You’re here because you want to learn how to use Robinhood, right? The app that’s made investing super accessible and stripped away all those annoying trading fees and commissions? Well, you’ve come to the perfect place!

In this guide, I’m going to walk you through every nitty-gritty detail of using Robinhood – from downloading the app all the way to building and managing your own investment portfolio. And I’ll break it all down in a way that’s easy for any beginner to understand.

Here’s a sneak peek at what we’ll cover:

- Creating your account

- How to effortlessly navigate Robinhood

- Placing your first trade from start to finish

- Monitoring and managing your portfolio

- The advanced Robinhood features

- Robinhood’s topnotch security practices

- Extra resources to continue leveling up your investing skills and knowledge

By the time we’re done here, you’ll have a crystal clear understanding of how to use Robinhood to start building some serious wealth. No confusing Wall Street jargon, I promise! Just straightforward guidance to become an investing pro on one of the legit, simplest, and most beginner-friendly platforms out there.

How to Use Robinhood – Getting Started

The first step is to download the Robinhood app on your smartphone or tablet from the App Store (for iOS) or Google Play Store (for Android). The app is free and takes just a couple of minutes to install.

Next, you’ll need to create your Robinhood account. The signup process is pretty straightforward – just enter some basic personal details like your name, email address, phone number, and Social Security number (for tax purposes). You’ll also need to set a secure password. To apply for a Robinhood account, you’ll need to be 18 years or older.

Before you can start trading, you must link your Robinhood account to a valid bank account or debit card. This is where you’ll transfer money from to fund your investments. Linking your bank is a simple process within the app, and you can do it securely with just a few taps.

Read also! Robinhood Gold Credit Card Review

Understanding the Robinhood Interface

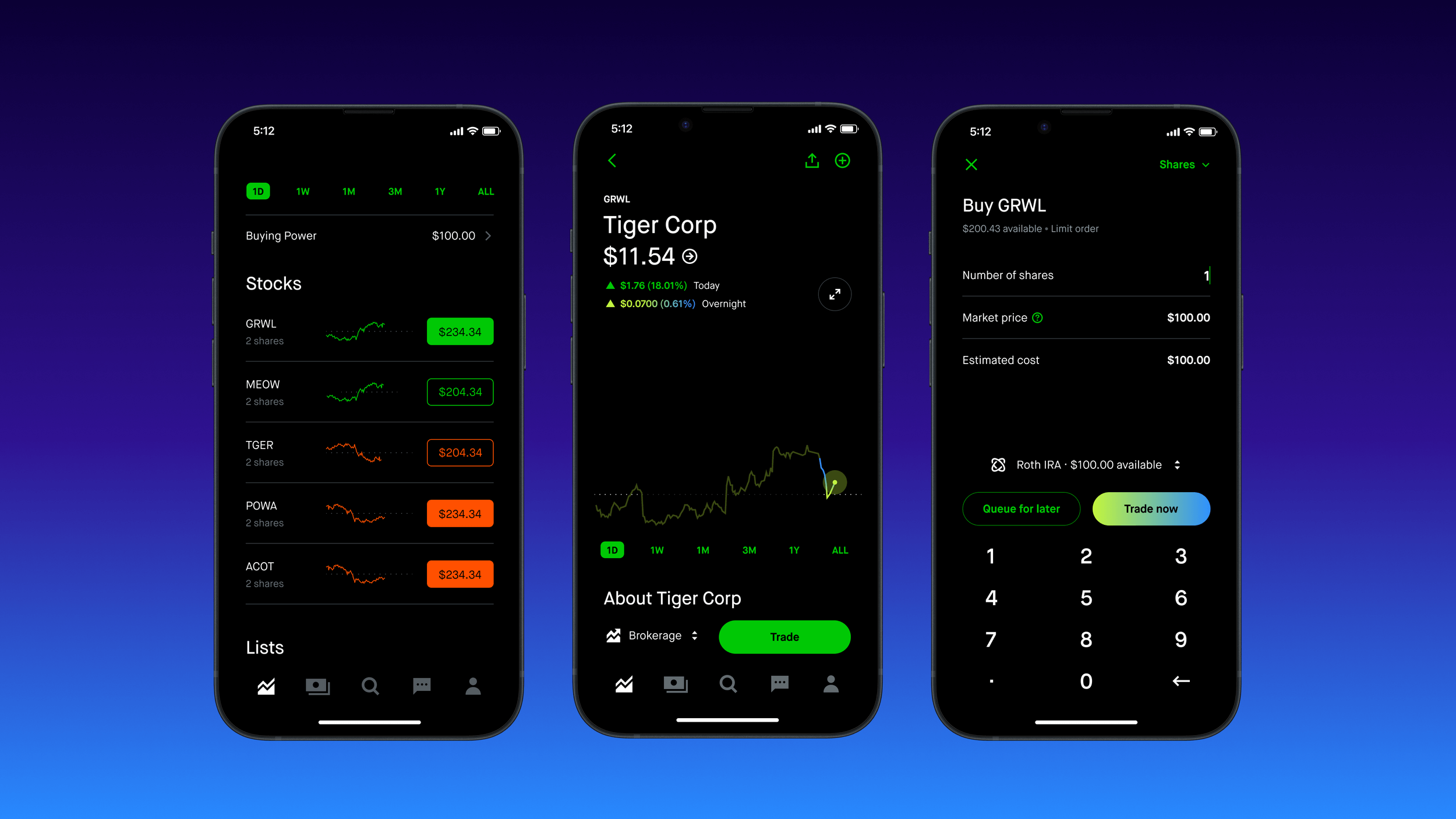

Once you’ve created your account and linked your bank, the Robinhood app will greet you with a clean, intuitive home screen. Here you’ll see your portfolio value, a newsfeed of the latest market happenings, and quick links to start trading right away.

The app’s main navigation is at the bottom, with tabs for your Portfolio, News feed, an Account overview, and more. The Portfolio tab shows you all the stocks, ETFs, and cryptocurrencies you currently own. News keeps you updated on market movements that could impact your investments. And Account lets you manage your personal details, banking info, and app settings.

Robinhood lets you personalize the look and feel of the app to suit your preferences. You can switch between light and dark mode themes, choose different chart styles for visualizing stock movements, and customize what data gets displayed.

Placing Your First Trade

Ready to trade? Just tap the trade button and use the search bar to find a particular stock ticker symbol, ETF, or cryptocurrency. You can browse trending stocks and funds too.

When buying, you’ll need to pick between a market order (which executes immediately at the current market price) or a limit order (which only goes through when the price hits your target). Limit orders let you buy low or sell high!

Once you settle on the order type and share quantity, placing the trade is just a couple of taps away. Review the order preview carefully, then swipe to confirm.

After your order executes, you’ll get a notification and can view all the nitty-gritty details like the purchase price, order type, share quantity, and total investment amount.

Read also! How to Make Money on Robinhood

Managing Your Portfolio

With Robinhood, keeping tabs on your investments is a breeze. Just hop over to the Portfolio tab to see all your current holdings at a glance, including how many shares you own and what they’re worth right now. Your account balance and total returns are displayed prominently too.

Don’t want to obsessively check the app for price movements? No problem! You can set up customized price alerts to ping your phone anytime one of your stocks or crypto hits a certain threshold – either up or down. That way you’ll never miss an opportunity to buy or sell.

Robinhood’s charts let you visualize a stock’s pricing history, trading volume, and key metrics like the moving averages.

If you’re more of a technical trader, you can toggle on additional indicators like Bollinger Bands, RSI, and more to analyze the charts like a pro.

To better visualize how to use the Robinhood app, watch the video below. Seeing the steps performed visually can help you to start investing yourself.

Advanced Features

While Robinhood is super beginner-friendly, it also offers more advanced trading options like buying options contracts. This lets you speculate on stock movements without owning the underlying shares.

You don’t need hundreds or thousands of dollars to get started either. Robinhood lets you buy fractional shares, so you can invest whatever spare change you have rather than full share increments.

One of the coolest features is recurring investments. You can “set it and forget it” by automating regular purchases of your favorite stocks or cryptos on a schedule.

For frequent traders, Robinhood Gold is a paid subscription that gives you advanced data and analysis, bigger instant deposits, professional research reports, and the ability to trade on margin.

Security and Safety

You’re probably wondering how safe your money and personal info will be on Robinhood, right? Well, let me put your mind at ease – they take security incredibly seriously. First off, you can enable robust two-factor authentication to prevent anyone but you from accessing your account. Choose to receive verification codes via SMS or through a dedicated authenticator app.

But wait, there’s more! Robinhood has layers of additional protections like biometric logins, data encryption, and hardcore fraud monitoring systems. All working together to safeguard your info and investments from any bad actors or sneaky hacker types.

Now, let’s be real – investing always comes with some inherent risk, no matter what platform you use. That’s why Robinhood actively encourages smart, responsible practices. Things like diversifying your portfolio, sticking to your budget, and never risking more cash than you can realistically afford to lose. Do your research, invest carefully, and you’ll be golden!

Additional Resources

So you’ve got the basics down, but maybe you’re hungry to really take a deeper dive into this whole investing thing? No sweat! Be sure to check out Robinhood Learn.

It’s stocked full of totally free courses and straightforward guides to turn you into an expert trader before you know it.

But here’s the thing – while Robinhood’s app is designed to be super intuitive, investing as a whole has a ton more to unpack. That’s why I’d strongly recommend using some other kickass resources too. Think: trusted personal finance websites, books, podcasts – heck, even online communities dedicated to leveling up your knowledge.

Oh, and if you ever get stuck or just have a burning question, Robinhood’s support squad has your back. Whether it’s scouring the FAQs, hitting up the chatbot, firing off an email, or straight-up calling someone – you’ve got options within the app to get the help you need.

Conclusion

Alright, time for a quick recap! We just showed you how to use Robinhood, from downloading the Robinhood app, to setting up your account, and building your very own investment portfolio from scratch.

We also covered account creation, navigating the app, placing trades, managing your investments, using advanced tools, and keeping your account super secure.

Now, I know some of this investing stuff might still feel a bit confusing if you’re brand new to it all. But let me tell you – the real beauty of Robinhood is just how beginner-friendly and simple it truly is.

Seriously, just download it today, follow the easy steps I laid out, and you’ll be an investing pro in no time! What’s stopping you from getting started?

FAQs

- How do I download the Robinhood app?

It’s super easy! Just head to the App Store on your iPhone or the Google Play Store on your Android device, search for “Robinhood”, and tap the download button. The app is 100% free to install.

- How do I add money to my Robinhood account?

Once your account is all set up, you’ll need to link a bank account or debit card so you can transfer in funds to start investing. The app will walk you through this simple process.

- How do I buy my first stock on Robinhood?

When you’re ready to make your first trade, just tap the big green “Trade” button in the app. From there, you can search for the stock, ETF, or crypto you want to buy, choose how many shares, and confirm the order.

- What’s the difference between market and limit orders on Robinhood?

With a market order, your trade will execute immediately at the current market price. A limit order, on the other hand, will only go through if the stock hits your specified target price – great for trying to buy low or sell high.

- How do I track the performance of my Robinhood investments?

Easy! Just head to the “Portfolio” tab to see a detailed breakdown of all your current holdings, including how much you’ve invested and the current value. You can also set up price alerts to stay on top of your positions.

- How does Robinhood keep my account secure?

Security is a top priority for Robinhood. They offer robust two-factor authentication to verify your identity, bank-level encryption to protect your data, and comprehensive fraud monitoring systems. Plus, you can enable biometric logins like Face ID or fingerprint scanning.