If you’re searching for a SeacrestFunded review, chances are you’re considering this prop firm but aren’t sure if it’s worth your time and money. Many traders fail because they overlook key details—don’t let that be you.

In this guide, I’ll reveal how SeacrestFunded works, its challenges, payouts, pros and cons, and whether it’s the right choice for you in 2025.

SeacrestFunded Overview

|

|

|---|---|

Founded |

2022 (formerly MyFundedFx) |

Headquarters |

Dallas, Texas |

Active Users |

92,612+ |

Countries Supported |

190+ |

Account Sizes |

Up to $400,000 (scalable to $1M) |

Profit Split |

Up to 80% |

Evaluation Types |

1-Step, 2-Step, 2-Step Max, 3-Step |

Profit Target |

6% (for evaluation phases) |

Risk Limits |

4% Daily Loss, 8% Overall Loss |

Payout Frequency |

Every 5 days |

Trading Instruments |

175+ assets (Forex, Indices, Crypto, Commodities) |

Scaling Plan |

+25% every 3 months (up to $1M) |

Regulation & Compliance |

Registered in Hong Kong & Cyprus |

What Is SeacrestFunded?

SeacrestFunded, founded in 2022 and headquartered in Dallas, Texas, is a proprietary trading firm that provides traders with access to simulated capital and performance-based payouts. Formerly known as MyFundedFx (MFFX), the firm has grown rapidly, boasting 92,612 active users across 190+ countries. In 2024 alone, it has paid out over $10 million, with the highest single payout reaching $74,914.16.

Unlike traditional brokers, SeacrestFunded does not offer direct market access or real funds. Instead, it runs a simulated trading model, where traders complete an evaluation to prove their skills.

Successful traders unlock larger simulated accounts and can withdraw up to 80% of their simulated profits per payout cycle. By eliminating financial risk, SeacrestFunded allows traders to grow their accounts without using their own money.

Is SeacrestFunded Regulated?

SeacrestFunded operates under MyFunded Capital (HK) Ltd in Hong Kong and MyFunded Capital Solutions Ltd in Cyprus, both of which are registered business entities compliant with local and international laws.

However, it’s important to note that prop trading firms like SeacrestFunded are not traditional brokers and typically do not fall under financial regulatory bodies like the SEC or FCA. Instead, they function as private funding programs offering traders access to simulated capital under specific terms.

How SeacrestFunded Works

SeacrestFunded follows a challenge-based model designed to identify skilled traders. The process is simple: traders sign up, choose an account size, and complete an evaluation by meeting specific profit targets while staying within risk limits. Depending on the chosen challenge (1-Step, 2-Step, or 3-Step), traders must achieve a 6% simulated profit target while avoiding a daily loss of 4% and an overall loss of 8%. There are no minimum trading days required in live simulated accounts, so traders can pass in as little as one trade.

Once traders pass the challenge and submit their KYC verification documents, they gain access to a funded virtual account. From this point, they can trade freely while following the firm’s rules. Every five days, traders can withdraw up to 80% of their simulated profits, making it one of the fastest payout structures in the industry.

This model is ideal for traders who want to grow their capital without personal financial risk. By using a scaling plan, SeacrestFunded allows successful traders to increase their account balance by 25% every three months, with the potential to scale up to $1 million. This structure ensures that traders who consistently perform well have the opportunity to manage larger accounts and increase their earnings over time.

Account Size and Challenges

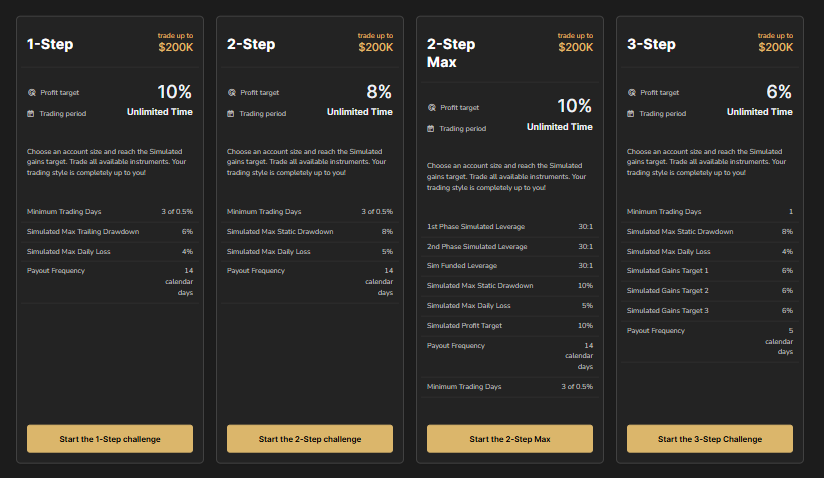

SeacrestFunded offers multiple challenge types to cater to different trading styles and risk appetites. These challenges act as a test phase, where traders must meet specific profit targets while maintaining disciplined risk management. There are four main challenge options:

- 1-Step Challenge – The simplest option, requiring traders to hit a 10% profit target while staying within the 4% daily loss and 8% overall loss limits.

- 2-Step Challenge – Traders must pass two phases, both with an 8% profit target, but still maintaining the same risk limits.

- 2-Step Max Challenge – A more advanced version of the 2-Step challenge, with a 10% profit target while staying within the 5% daily loss, and is for traders seeking a higher payout structure.

- 3-Step Challenge – The most extensive evaluation, requiring three successful phases before qualifying for a funded virtual account.

Each challenge allows traders to choose from different simulated account sizes, ranging from $5,000 to $400,000. The cost of entry varies depending on the selected account size, with a one-time fee that grants traders access to the evaluation process.

One major advantage of SeacrestFunded’s model is that there are no time restrictions on completing the challenges. Unlike other prop firms that require traders to hit targets within 30 or 60 days, SeacrestFunded lets traders progress at their own pace. This flexibility is especially beneficial for swing traders or those who prefer a more careful, strategic approach to the market.

Once a trader successfully passes their selected challenge, they move on to the verification stage, where they submit identification documents to confirm their identity. After approval, they gain access to a funded virtual account, where they can start earning payouts based on their trading performance.

SeacrestFunded Review: Trading Platforms

SeacrestFunded offers three powerful trading platforms—DXTrade, Match-Trader, and cTrader—each designed to provide traders with a seamless experience across web, Android, and iOS devices.

DXTrade stands out with its cloud-based structure, making trading smooth and accessible from anywhere. It features advanced charting with over 80 indicators, multi-view watchlists, and a built-in trading journal to track performance.

One-click trading, protection orders, and customizable stop-loss settings help traders manage risks effectively.

Match-Trader provides a trader-centric experience with instant deposits through a built-in crypto payment gateway, ensuring uninterrupted trading. It also offers full control over trade execution, detailed analytical tools, and seamless integration with TradingView charts.

The platform’s all-in-one widget keeps market movers, news, and event calendars within easy reach.

cTrader caters to professional traders with deep liquidity access, lightning-fast order execution, and sophisticated risk management tools. It supports multiple order types, automated trading through cAlgo, and an intuitive interface designed for both beginner and experienced traders.

Trading Rules and Conditions

SeacrestFunded stands out by offering traders complete flexibility regarding trading days. Unlike many prop firms that impose strict time limits, SeacrestFunded allows traders to complete their evaluation at their own pace. The only time-based requirement applies to the scaling plan, where traders must achieve a 12% simulated profit within 90 days to qualify for an account increase.

To pass the evaluation and qualify for a funded virtual account, traders must meet clear profit and risk thresholds:

- Profit Target: Traders need to achieve a 6% simulated profit during the challenge phase.

- Daily Loss Limit: The maximum allowable simulated loss in a single day is 4% of the account balance.

- Overall Loss Limit: Traders must avoid exceeding an 8% simulated loss across the entire evaluation period.

If a trader breaches these limits, their account will be disqualified. These rules encourage strong risk management and prevent reckless trading strategies.

Once traders pass their challenge and verification process, they gain access to a live simulated account, where they can start earning withdrawals. SeacrestFunded offers one of the fastest payout structures in the industry, allowing traders to request a payout every five days.

Traders keep up to 80% of their simulated profits, which is one of the highest payout rates among prop firms. This means that if a trader generates $5,000 in simulated gains, they can withdraw $4,000 while SeacrestFunded retains 20% as a fee. This profit split makes the firm attractive to experienced traders looking for frequent and substantial earnings.

What Instruments Can You Trade?

Traders can access a wide range of 175+ trading instruments, including:

- Forex pairs – Major, minor, and exotic currency pairs

- Indices – Global stock indices like the S&P 500, Nasdaq, and Dow Jones

- Commodities – Gold, silver, oil, and other key resources

- Cryptocurrencies – Bitcoin, Ethereum, and a selection of altcoins

With such a diverse selection, traders can adapt to different market conditions and take advantage of various asset classes. Additionally, holding trades overnight is allowed across all account types. However, as revealed later in this SeacrestFunded review, traders should be aware of swap fees, which apply to positions held beyond a trading day.

Permitted and Prohibited Trading Strategies

Traders at SeacrestFunded are allowed to use any trading style as long as they follow risk management rules. These trading styles include scalping, day trading, and swing trading. The firm also permits martingale strategies, grid trading, and hedging (within the same account), making it more inclusive than many other prop firms.

However, certain trading practices are strictly prohibited. Violating these rules can result in immediate disqualification and account closure. Some of the key prohibited practices include:

- Copy trading – Using Expert Advisors (EAs) or mirroring trades across multiple accounts

- Simulated reverse trading & group hedging – Placing opposite trades in different accounts to exploit payout rules

- External account management – Purchasing or selling account management services

- High-Frequency Trading (HFT) – Using ultra-fast algorithms or AI-based mass data entry techniques

- Exploiting platform errors – Taking advantage of price discrepancies, latency issues, or slow data feeds

SeacrestFunded enforces these rules to prevent manipulation and maintain a level playing field for all traders. As mentioned, those violating the policies risk terminating their demo accounts. In severe cases, you may be permanently banned from the platform. So we encourage you to read and understand all terms before participating in the program to avoid unintentional violations.

Scaling Plan – How to Grow Your Account

SeacrestFunded offers a scaling plan designed to help traders gradually increase their account size based on consistent performance. This feature allows traders to expand their simulated funding by 25% every three months, provided they meet specific criteria. The ultimate goal is to scale accounts up to a maximum of $1 million in simulated funds, giving traders the ability to manage larger positions and increase their potential payouts.

To qualify for scaling, traders must:

- Start with a fresh account at its initial simulated balance.

- Achieve a 12% net simulated gain within a 90-day period.

- Maintain proper risk management and avoid rule violations.

For example, a trader starting with a $100,000 account who meets the scaling requirements can increase their balance to $125,000 after three months. If they continue performing well, they can reach $150,000 at six months, and eventually scale up to $500,000 or beyond. This plan rewards disciplined traders and provides long-term growth opportunities.

Additionally, SeacrestFunded allows traders to merge accounts once they qualify for scaling. This means that if a trader has multiple funded virtual accounts, they can combine them into a single larger account to simplify management and maximize trading potential.

Fees & Costs

In this SeacrestFunded review, I must emphasize that, unlike traditional brokers that profit from spreads and commissions, SeacrestFunded operates on a one-time entry fee model. This means that you won’t pay monthly or hidden charges. Traders must pay an upfront fee to participate in the evaluation process, which varies depending on the account size you choose.

SeacrestFunded offers four challenge types, each with different pricing based on account size. Here’s a breakdown:

📌 1-Step & 2-Step Challenges

- $5,000 account – $50

- $10,000 account – $100

- $25,000 account – $200

- $50,000 account – $300

- $100,000 account – $500

📌 2-Step Max Challenge (Lower Fees)

- $5,000 account – $38

- $10,000 account – $75

- $25,000 account – $140

- $50,000 account – $210

- $100,000 account – $425

📌 3-Step Challenge (Advanced Traders)

- $10,000 account – $70

- $25,000 account – $150

- $50,000 account – $225

- $100,000 account – $375

As you can see, higher account sizes require higher fees but provide more trading capital. The 2-Step Max Challenge offers the most cost-effective entry option.

Additionally, you should be aware of potential swap fees when holding positions overnight. Every Wednesday, a 3-day swap charge applies to account for weekend rollovers. While this is standard practice in the trading industry, traders should factor these fees into their strategies to avoid unnecessary costs.

Getting Verified & Funded

Once a trader successfully passes their selected challenge, the next step is verification. This is a standard Know Your Customer (KYC) process to confirm the trader’s identity before granting access to a funded virtual account. Traders are required to submit a government-issued ID, such as a passport or driver’s license. The review process is fast, less than 1 hour, ensuring traders can start trading as soon as possible.

After verification, traders gain access to a live simulated account, where they can trade without any further simulated profit targets. The only requirements at this stage are to avoid exceeding the daily and overall loss limits. Unlike the challenge phase, there is no longer a minimum trading period, giving traders full flexibility in how they manage their trades.

At this stage, traders are considered fully funded and can start earning payouts based on their simulated profits. With a fast-track verification process and no additional trading restrictions, SeacrestFunded ensures that traders can smoothly transition from the evaluation phase to a funded virtual account.

Payouts & Withdrawals

SeacrestFunded offers one of the fastest payout structures in the prop trading industry, allowing traders to request withdrawals as frequently as every five days. Traders receive up to 80% of their simulated profits, ensuring they keep the majority of their earnings.

The payout process is straightforward:

- Traders complete a 14-day trading cycle and generate simulated profits.

- They submit a payout request through the dashboard.

- Funds are processed and sent via cryptocurrency, bank transfer, or other available payment methods.

Unlike some prop firms that impose long waiting periods, SeacrestFunded’s five-day payout cycle ensures traders can quickly access their funds. The firm has already processed over $10 million in payouts in 2024 alone, proving its reliability.

Additionally, SeacrestFunded offers a scaling plan, which allows traders to increase their simulated account balance by 25% every three months, provided they meet the required 12% net gain. This feature enables traders to grow their accounts over time, maximizing their earning potential.

With fast withdrawals, flexible scaling options, and a high profit split, SeacrestFunded provides traders with a structured yet rewarding path to financial growth in the prop trading space.

SeacrestFunded Reviews on Trustpilot

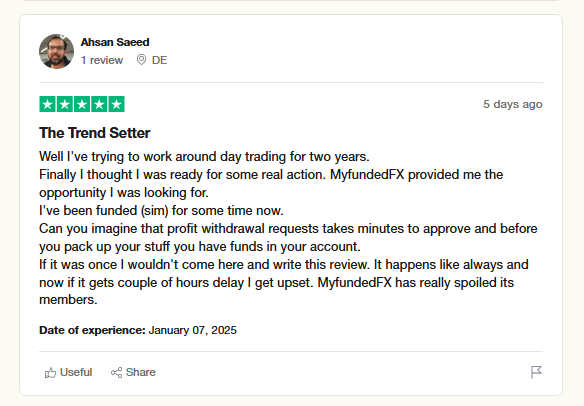

It was impressive when we found that SeacrestFunded holds a 4.2-star rating on Trustpilot. This rating reflects a generally positive reputation among traders. Many users praise the firm for its fast payout processing, responsive customer support, and flexible trading conditions.

For instance, Nebojsa, a trader from Austria, describes SeacrestFunded as “one of the best prop firms in the early stage,” highlighting the simple rules and quick funding process. Similarly, Led from the UK shares a “great experience,” emphasizing the helpfulness of live chat support. Another trader, Ahsan Saeed from Germany, calls SeacrestFunded a “trendsetter,” noting that profit withdrawals are processed in minutes, a rarity in the industry.

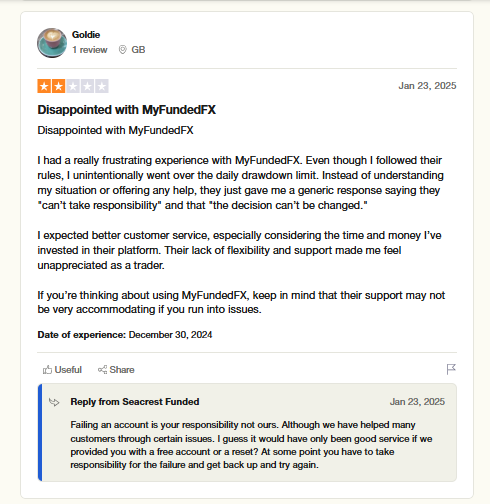

However, not all reviews are glowing. Goldie from the UK rated the firm 2 stars, expressing frustration over a rigid approach to drawdown violations.

SeacrestFunded’s response was blunt, stating that “failing an account is your responsibility, not ours.” This indicates that while the firm is efficient in payouts and support, it maintains strict adherence to its rules, which some traders may find unforgiving.

Overall, the SeacrestFunded reviews on TrustPilot suggest that SeacrestFunded is a reliable choice for disciplined traders who can follow the firm’s guidelines. Those looking for more flexibility in rule enforcement may need to consider these factors before signing up.

SeacrestFunded Review: Pros & Cons

Like any proprietary trading firm, SeacrestFunded has its strengths and weaknesses. Let’s see what they are:

✅ Pros

- No Time Limit on Challenges – Unlike many prop firms that impose strict deadlines, SeacrestFunded allows traders to complete their challenge at their own pace.

- Fast Payouts – Traders can withdraw up to 80% of simulated profits every five days, making it one of the fastest payout models in the industry.

- Diverse Trading Strategies Allowed – Scalping, hedging, martingale, and grid trading are all permitted, giving traders maximum flexibility.

- Generous Scaling Plan – Successful traders can increase their account size by 25% every three months, with the potential to scale up to $1 million.

- Low Entry Cost – The firm offers affordable challenge fees, making it accessible to a broad range of traders.

- Wide Asset Selection – Over 175 trading instruments, including forex, indices, commodities, and crypto, are available.

❌ Cons

- No New U.S. Clients – After rebranding, SeacrestFunded no longer accepts new U.S. traders, limiting access for prospective American clients.

- Simulated Trading Model – Unlike some prop firms that provide real market access, SeacrestFunded operates on a simulated basis, meaning trades do not impact live markets.

- Strict Risk Management Rules – The 4% daily loss limit and 8% overall loss limit can be restrictive for traders who use aggressive strategies.

- Prohibited Trading Practices – Copy trading, reverse trading, and certain high-frequency strategies are not allowed, which may limit some traders.

- No Refund on Challenge Fees – Unlike some firms like FTMO that refund the evaluation fee after passing, SeacrestFunded does not offer refunds.

How to Get Started with SeacrestFunded

Getting started with SeacrestFunded is quick and straightforward. Follow these simple steps to begin your trading journey:

📝 Step 1: Create an Account

Visit the SeacrestFunded website, sign up, and verify your email to access the dashboard.

📊 Step 2: Choose Your Account Size

Browse the available challenge types and select an account size that fits your trading goals. Options range from $5,000 to $100,000.

💳 Step 3: Make Your Payment

Pay the one-time registration fee using a credit card or cryptocurrency. If paying with crypto, double-check the correct network to avoid delays.

📩 Step 4: Receive Your Credentials

Once payment is confirmed, you’ll receive your trading account details via email.

📈 Step 5: Start Trading

Log in, review the challenge rules, and begin trading with your selected account size.

💡 Tip: Ensure you pick the right challenge and trading conditions that match your strategy. Ready to trade?

Final Verdict – Is SeacrestFunded Worth It?

SeacrestFunded is a solid choice for traders looking to access high virtual capital without personal financial risk. The firm stands out for its flexible evaluation process, fast payouts, and scalable funding model, making it appealing to both beginners and experienced traders.

However, it’s important to recognize that SeacrestFunded operates on a simulated trading model, meaning traders are not trading real funds in live markets. For those who prioritize a real market experience, this may be a drawback. Additionally, strict risk management rules mean traders must be disciplined in their approach.

Overall, if you’re looking for a low-cost, high-reward opportunity to trade larger accounts, SeacrestFunded is a reputable and competitive option in the prop trading space. It provides a structured pathway for traders to grow their skills and earn payouts, making it worth considering for those who can trade consistently within the firm’s rules.

FAQs

Is SeacrestFunded Legit?

Yes, SeacrestFunded is a legitimate proprietary trading firm. Before rebranding, it operated under MyFunded Capital (HK) Ltd, registered in Hong Kong, and MyFunded Capital Solutions Ltd, registered in Cyprus.

Does SeacrestFunded Accept U.S. Clients?

No, traders from the United States are not accepted. However, proprietary trading firms like Topstep do.

Can I Trade News with SeacrestFunded?

Yes, traders are allowed to trade during news events. There are no restrictions on trading major economic releases, which is a significant advantage for those who specialize in high-volatility strategies.

How Many Accounts Can I Have?

Traders can manage multiple accounts, but the total simulated balance cannot exceed $400,000 at any given time. For those looking to scale further, SeacrestFunded offers a scaling plan, allowing traders to grow their accounts up to $1 million under specific conditions.