This guide breaks down five Ultima Markets account types that fit your trading style, budget, and goals. After reading this, you can make your choice and start trading with confidence instead of second-guessing your choice.

Ultima Markets Account Types: Quick Overview

Before diving deep, here are the 5 types of accounts Ultima Markets offers:

- Standard Account – Commission-free trading with 1.0 pip spreads for straightforward cost calculation

- ECN Account – Raw 0.0 pip spreads with $5 commissions for active traders seeking lowest costs

- Cent Accounts – Micro-lot trading with minimal risk exposure, available in Standard and ECN variants

- Demo Account – $100,000 in virtual funds for risk-free practice and platform testing

- PAMM/MAM Accounts – Professional money management services for hands-off investing

What is Ultima Markets?

Ultima Markets is a legit CFD and forex broker established in 2016. They offer traders like you access to 250+ trading instruments across currencies, commodities, indices, and stocks.

Ultima Markets is licensed and authorized by the FCA regulation in the UK and the FSC regulation in Mauritius. This broker provides traders with institutional-grade execution technology and comprehensive fund protection measures, including negative balance protection and up to $1,000,000 insurance coverage per account.

Read also: Ultima Markets Review

Ultima Markets Account Types: Which One Fits You?

The account type you choose sets the foundation for your trading success. Remember, changing account types later is possible, but starting with the right choice from the beginning saves time and potential losses from inappropriate cost structures.

Standard Account

The Standard Account eliminates the complexity of commission fees by building everything into the spread.

- Minimum Deposit: $50 USD (accessible starting point)

- Spreads: From 1.0 pips (EUR/USD typically 1.2-1.5 pips)

- Commission: $0 (all costs included in spread)

- Leverage: Up to 1:2000

- Platforms: MT4, MT5, WebTrader, Mobile Apps

- Products: 250+ instruments across all asset classes

You’ll pay 1.0 pips minimum on major currency pairs like EUR/USD, which means a $10 cost per standard lot trade. This straightforward pricing helps beginners focus on learning trading strategies instead of calculating complex fee structures.

If you’re swing trading EUR/USD with weekly positions, paying 1.2 pips per trade is simpler than managing separate spread and commission costs. For a $1,000 account making 2-3 trades weekly, the Standard Account’s predictable costs make budgeting easier.

Advantages of Ultima Markets Standard Account:

- No surprise commission fees affecting profit calculations

- Ideal for position trading and swing trading strategies

- Perfect for learning without complex cost structures

- All trading platforms available

Limitations of Ultima Markets Standard Account:

- Higher total costs for frequent traders (10+ trades daily)

- Less competitive for scalping strategies requiring tight spreads

- Not optimal for high-frequency algorithmic trading

Best for: New traders wanting simple pricing, casual traders making fewer than 10 trades weekly, and anyone who prefers predictable costs without commission calculations.

ECN Account

If you want to enjoy the best trading conditions as a trader, then you should consider the ECN account.

- Minimum Deposit: $50 USD (same as Standard)

- Spreads: From 0.0 pips (EUR/USD typically 0.1-0.3 pips raw)

- Commission: $5 per round turn ($2.50 each way)

- Leverage: Up to 1:2000

- Platforms: MT4, MT5, WebTrader, Mobile Apps

- Products: 250+ instruments across all asset classes

As you can see, the ECN Account provides direct market access with raw spreads starting from 0.0 pips, plus a $5 commission per round turn (open and close). For active traders, this typically results in 30-50% lower trading costs compared to commission-free accounts.

Scalping EUR/USD with 20 trades daily, you’ll pay approximately 0.2 pips spread + $5 commission = roughly 0.7 pips total cost versus 1.2+ pips on Standard accounts. Over 100 trades monthly, this saves $500+ on standard lot trading.

Advantages of Ultima Markets ECN Account:

- Lowest total trading costs for active strategies

- Raw market spreads without broker markup

- Superior execution speeds for time-sensitive trades

- Transparent pricing model

- Ideal for automated trading systems

Limitations of Ultima Markets ECN Account:

- Commission fees complicate profit/loss calculations

- Less cost-effective for very low-frequency trading

- Requires understanding of total cost calculation

Best for: Traders making 10+ trades weekly, scalpers, day traders, and anyone prioritizing the lowest possible trading costs over pricing simplicity.

Cent Accounts

Ultima Markets offers two types of Cent accounts—Standard Cent Account and ECN Cent Account. They both allow you to trade real markets with cents instead of dollars, effectively reducing your risk exposure by 100x while maintaining realistic trading conditions.

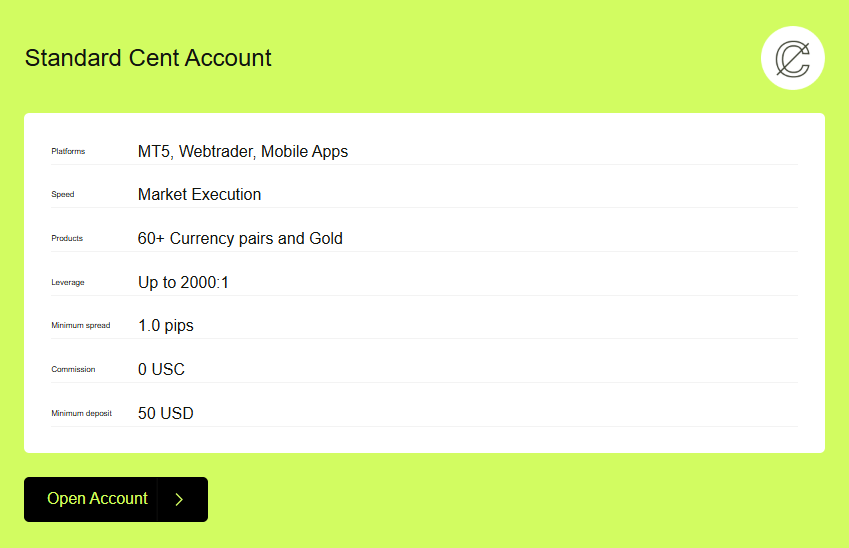

Standard Cent Account:

Perfect for beginners who want simple, commission-free pricing while learning:

- Minimum Deposit: $50 USD

- Spreads: From 1.0 pips

- Commission: $0 USC (cents)

- Products: 60+ currency pairs plus gold

- Platforms: MT5, WebTrader, Mobile Apps

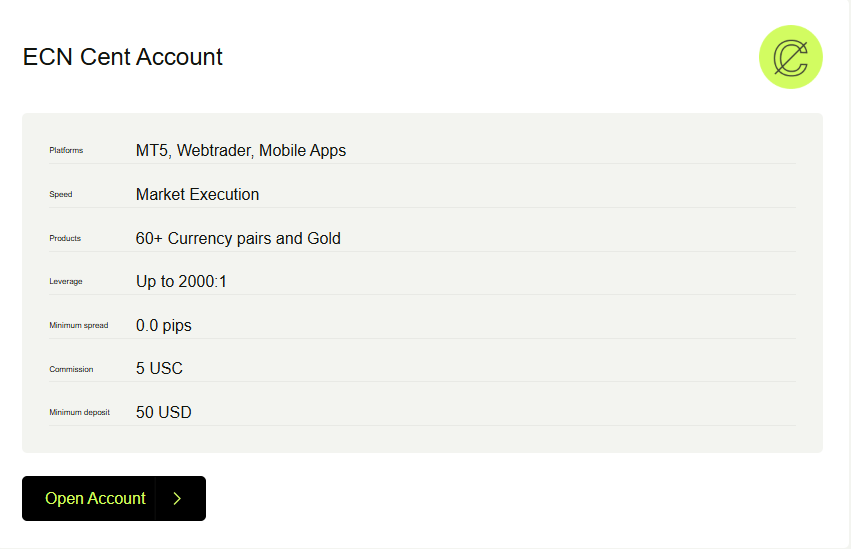

ECN Cent Account:

Ideal for learning advanced strategies with professional-grade pricing:

- Minimum Deposit: $50 USD

- Spreads: From 0.0 pips (raw market spreads)

- Commission: $5 USC (cents) per round turn

- Products: 60+ currency pairs plus gold

- Platforms: MT5, WebTrader, Mobile Apps

On both accounts, you can trade 0.01 lots (1 cent per pip) instead of standard lots ($1 per pip), making learning affordable.

For example, instead of risking $100 per pip movement on EUR/USD, you risk $1 per pip movement. A 50-pip loss costs $50 instead of $5,000, allowing you to learn from mistakes without devastating losses.

Advantages of Ultima Markets Cent Account:

- Learn trading psychology with real money but minimal risk

- Perfect position sizing practice for future scaling

- Test strategies with actual market conditions

- Smooth transition path to standard accounts

Disadvantages of Ultima Markets Cent Account:

- Limited instrument selection (60+ vs 250+)

- Lower profit potential requires patience

- May not satisfy traders ready for larger positions

Best for: Complete beginners wanting real-market experience with minimal risk, traders testing new strategies, or anyone with limited capital wanting to practice position sizing.

Demo Account

Ultima Markets Demo accounts provide up to $100,000 in virtual funds with real market conditions.

Key Features:

- Virtual Funds: Up to $100,000

- Market Conditions: Real-time pricing and execution

- Time Limit: Unlimited practice time

- Platforms: All available (MT4, MT5, WebTrader, Mobile)

- Products: Full 250+ instrument access

This type of account allows you to test strategies, learn platform features, and develop trading skills without financial risk. For instance, you can test your scalping strategy on EUR/USD during London session volatility without risking real money. Practice managing multiple positions, using stop losses, and handling emotional pressure of trades moving against you.

Critical for success:

- Treat demo trading seriously—use realistic position sizes

- Practice with amounts you’d actually trade live

- Test your strategies across different market conditions

- Learn platform features thoroughly before going live

Best for: Every trader should start here, regardless of experience level, plus anyone testing new strategies or evaluating Ultima Markets’ platform features.

PAMM/MAM Accounts

Ultima Markets offers sophisticated PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) solutions that connect skilled traders with investors through flexible, transparent fund management systems.

Understanding PAMM vs MAM:

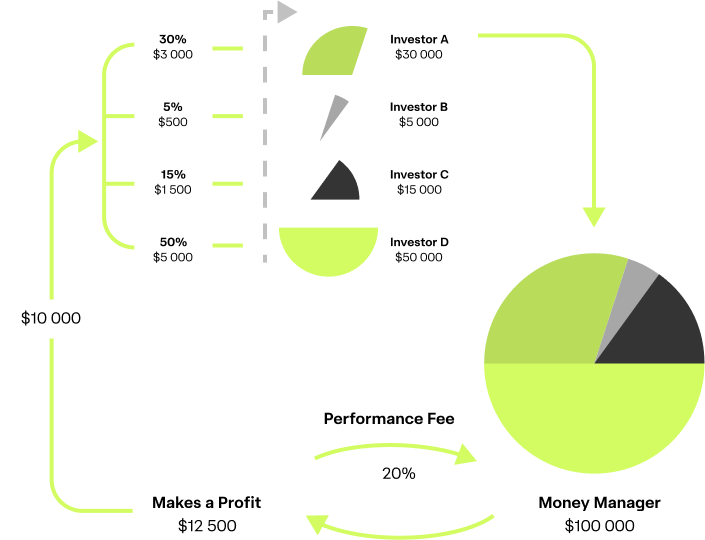

How PAMM Works

Operates as a pooled fund where multiple investors allocate capital to qualified money managers. Profits and losses are distributed proportionally based on each investor’s contribution percentage. Managers earn performance-based incentives while investors benefit from professional trading expertise.

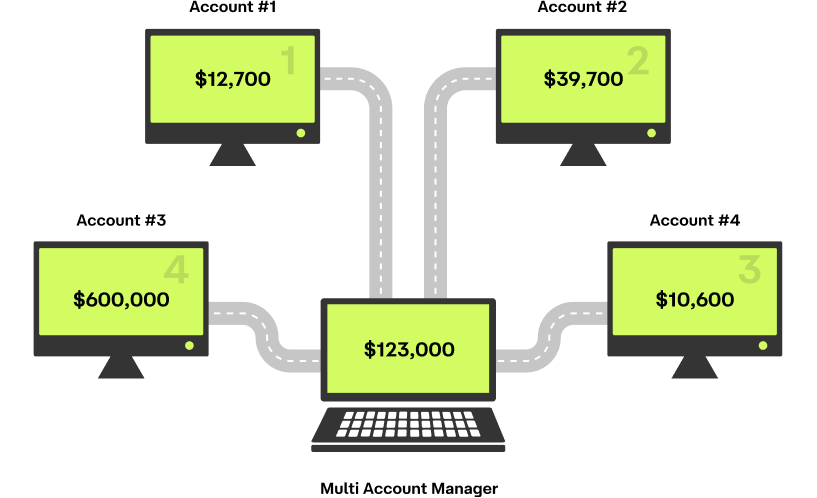

How MAM Works

Enables fund managers to simultaneously execute trades across multiple individual client accounts. Each client maintains a separate account while benefiting from the manager’s trading decisions. This system allows for more customized management approaches and individual account control.

As an investor, you could allocate $2,000 to a PAMM fund with a proven manager showing 15% annual returns. Your investment grows alongside other investors’ funds, with profits distributed based on your percentage of the total pool. As a skilled trader, you could manage multiple client accounts through MAM, earning performance fees while clients benefit from your expertise.

Key Features and Benefits

For Investors:

- Professional trading without requiring market knowledge

- Transparent entry and exit pricing

- Real-time order management and performance tracking

- Maintain account ownership and withdrawal rights

- Unlimited access to various fund managers

- Automatic profit/loss allocation based on investment percentage

For Fund Managers:

- Manage pooled funds or multiple accounts efficiently

- Customizable fee and commission structures

- STP (Straight Through Processing) access with instant allocation

- Expert Advisor compatibility for automated strategies

- Autonomous control over trading decisions

- Automatic client onboarding system

Best for: Passive investors seeking professional trading management, busy professionals without time for active trading, experienced traders wanting to manage others’ funds, or investors seeking diversified strategy exposure without learning technical analysis.

Getting Started Process:

- Register: Complete Ultima Markets account registration and verification

- Request Access: Email info@ultimamarkets.com for PAMM/MAM account setup

- Start Trading: Configure terms, connect with investors/managers, and begin operations

Ultima Markets Account Comparison

Account Type |

Min Deposit |

Spread Type |

Commission |

Platform |

|---|---|---|---|---|

ECN |

$50 USD |

Raw (0.0+ pips) |

$5 per round turn |

MT4/MT5, Webtrader, Mobile Apps |

Standard Cent |

$50 USD |

Variable (1.0+ pips) |

$0 USC |

MT4/MT5, Webtrader, Mobile Apps |

ECN Cent |

$50 USD |

Raw (0.0+ pips) |

$5 USC per round turn |

MT5, Webtrader, Mobile Apps |

Demo |

$0 |

Simulated |

$0 |

N/A |

*Example based on EUR/USD standard lot trade during typical market conditions

Choosing Your Best Ultima Markets Account

Start With Your Trading Frequency

Low Frequency (1-5 trades per week): Choose Standard Account. Commission-free pricing works in your favor when you’re not trading frequently. The slightly wider spreads won’t significantly impact your returns, and the simplified cost structure helps with trade planning.

Medium Frequency (5-15 trades per week): Calculate both options. If you’re trading standard lots, ECN often becomes cost-effective. For smaller position sizes, Standard might still be cheaper. Use this calculation: (Average spread difference × position size × weekly trades) vs (weekly trades × $5 commission).

High Frequency (15+ trades per week): Choose ECN Account immediately. The tighter spreads will save you significant money that far exceeds the commission costs. This is non-negotiable for profitable scalping.

Consider Your Capital and Risk Tolerance

Under $500 starting capital: Start with Cent accounts (Standard or ECN based on frequency above). This allows proper position sizing without over-leveraging. Graduate to regular accounts as your capital and confidence grow.

$500-$2,000 starting capital: Go directly to Standard or ECN accounts based on your trading frequency. You have enough capital to trade mini lots comfortably while maintaining proper risk management.

$2,000+ starting capital: ECN Account typically provides the best value. Your larger positions benefit more from tight spreads, and the commission becomes a smaller percentage of your trading costs.

Account Selection by Trading Style

Swing Traders (positions held days to weeks):

- Standard Account recommended

- Lower frequency makes commission-free structure ideal

- Focus on fundamental analysis over execution speed

Day Traders (positions closed same day):

- ECN Account for most

- Standard Account acceptable if trading fewer than 5 times daily

- Raw spreads become crucial for profitability

Scalpers (multiple trades per session):

- ECN Account mandatory

- Raw spreads essential for strategy viability

- Commission costs are easily offset by spread savings

News Traders (trading economic announcements):

- ECN Account preferred

- Fast execution and tight spreads crucial during volatility

- Market execution helps avoid slippage

How to Get Started with Ultima Markets

Step 1: Registration (5 minutes)

Visit the Ultima Markets website and complete the online application. You’ll provide basic information including name, email, phone number, and trading experience level. Choose your preferred account type during registration—you can always start with Demo and upgrade later.

Step 2: Account Verification (1-2 business days)

Submit required documents for identity verification:

- Identity proof: Government-issued photo ID (passport, driver’s license)

- Address proof: Recent utility bill or bank statement (under 3 months old)

- Additional documents: May be requested based on deposit amount or payment method

Pro tip: Upload clear, high-resolution documents to avoid verification delays. Most verifications complete within 24 hours for standard documentation.

Step 3: Make Your First Deposit (Instant to 5 days)

Choose from multiple deposit methods based on your needs:

Fastest options (1 hour processing):

- Credit/Debit cards (Visa, Mastercard): $50-$1,900 limit

- Cryptocurrency (Bitcoin, USDT): $50-$5,000,000 limit

- Regional payment methods (Alipay, UnionPay): Varies by region

Slower but higher limits (2-5 business days):

- International wire transfer: Up to $99,999,999.99

- Bank transfers: Various limits by region

Smart deposit strategy: Start with the minimum for your chosen account type, test the platform and execution, then add more capital once you’re satisfied with performance.

Step 4: Platform Setup and First Trades (30 minutes)

Download your preferred trading platform (MT4, MT5, or use WebTrader) and log in with credentials sent to your email. Start with small positions to test execution quality and get comfortable with the platform before implementing your full trading strategy.

Frequently Asked Questions

What Ultima Markets account types are available?

Ultima Markets offers five account types: Standard (commission-free with 1.0+ pip spreads), ECN (raw spreads from 0.0 pips with $5 commissions), Standard Cent and ECN Cent (micro-lot versions for reduced risk), and Demo accounts with $100,000 virtual funds. PAMM/MAM accounts are also available for professional money management services.

What is the minimum deposit for each Ultima Markets account?

All live trading accounts require just $50 USD minimum deposit, making Ultima Markets accessible regardless of your starting capital. Demo accounts require no deposit and provide up to $100,000 in virtual funds for unlimited practice trading.

Which Ultima Markets account is best for scalping?

ECN Account is essential for profitable scalping. The raw spreads starting from 0.0 pips combined with market execution provide the tight pricing scalpers need. While you’ll pay $5 commission per round turn, the spread savings typically result in 40-60% lower total costs compared to Standard accounts for high-frequency strategies.

Can I switch account types after opening one?

You can open additional accounts of different types, but transferring funds between account types typically requires withdrawal and re-deposit. Contact Ultima Markets support for specific procedures, as they may accommodate internal transfers under certain circumstances. Most traders find it easier to open a new account type rather than converting existing accounts.

Do all account types offer the same leverage?

Yes, all live trading accounts offer identical maximum leverage up to 1:2000. Your account type choice should focus on cost structure and features rather than leverage differences. Remember that available leverage varies by instrument—forex pairs typically offer higher leverage than stock CFDs.