If you want to consistently profit from the forex markets, but don’t want to be tied to the screen all day or hold trades for months on end – then forex swing trading could be the answer to your search.

Swing trading aims to capture profitable swings in market prices over a well-defined timeframe lasting from a few days to a couple of weeks. It sits perfectly between day trading and long-term trend following.

In this beginner’s guide to swing trading forex you’ll learn:

- The meaning of swing trading and its timeframe

- Why swing trading is well-suited for the Forex markets

- How swing traders analyze and enter winning trades

- The vital skills needed to succeed with this style of trading

Successful forex swing traders gain an edge by analyzing technical charts to spot trade opportunities, jump on emerging short-term trends early on, then ride the wave until the momentum dries up. As price swings back and forth, the savvy trader makes money fading the herd’s emotional reactions by strategically entering and exiting trades.

To start laying the knowledge groundwork that will equip you to spot these tradable swings consistently, let’s quickly define what swing trading is in its essence…

What is Swing Trading in Forex?

Swing trading allows traders to profit from short-term price movements in the forex market – bigger than scalping small intraday moves but smaller than long-term position trading. Let’s look at an example to better understand this definition:

Say a swing trader is analyzing the EUR/USD currency pair on the daily chart and notices it has started trending higher. They believe based on technical factors that this uptrend could potentially continue for the next couple weeks.

The trader could enter a long position when the price pulls back to a key support level during an uptrend, suggesting the swing higher may resume after some consolidation. They might then hold this long euro trade for around 1-3 weeks aiming to profit from the expected swing continuation pattern.

If EUR/USD trends favorably as anticipated, the EUR/USD swing trade could capture a nice profit of $500-1,000 over that timeframe. If the trend stalls or reverses earlier than expected against the position, the trader would exit the losing trade quicker with a relatively small loss compared to longer-term trades.

This demonstrates the essence of swing trading – profiting from identified intermediate-term swings and trends in the currencies markets.

Read also! What is Day Trading?

Best Timeframes for Swing Trading

As the example illustrates, swing traders are aiming to profit from price movements lasting somewhere between a few days to a few weeks typically. This means they need to analyze charts capable of identifying emerging short-term trends and swing points that may play out over this timeframe.

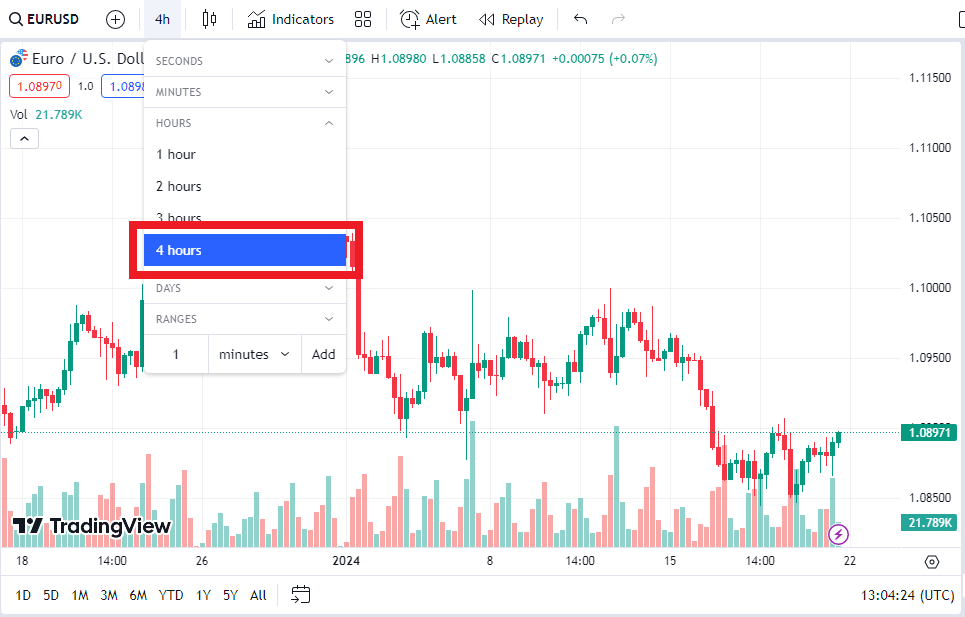

Swing traders often analyze 4-hour and daily price charts when scanning for trading opportunities, as these provide a clear picture of the intermediate-term trends and momentum.

Intraday charts like the 1-minute and 15-minute charts are more suited for day traders looking to scalp small moves that begin and end within a single trading session.

On the opposite end of the spectrum from swing trading are long-term position traders. These traders analyze long-term trends, using weekly and monthly charts. They aim to capture very large moves that can sometimes take months or even years to play out based on fundamental economic shifts.

Swing trading focuses on that sweet spot in between – taking advantage of short to medium-term opportunities lasting days to weeks. This provides more substantial profit potential than hyperactive day trading, while involving less duration risk than hoping a single position pays off over months or years. The liquid forex market offers countless intermediate-term trends making swing trading a potentially rewarding endeavor.

Why Swing Trade Forex?

There are some clear advantages of swing trading specifically in the forex markets that make it an appealing choice for traders.

Don’t need to sit at computer all day monitoring price like day trading

First, unlike day trading where you need to be glued to your charts all day long waiting for opportunities in often noisy market conditions, swing trading offers more flexibility. Swing traders check in periodically throughout the day but do not have to actively monitor the markets for hours on end if there are no clear trading setups.

Larger profit targets than scalping strategies

The intermediate timeframes of swing trading also allow for larger profit targets than day trading strategies aiming for quick small scalps. A few big winning swing trades can pay off more than hundreds of small intraday scalps.

Avoid extended durations of long-term trend trading

At the same time, swing traders avoid taking on the longer-term timing risks that come with positioning for monster moves over months or years. Forex markets don’t trend for extended periods, so swing trading focuses on taking advantage of shorter-term momentum.

Additionally, because currencies tend to trend and revert to aggressively compared to other markets, this makes profitable swing trading opportunities plentiful. The volatile nature of forex provides plenty of intermediate-term trends, ranges, and chart pattern breakouts perfectly suited for swing traders.

For traders looking for a flexible trading style that targets bigger Potential gains than day trading while avoiding huge timing risks, forex swing trading checks all the boxes. The abundance of tradable swings provides great chances for savvy swing traders.

Now, let’s get into the specifics of executing effective swing trading strategies…

Characteristics of Swing Trading

Swing trading well requires thorough analysis before entering trades, disciplined execution of trades, and prudent risk management.

-

Fundamental and technical analysis to spot opportunities

Before entering swing trade positions, skilled swing traders analyze both fundamental and technical factors across various timeframes to identify high-confidence opportunities with strong risk/reward potential. This includes keeping up on economic releases, news, and central bank policy, and combining that awareness with analysis of trends, support/resistance levels, momentum oscillators, and more on 4-hour to daily charts.

-

Disciplined risk and money management skills required

Once a trade is entered, stop losses should always be used on all swing trades to contain potential losing trades to predetermined acceptable levels. Additionally, sound game plans for taking partial profits at key levels and moving stops to break even/trailing stops are essential trade management components.

Winning swing trades should be managed according to plan as well, allowing the profits to ride as long as the intermediate-term trend persists in the trader’s favor. Letting winners run is vital, as most profits often come from a subset of large winning trades.

Please have a look at the Day Trading vs Swing Trading comparison resource as well when you get the opportunity to complement what you’ve learned here about swing trading forex specifically.

Wrapping Up

In summary, forex swing trading:

- Aims to profit from short to medium-term price swings lasting days to weeks

- Requires analysis skills to identify high-confidence trade entry points

- Relies on disciplined risk and money management principles

- Captures larger potential gains than day trading, with capped downside risk

The volatile forex markets offer abundant intermediate-term trends making swing trading very appealing for traders who:

- Want flexibility without watching charts all day like day traders

- Seek larger profit targets than scalping strategies

- Wish to avoid the timing uncertainty of long-term positions

For newer traders interested in forex swing trading, hopefully, this intro guide covered the key foundations:

- Swing trading definition and timeframes

- Reasons swing trading forex is advantageous

- How to analyze markets and identify opportunities

- Skills and best practices for succeeding with this style

If effectively trading market swings for profits sounds enticing, the few days to few weeks timeframe provides enough time for trades to play out while capping the risk. With the proper skills and strategies, fruitful forex swing trading is an achievable goal!

FAQs

- What is the typical timeframe for swing trades?

Swing traders hold trades anywhere from 2 days on the short end up to several weeks on the longer end, capturing swings over that timeframe.

- What currency pairs work best for swing trading forex?

Major pairs like EUR/USD and GBP/USD work well due to ample liquidity. Volatile crosses like GBP/JPY can also provide great swing trade opportunities.

- What types of analysis do swing traders use?

Swing traders use technical analysis of price charts across several timeframes as well as fundamental analysis to identify trading opportunities.

- What skills are most important in swing trading?

Discipline in executing high-probability trades selectively along with defined risk and money management skills are vital for consistent success.

- Is swing trading suitable for beginners?

With the proper education and realistic expectations, swing trading can potentially fit beginners willing to master analysis plus emotional and risk control.