If you’ve been eyeing the world of futures trading, two of the biggest names you’ll come across are Topstep and Apex Trader Funding. At first glance, they seem to offer similar services—both give you access to funded accounts, both work with the futures markets, and both talk about “simple rules” and “fast payouts.”

But under the hood, they’re very different. This guide is built to walk you step-by-step through those differences and help you decide which prop firm aligns better with your goals—especially if you’re just starting out.

Topstep vs Apex Trader Funding: A Quick Glance

|

|

|

Launched |

2012 |

2021 |

Founder |

Michael Patak |

Darrell Martin |

Headquarters |

Chicago, Illinois, USA |

Austin, Texas, USA |

Evaluation Pricing |

From $49/month (for $50k account) |

From $50–$200/month (frequent discounts) |

Profit Payouts |

100% of first $5k, then 90% |

100% of first $25k, then 90% |

Total Payouts (2024) |

81,177+ payouts |

Over $538 million (since 2022) |

Trading Platform(s) |

TopstepX (powered by TradingView) |

NinjaTrader, Rithmic, Tradovate, others |

Instruments Traded |

Futures |

Futures |

Apex vs Topstep: Company Background:

Let’s start with the foundations. Topstep has been around since 2012 and is based in Chicago, one of the historical hearts of U.S. futures trading. It was built with a strong emphasis on trader education, risk management, and structure. Over the last decade, Topstep has earned the trust of thousands of traders, and in 2024 alone, it processed over 81,000 payouts. It positions itself as a professional and disciplined environment for those who want to take trading seriously—and many beginners appreciate the mentorship vibe and built-in learning tools.

On the other side, we have a newer but rapidly rising player: Apex Trader Funding, founded in 2021 by trader and educator Darrell Martin. Darrell launched Apex after experiencing the frustrating limitations of other prop firms firsthand. His goal was to create a model that real traders would actually want to use—one that prioritizes fewer restrictions, faster payouts, and more generous profit splits. Despite being the newer name, Apex has made a big splash, paying out over $538 million since its launch and building a community that spans over 150 countries. It’s a clear disruptor, designed to empower traders rather than box them in with tight rules.

While Topstep offers stability and a time-tested system, Apex appeals to traders who value freedom and flexibility. But before choosing sides, it’s important to understand how each firm evaluates your trading skills.

Evaluation Process

At the core of both platforms is a trader evaluation—a test phase where you prove you can trade responsibly before receiving real capital. But the way these evaluations work couldn’t be more different.

Topstep uses its well-known Trading Combine®, which lets you choose between account sizes like $50K, $100K, or $150K. You must trade within the firm’s set limits on losses and contract sizes, and pass certain profit targets without violating any rules. Topstep’s evaluation is technically one step, but payouts require you to complete 5 winning days with at least $150 profit each—so consistency is key. Their rules are clear and simple, but they do impose daily loss limits and restrict certain trading periods like major news events.

Apex, meanwhile, takes a far more relaxed approach. Their evaluation also lasts just 7 minimum trading days, and as long as you don’t hit the max trailing drawdown and meet your profit target, you’re in. There are no daily drawdowns, no scaling rules, and you’re even allowed to trade through news and holidays. Plus, if you accidentally try to place a trade over your contract limit, the system won’t disqualify you—it’ll simply reject the order. That’s a beginner-friendly safety net Topstep doesn’t offer. For many, this makes Apex feel less like a test and more like a real-world simulation.

So while both firms technically give you access to funded capital within days, Topstep leans on structure and discipline, while Apex emphasizes freedom and flexibility. The next logical step is to see how these evaluations feed into the actual account types and costs—which we’ll explore next.

Account Options & Pricing: What You Get, What You Pay

Both Topstep and Apex offer multiple account sizes so traders can choose a plan that suits their goals, risk tolerance, and budget. But they go about it in very different ways—and those differences matter, especially for beginners who want to start small and scale up.

Topstep gives you three core options: a $50K, $100K, or $150K account in the Trading Combine®. Monthly pricing starts at $49 for the smallest account, then climbs to $99 and $149 respectively. Profit targets range from $3,000 to $9,000, with maximum loss limits increasing as you go up. These prices stay locked in—even if it takes you months to pass the evaluation. However, once you pass, you’ll need to pay a $149 activation fee before trading live. And while Topstep does offer real buying power, keep in mind that your profits are split and some withdrawal requirements apply (more on that later).

Apex, meanwhile, is known for its aggressive pricing and generous promos—50% to 90% discounts are not uncommon. Regular prices start at around $147/month for a $25K Performance Account, going up to over $200 for the $300K plans. However, when discounted, a $50K or $100K evaluation can often be snagged for as low as $35/month. What’s more? You can fund multiple accounts at once, and they all come with free NinjaTrader licenses, real-time data, and no hidden platform fees—something Topstep doesn’t include. Once funded, you don’t need to pay monthly rebills, and you can trade with up to 20 live funded accounts if you want.

In short, Topstep keeps it neat and tidy with fixed pricing and structured scaling. Apex gives you way more flexibility and cost-saving potential, especially if you take advantage of their frequent promos.

Topstep vs Apex: Rules & Restrictions

Here’s where the two firms really part ways. If you’ve heard traders online debating “Topstep vs Apex,” this is likely what they’re arguing about: the rules.

Topstep is built with structure in mind. Each Trading Combine® account comes with clearly defined maximum position sizes, daily loss limits, and total drawdown limits. For instance, on the $50K account, you’re limited to 5 contracts and a $2,000 loss cap. Topstep also restricts trading during high-impact news events and requires all trades to be closed by the end of the trading day. That may sound rigid, but for beginners, it does help create discipline and consistency—two traits essential for long-term success.

Apex, by contrast, has made a name for itself by being far more relaxed. There are no daily drawdowns, no scaling plans, and no restrictions on news trading. You can place trades during FOMC or NFP events without worrying about getting disqualified. The only hard rule is the Trailing Threshold, which adjusts dynamically based on your highest account balance. Plus, Apex won’t auto-fail you for exceeding contract size—they’ll just block the order. That’s a big safety cushion for beginners still learning platform mechanics.

In essence, Topstep teaches you to follow rules like a pro, while Apex gives you the freedom to experiment and grow without fear of disqualification over a mistake.

Platforms & Tools

Choosing a prop firm also means choosing where and how you’ll trade every day. And both Topstep and Apex give traders access to solid tools—but again, the experience is quite different.

Topstep has developed its own custom platform, TopstepX™, designed specifically for prop firm traders. It features an intuitive interface, charting from TradingView, a built-in Tilt™ Indicator that helps you manage your emotions, and a Trade Copier if you’re running multiple accounts. Best of all? There are no trading commissions while using TopstepX™, which is great for active traders who want to keep costs low. However, if you want to trade through platforms like NinjaTrader or Tradovate, that will come with extra fees and setup steps outside of TopstepX™.

Apex, on the other hand, doesn’t lock you into one platform. You can trade on NinjaTrader, Tradovate, Rithmic-based platforms, and more. Apex even offers funded accounts via WealthCharts, and they bundle in free platform licenses—a big win for new traders who don’t want to spend extra on tools. Plus, Apex has a unique edge in automation and copy-trading options, making it easy to scale across multiple accounts or use bots if you choose. For tech-savvy beginners, this makes Apex a very attractive option.

So if you like an all-in-one experience with clean tools, TopstepX might feel more curated. But if you value freedom of choice and want more advanced platform flexibility out of the box, Apex clearly wins this round.

Payout Policies: How and When You Get Paid

This is the part that most traders really care about: How soon can I withdraw profits—and how much of it do I keep?

Apex Trader Funding is widely praised for its generous payout system. Once you’re funded, you can request your first payout after just 10 trading days, with no minimum profit target required. Better still, Apex gives you 100% of the first $25,000 you withdraw, and 90% of everything after that—a standout policy that beats nearly every other prop firm in the futures space. Payouts are processed weekly, and traders can receive payments via ACH, wire, Deel, and more. You’re also allowed to grow your funded account balance over time, which can help extend your drawdown buffer.

Topstep takes a more structured approach. Before your first withdrawal, you’ll need to complete a consistency check and earn a minimum of 5 winning trading days. Once those are met, you can withdraw once a week with a profit split of 80/20. After hitting $5,000 in total withdrawals, that split increases to 90/10. It’s fair, but not as fast or flexible as Apex—especially for traders who want to start withdrawing smaller amounts early on.

So in terms of raw payout speed, profit retention, and flexibility, Apex wins hands down. But for traders who value structure and gradual scaling, Topstep’s model still offers solid long-term growth.

Topstep vs Apex: Trustpilot Reviews & User Sentiment

When it comes to public reputation, both firms hold their own—but they attract slightly different kinds of praise.

Topstep has an impressive 4.3-star rating on Trustpilot (as of August 2025), backed by over 10,000 reviews.

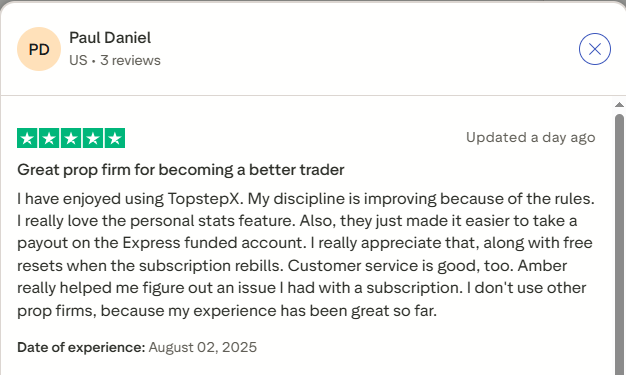

Some traders like Paul Daniel rave about TopstepX, the personal stats dashboard, and rule structure that boosts discipline, plus recent changes that make payouts easier on Express accounts. Free resets on subscription renewals also earned praise.

Yet, one reviewer, Dave C, shared frustration with Topstep’s phone support system, describing difficulty reaching a human representative and calls ending abruptly due to “high traffic volume.”

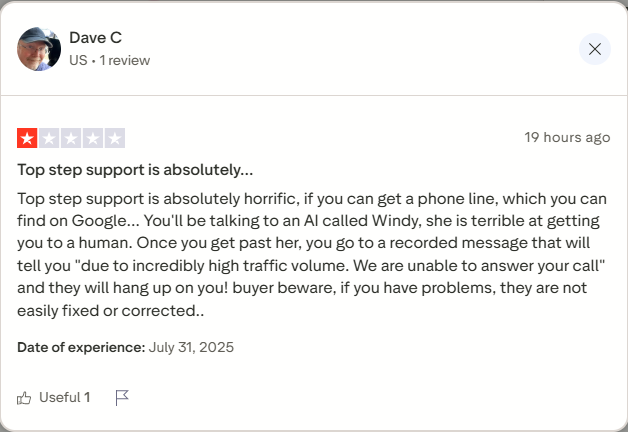

Apex Trader Funding, meanwhile, holds a 4.4-star rating, but with over 9,000 reviews—a much higher volume, showing broader reach and faster community growth.

Apex users often highlight the firm’s challenging payout rules as a positive, saying it forces them to become more disciplined and consistent. One trader, funded for over a month, said they’ve already received two payouts and credited Apex’s strict rules for helping them improve day by day.

However, not all feedback is glowing—another user mentioned slow response times from Apex’s support team, noting that a week-old ticket had gone unanswered.

Overall, the sentiment suggests that while both firms can help traders grow, Apex shines for those who embrace tougher rules, and Topstep appeals to traders who value structured tools and an informative trading dashboard—though both could step up their customer service game.

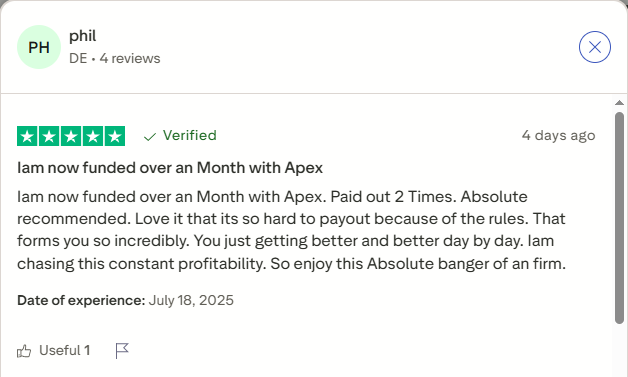

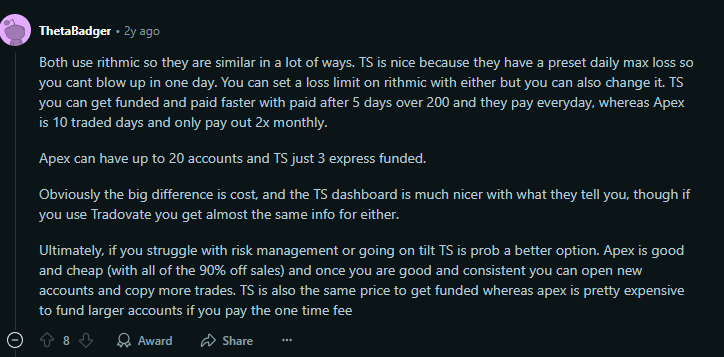

Apex vs Topstep: What Traders Are Saying on Reddit

When traders on Reddit compare Apex Trader Funding and Topstep, a few clear themes stand out. Many agree that both firms share some similarities—like using the Rithmic connection—but their rules and experiences can feel very different.

Traders praise Topstep for its simpler, more beginner-friendly rules, especially the preset daily max loss that helps prevent blowing up an account in a single bad day. You can request payouts after just five winning days (at least $200 profit each) and get paid daily, which some find faster and less restrictive than Apex’s requirement of 10 trading days and a twice-monthly payout window.

On the other hand, Apex wins big points for cost savings—especially during its frequent 80–90% discount promotions—and for allowing up to 20 accounts (versus Topstep’s limit of three express-funded accounts). However, several traders note that Apex’s live trailing drawdown can be tricky to manage, and its platform analytics aren’t as polished as Topstep’s dashboard, which offers detailed trade stats and win-rate tracking.

Interestingly, even one trader, @livinglifeonmars, who had earned over $40,000 from Apex and only $3,000 from Topstep still recommended Topstep for its simplicity and smoother overall experience—especially for traders still building consistency.

Topstep vs Apex Trader Funding: Which One Supports Beginners Better?

If you’re just starting your trading journey, the learning curve can feel overwhelming. So which of these two firms does a better job holding your hand without holding you back?

Topstep stands out for its educational-first approach. Everything from the daily TopstepTV sessions, to free group coaching, to the Coach T™ personal trading insights, is designed to help you grow into a consistently profitable trader. They also give you real-time feedback, a sense of structure, and accountability tools that beginners often lack when trading solo. Plus, the rules are clear and designed to build discipline—ideal for someone trying to avoid costly habits.

Apex, while not as heavy on education, is more welcoming in terms of lower entry costs, fewer restrictions, and faster funding. You don’t have to master every rule upfront—there are no scaling plans, no daily drawdown, and you can trade your own strategy as long as you stay within the trailing threshold. This freedom appeals to newer traders who learn best by doing, especially those already comfortable using platforms like NinjaTrader.

In summary: If you learn best with structure, coaching, and consistent feedback, Topstep is your ally. If you prefer to dive in, learn fast, and grow through experience, Apex may suit you better.

Topstep vs Apex: Which One Should You Choose?

At the end of the day, both Topstep and Apex Trader Funding are legit, well-established firms—each with their own personality and perks. The better choice depends on what you need most as a trader.

✅ Choose Topstep if you value:

- A structured environment that trains you to become consistent

- Expert coaching and daily feedback

- A proprietary platform (TopstepX) with TradingView charts

- A ruleset that prioritizes trader development over fast profits

✅ Choose Apex if you want:

- Fast evaluations and quicker access to real payouts

- Higher profit splits and flexible trading rules

- Low-cost entry during regular promo periods

- A hands-off experience that lets you trade your way

If you’re still learning and want help along the way, Topstep is your on-ramp. But if you’re confident in your edge and want the fastest route to funded trading, Apex is hard to beat.

Topstep vs Apex Trader Funding: Conclusion

From this comparison of Apex Trader Funding vs Topstep, you can see that there’s no one-size-fits-all in prop trading, and that’s the beauty of it.

Topstep brings the classroom, the coaching, and the community support. Apex brings the freedom, the speed, and the payout potential. Both have helped thousands of traders go from demo warriors to live-market professionals—and if you understand your own trading style and goals, the right choice should now be clear.

Still unsure? Don’t rush. Revisit the payout rules, evaluation steps, and account types. The better you understand the offer, the better your chances of making it work.

Compare also ↓

❓ FAQs

- Is Topstep better than Apex Trader Funding?

Neither is universally “better”—it depends on your priorities. Topstep is ideal if you want simple rules, built-in discipline tools, and daily payout options. Apex is better if you want lower costs (with discounts), higher initial payout limits, and more flexible trading rules.

- Can I trade news events with Apex and Topstep?

Yes, both allow trading around news events. However, you still need to follow each firm’s risk and position size rules to avoid breaching their drawdown limits.

- Can I use both firms at the same time?

Yes, many traders do. Just make sure you’re not over-leveraging yourself or violating any firm’s exclusivity rules.

- Which one is cheaper to start with?

Apex usually wins here—especially during promos. You can often start for under $50. Topstep’s lowest-tier account starts at $49/month but has a more structured journey to funding.

- Do either of them offer support for swing trading?

Yes, but with conditions. Topstep requires trades to be closed by market end unless you meet specific criteria. Apex offers more flexibility, especially if you use their static (non-trailing) account options.

- What platforms can I use with these prop firms?

Both support NinjaTrader, Rithmic, and popular trading platforms. Topstep also offers their in-house TopstepX platform with TradingView integration.

- What’s the fastest I can get funded?

With Apex, it can be as fast as 7–10 days. Topstep requires 5 winning days and a more detailed evaluation, so expect a longer path.