Is Robinhood Legit? That seems to be the burning question on many aspiring investors’ minds these days. With the rise of commission-free trading apps and Robinhood leading the charge, new and experienced traders alike are wondering if this platform is legitimate or too good to be true. Well, let’s find out if Robinhood is truly legit in this detailed review.

In this article, we will examine various aspects of Robinhood’s business to determine its legitimacy, focusing on:

- Regulatory compliance and licensing

- Banking and investment protections

- Customer reviews and experiences

- Transparency around risks and fees

- Overall quality of products and services

By the time you finish reading this review, you’ll have a clear picture of whether Robinhood deserves your trust and investment dollars. No fluff, no sugar-coating – just an honest assessment of is Robinhood legit or not.

Is Robinhood Legit?

Yes! When it comes to Robinhood being legitimate, the proof is in the licenses and registrations they hold from top regulators.

Robinhood Financial LLC and Robinhood Securities, LLC are registered broker-dealers with FINRA and regulated by the SEC, just like the big-name brokerages. This means they follow all the rules set by these oversight bodies. They’re also members of SIPC, so your invested cash has up to $500,000 in protection, the same safety net you’d get anywhere else.

Their crypto arm, Robinhood Crypto LLC, has its ducks in a row as a properly licensed money transmitter. Same story for their banking services under Robinhood Money LLC. Even their credit card business, Robinhood Credit Inc., is fully licensed and overseen by regulators.

Robinhood has checked every compliance box across the SEC, FINRA, and other regulators for all their different business lines. They’re not some fly-by-night operation – they’re a legitimately licensed and regulated financial services firm from top to bottom under the proper authorities. You can invest and bank with total peace of mind on a lawfully operating platform.

Read our complete Robinhood Review!

Secure Banking Partnerships

When it comes to banking, Robinhood has legit partners you can trust. Their credit cards are issued by Coastal Community Bank, which is FDIC insured.

And their Robinhood Cash Card is backed by Sutton Bank, another FDIC member.

What does FDIC insurance mean for you?

It means your cash deposits are protected up to $2.25 million if anything ever happens to the bank. Your money is just as safe with Robinhood as it would be at any traditional bank.

Protection for Investors

As a Robinhood investing customer, your stocks and funds are also protected. The securities offered through Robinhood Financial LLC are covered by SIPC insurance.

SIPC protects you up to $500,000 in case the broker-dealer firm goes bust. It ensures you don’t lose your investments if the brokerage fails. Just like FDIC for banking, SIPC is an essential safeguard for investors.

Transparency and Risk Disclosures

Robinhood is upfront about the risks, especially for complex stuff like options trading. They make sure customers understand options can be super risky with chances of big losses fast. They have mandatory educational materials you must review before options trading. Robinhood wants you to go in with eyes wide open.

Quality of Service

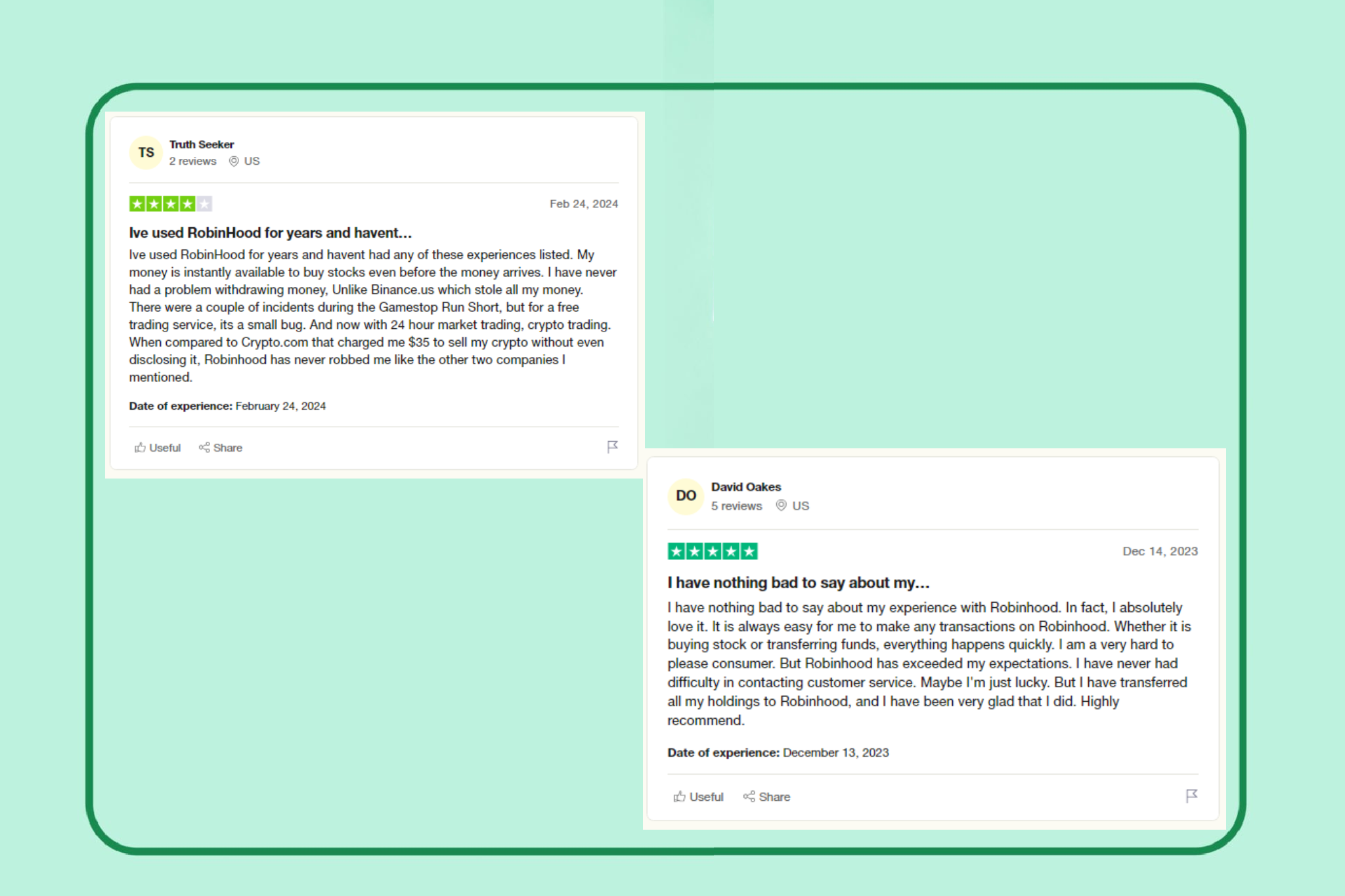

Look, the reviews are a little all over the place when it comes to whether Robinhood is legit or not.

On one hand, you’ve got people like Truth Seeker and David who are riding high on Robinhood. They say their money is safe, trades happen smooth as butter, and they actually get help from customer service when needed. Definitely doesn’t sound like a scam based on their experiences.

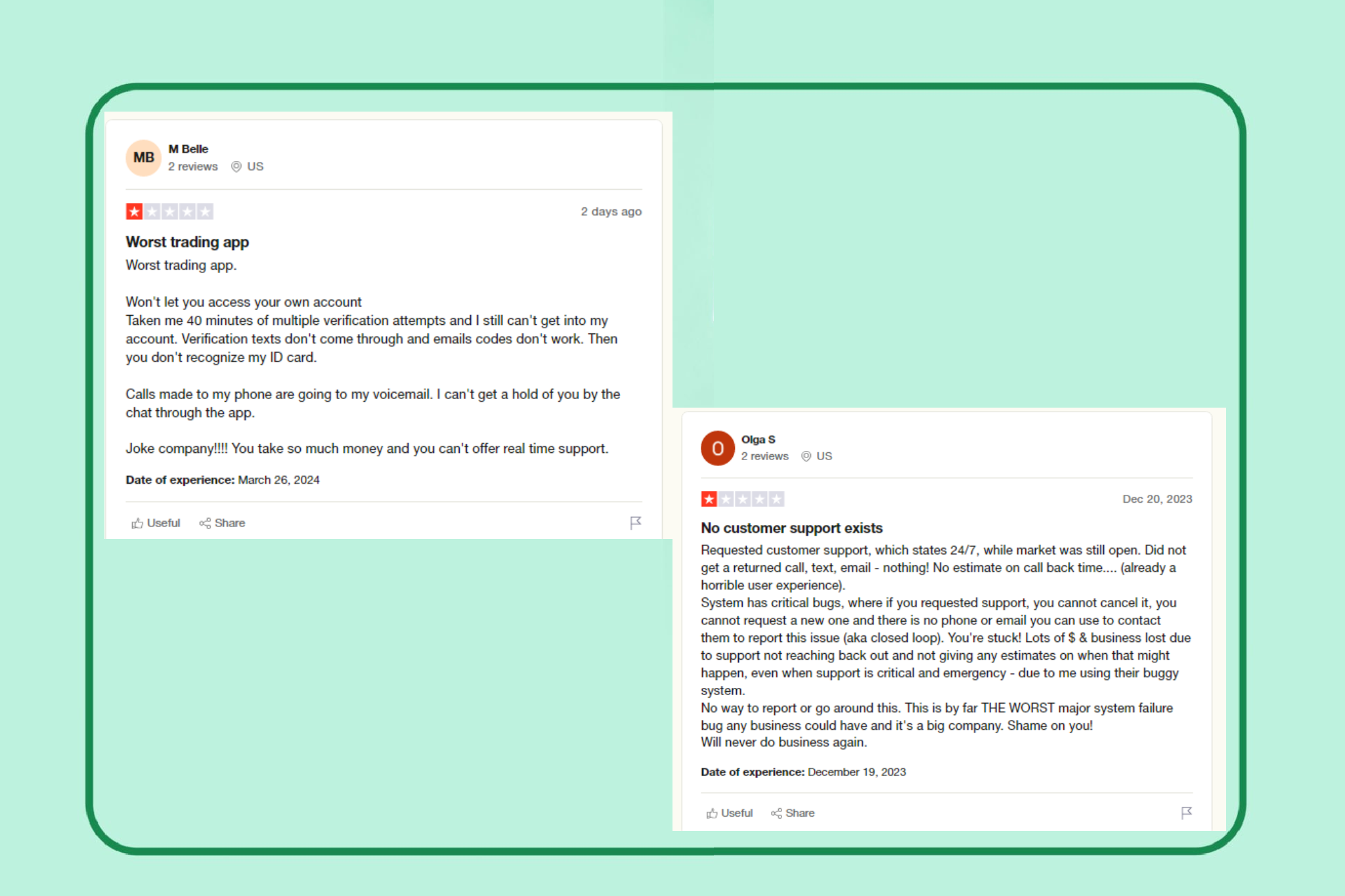

But then you have horror stories from folks like M Belle and Olga who couldn’t even access their accounts or get any support despite Robinhood claiming to be 24/7. System bugs, failed verifications, and a total inability to reach anyone? That’s brutal and would make anyone question how legit this company really is.

So what’s the verdict? From what I can tell, Robinhood seems legitimate overall, but they’ve got some growing pains to work through on the technical and customer service fronts. Some users have a seamless experience while others are pulling their hair out. Robinhood has some work to do to achieve consistency across the board.

Read also! How to Use Robinhood: The Complete Tutorial for Beginners

Conclusion

Let me wrap this up – Robinhood may be a newer kid on the block, but they are 100% legit and safe to use based on the facts. They’ve got all the proper licenses and registrations as a broker-dealer, crypto business, banking service – you name it. Your money is protected just like at any major financial institution thanks to SIPC insurance on investments and partnerships with FDIC-insured banks.

Robinhood operates primarily in the United States right now, but they are available in some other countries like the UK and Australia as well. Wherever they do business, they follow the local rules and regulations to a T.

At the end of the day, you can have confidence investing with Robinhood. But don’t just take my word for it – I’d encourage you to check them out for yourself. Read reviews, compare against competitors, and make sure Robinhood’s offering is the right fit for your needs. As with any financial decision, it’s wise to do your own research before pulling the trigger. The facts seem to be on Robinhood’s side from where I’m standing.

FAQs

- Is Robinhood legit?

Absolutely, Robinhood is 100% legitimate. They are properly licensed and registered financial service providers. Their broker-dealer arms have SIPC protection, their banking services are FDIC insured, and their crypto/lending businesses follow all regulations too. Robinhood operates completely above board.

- Is Robinhood FDIC insured?

Yes and no – Robinhood itself is not an FDIC-insured bank. However, the banks they partner with for things like the Robinhood Cash Card are FDIC members. So your cash funds within Robinhood’s banking products do get that FDIC protection up to $2.25M limit.

- Is Robinhood good?

From a legitimacy standpoint, Robinhood seems to check all the right boxes in terms of licensing, security, and regulatory compliance. The quality of their platform and service is a different story – some users rave about it, others have faced issues. You’d have to try it yourself to judge if it’s “good” for your needs.

- Why is Robinhood bad?

Robinhood isn’t inherently “bad”, but no platform is perfect. Some knocks against them include past outages during high trading volumes, technical glitches, inconsistent customer support, and limited investment selection compared to major brokers. But for basic, no-frills trading, Robinhood works just fine for many.