Key Insights

- Michael Saylor selling MicroStrategy shares over 4 months to address finances and buy Bitcoin

- Will liquidate 5,000 MSTR stock options daily that are set to expire in April

- Says despite sales, his overall equity stake in the firm remains significant

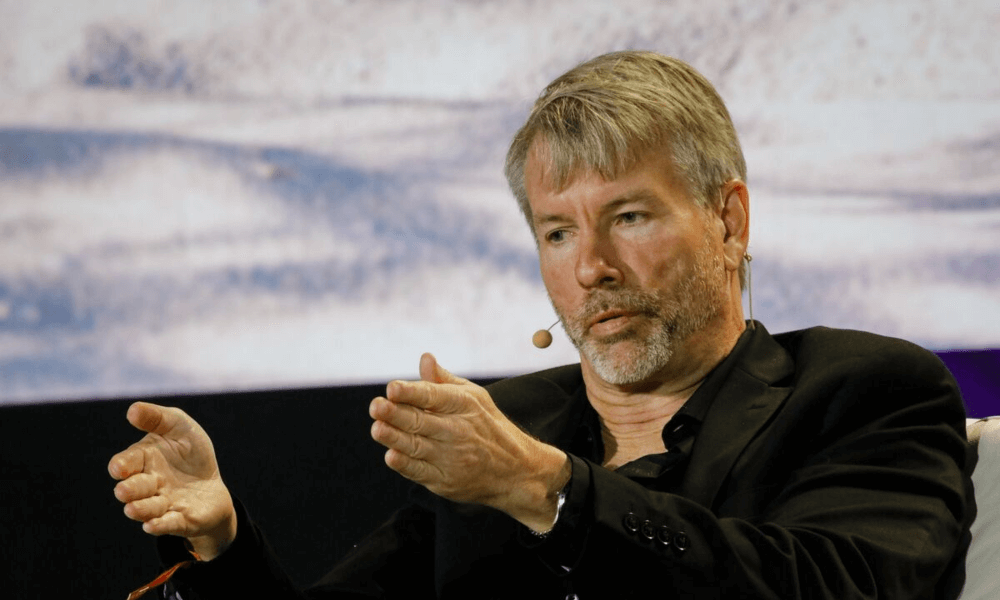

NEW YORK – MicroStrategy executive chairman and noted Bitcoin bull Michael Saylor initiated a months-long plan this week to unload shares in the business intelligence firm he founded, aiming to boost personal holdings of the cryptocurrency.

In a Securities and Exchange Commission (SEC) filing Tuesday, Saylor disclosed he will daily offload 5,000 MicroStrategy (MSTR) stock options set to expire in April over the four-month period until end-April 2024.

Proceeds will address undisclosed personal financial obligations as well as expand Saylor’s Bitcoin wallet, the regulatory document outlined. He assured his overall MSTR equity stake remains “significant” regardless, while declining to specify figures.

Saylor can shed up to 400,000 vested MSTR options between Jan. 2 and April 26 per prior regulatory filings – potentially raising over $216 million total at current market rates.

MicroStrategy shares themselves have rocketed over 400% across the past year, aided by Saylor’s very public wagers on Bitcoin ultimately superseding gold as the global inflation hedge of choice.

The firm now holds around 189,150 coins worth some $8.5 billion altogether – by far the largest corporate Bitcoin reserve on record. It continues directing excess cash flows into further accumulation, most recently adding 14,620 BTC in late December.

Yet MicroStrategy stock gains have not matched Bitcoin’s own stellar 170% price appreciation since 2022. That has sparked suggestions Saylor aims to increase direct crypto exposure by converting some MSTR equity into coins instead.

The CEO-turned Bitcoin maximalist will speak at several major crypto conferences this year to proselytize mass blockchain adoption. He must balance those evangelizing duties with stabilizing personal finances through planned MSTR sales.

Regulatory filings reveal Saylor has already begun the staggered selling process as of Jan. 2. Watchers keenly anticipate if conversion into Bitcoin follows next.