments on the MetaTrader 5 (MT5) platform. Whether you prefer forex, indices, commodities, or cryptocurrencies, you can start executing trades immediately.

Seacrest Markets ensures a smooth and hassle-free onboarding process for beginners and experienced traders.

Concluding Seacrest Markets Review

Seacrest Markets has positioned itself as a modern, trader-focused brokerage that combines advanced technology with competitive trading conditions. The FSCA regulation adds a level of credibility, while its low deposit requirements make it an attractive option for traders of all levels.

So, if you’re looking for a regulated broker in South Africa with competitive pricing, and a wide range of assets, Seacrest Markets is worth considering.

Frequently Asked Questions

1. Is Seacrest Markets legit?

Yes, Seacrest Markets is a legitimate broker. It is licensed and regulated by the FSCA of South Africa under FSP License Number 53315.

2. What is the minimum deposit to open an account?

The minimum deposit required to start trading with Seacrest Markets is $50 or its equivalent in other currencies. This low entry requirement makes it accessible to both beginners and experienced traders.

3. What trading platforms does Seacrest Markets support?

Seacrest Markets exclusively offers MetaTrader 5 (MT5), a powerful and feature-rich trading platform.

4. Does Seacrest Markets charge deposit and withdrawal fees?

No, Seacrest Markets does not charge fees on deposits or withdrawals. However, payment providers may apply their own transaction fees, depending on the funding method used.