If you’ve been asking Google this question, “How to trade on Octafx for beginners”, you can stop searching now. This step by step guide is your one-stop-shop for all things Octa trading. We’ll take you from complete newbie to placing your first trade, and beyond.

Here are some of the things we’ll cover:

- Why choose Octa for trading?

- How to start trading on OctaFX

- Choosing Your Account Type

- Funding Your Account

- Getting to know the Trading Platform

- Placing Your First Trade

- Managing Your Trade

- And more…..

By the time you finish reading this guide, you’ll know the ins and outs of trading on Octa. Lets start!

What is Octa?

Octa, formerly known as OctaFX, is a leading online forex broker founded back in 2011. In 2023, the company rebranded from OctaFX to Octa, reflecting its evolution and commitment to providing a comprehensive trading experience. Octa offers over 7 million clients worldwide a wide range of financial instruments, including forex, cryptocurrencies, commodities, and stock indices.

Why choose Octa for trading?

Octa stands out in the trading industry for several reasons:

Low Spreads: Octa boasts some of the lowest spreads in the industry, helping you maximize your potential profits.

Fast Execution: With Octa, you can buy or sell at the price you see, thanks to their lightning-fast execution speeds.

No Overnight Swaps: You don’t have to pay swaps on orders held overnight, which can be a significant advantage for long-term trades.

Minimal Slippage: 97.5% of orders are executed without slippage, ensuring you get the price you expect.

Profitable Orders: With features like 30 pips +$900 order profit, Octa provides opportunities for substantial gains.

No Commission on Deposits and Withdrawals: Octa doesn’t charge any commissions on deposits or withdrawals, helping you keep more of your money.

Now that you understand what Octa is and why it’s a great choice for trading, let’s dive into how you can start trading on this platform.

How to Start Trading on OctaFX

Now that you’ve decided to start trading with Octa, let’s walk through the first steps together. Don’t worry, it’s easier than you might think!

Creating Your Account

First things first, we need to set up your Octa account. Here’s how:

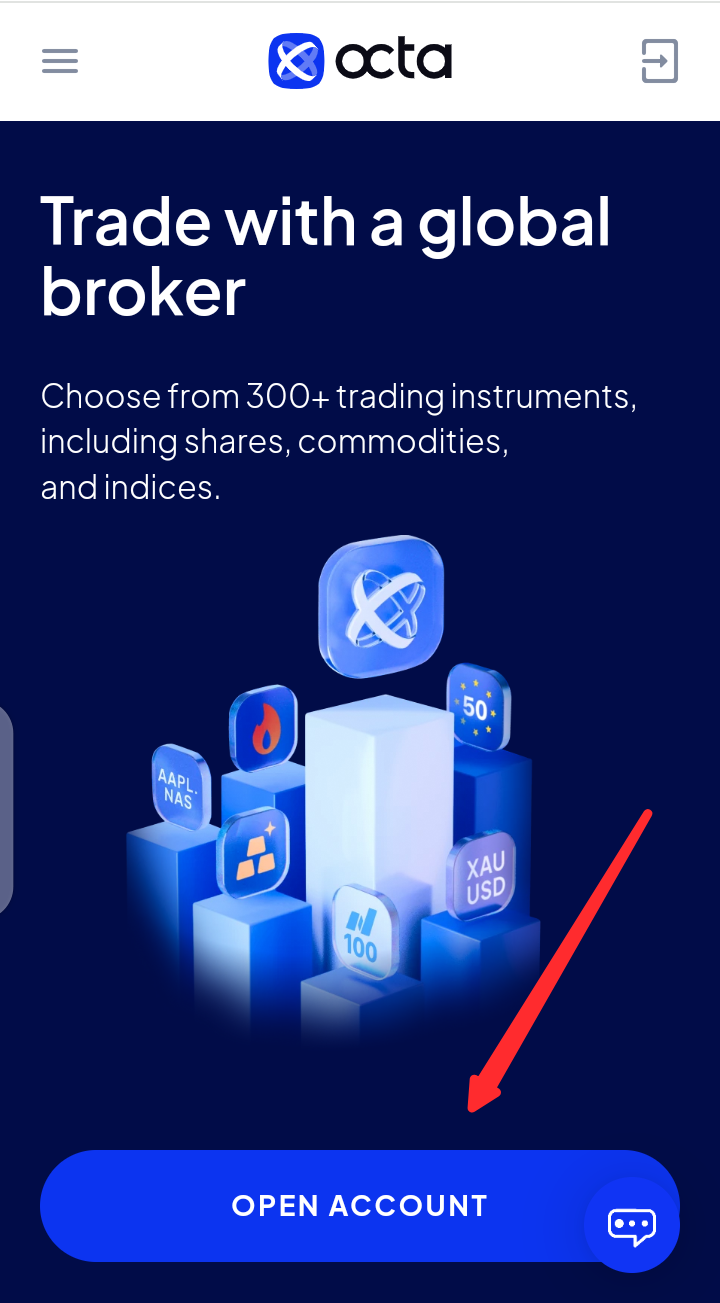

- Visit the Octa website: Open your web browser and go to the Octa homepage.

- Find the “Open Account” button. It’s usually visible at the middle of the page.

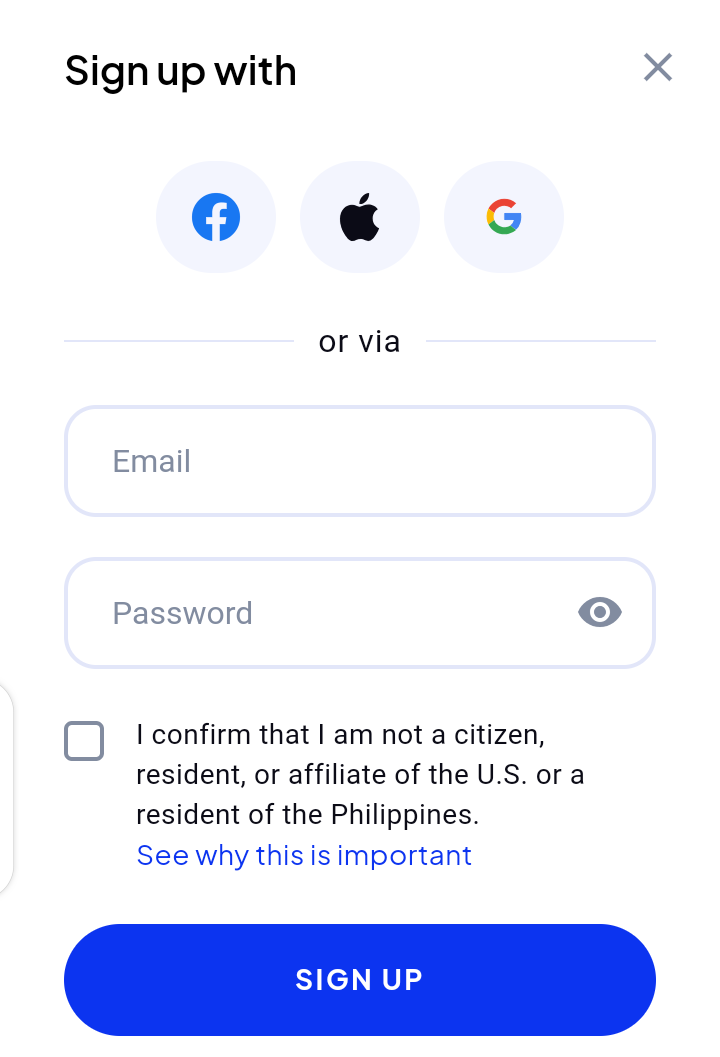

- Fill out the registration form: You’ll need to provide some basic information like your name, email address, and phone number.

- Choose a strong password: Make sure it’s something you can remember, but hard for others to guess.

- Agree to the terms and conditions: Take a moment to read through these.

- Click “Sign Up“: Your account is now created!

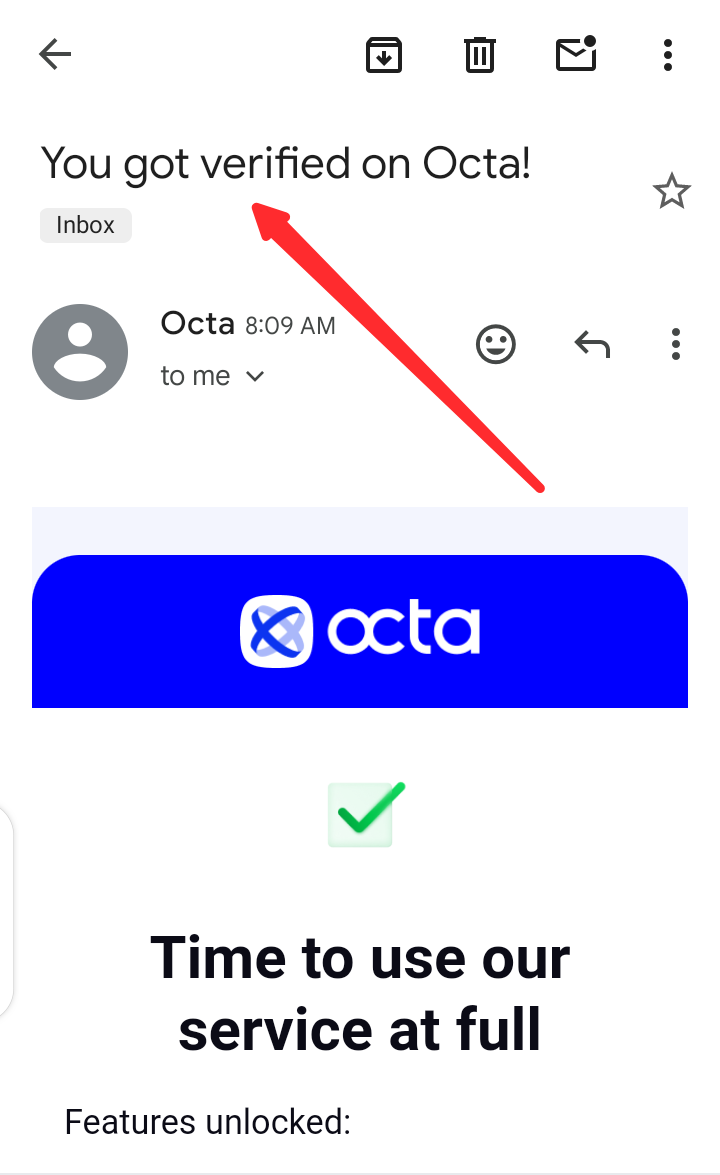

Verifying Your Email

After you’ve submitted your registration, Octa will send an email to the address you provided. This email contains a link to verify your account. Click on this link to confirm that your email address is correct. This step is important for the security of your account.

Completing the KYC Process:

KYC stands for “Know Your Customer.” It’s a standard process in the financial world to prevent fraud. Here’s what you need to do:

- Log into your new Octa account.

- Look for a section called “Account Verification.”

You’ll need to provide some documents:

-

- A photo ID (like a passport or driver’s license)

- Proof of address (like a recent utility bill or bank statement) d. Upload clear, high-quality images of these documents. e. Wait for Octa to verify your documents. My verification was less than 10 minutes.

So what’s next? Once your account is verified, you’re ready to start exploring the Octa platform. Take some time to look around and get familiar with the layout. Don’t worry about understanding everything right away – we’ll cover all the important parts in the upcoming sections.

Remember, if you have any questions during this process, Octa’s customer support team is there to help. Don’t hesitate to reach out to them if you’re unsure about anything.

Choosing Your Account Type

Now that you’ve signed up, it’s time to pick the right account for you. Don’t worry, I’ll walk you through it step by step.

Octa offers three main account types, each designed to fit different trading styles.

Let’s break them down in simple terms:

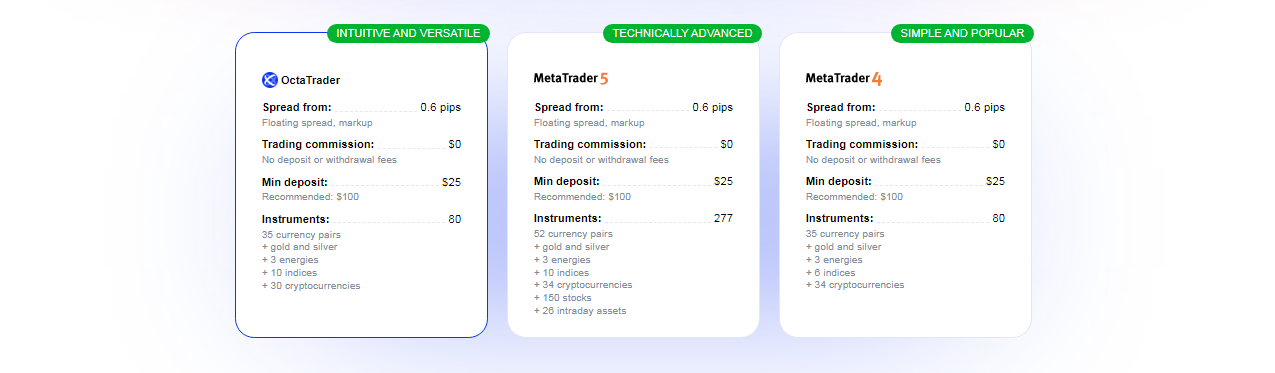

- OctaTrader: This is our very own trading platform. It’s user-friendly and perfect for beginners. The spread (that’s the tiny difference between buying and selling prices) starts from just 0.6 pips. The best part? There are no extra fees on your trades. You can start with the minimum deposit of $25.

- MetaTrader 4 (MT4): This is a popular platform that many traders love. It has the same great spread as OctaTrader, starting from 0.6 pips. There are no hidden costs, and you can also begin with just $25.

- MetaTrader 5 (MT5): This is the newer version of MT4. It has some extra features, but don’t worry about those just yet. The spread is still fantastic, starting at 0.6 pips, and you can kick off your trading journey with $25.

- Islamic Account: If you’re a Muslim trader, we’ve got you covered. This account follows Islamic finance principles, meaning there are no interest charges. You can use any of our platforms with this account, and you’ll get the same low spreads as other accounts.

- Demo Account: This is my top recommendation for absolute beginners. It’s like a practice playground where you can try out everything without risking real money. It’s completely free and a great way to learn the ropes.

Here’s a pro tip: All our accounts use US dollars. This makes it easier to keep track of your money, especially if you’re new to trading.

Funding Your Account

First, let’s talk about the different ways you can put money into your account:

- Credit or Debit Cards: This is probably the easiest way. It’s just like buying something online. You enter your card details, and the money shows up in your account almost instantly.

- Bank Transfer: If you prefer using your bank account, this is a good option. It might take a day or two for the money to arrive, but it’s very secure.

- E-wallets: These are online payment systems like Skrill or Neteller. They’re fast and convenient if you already use them.

Now, let me walk you through making your first deposit:

- Log into your Octa account.

- Look for a button that says “Deposit”. Click on it.

- Choose how you want to add money (remember those options we just talked about?).

- Enter how much you want to deposit. Remember, you can start with as little as $25.

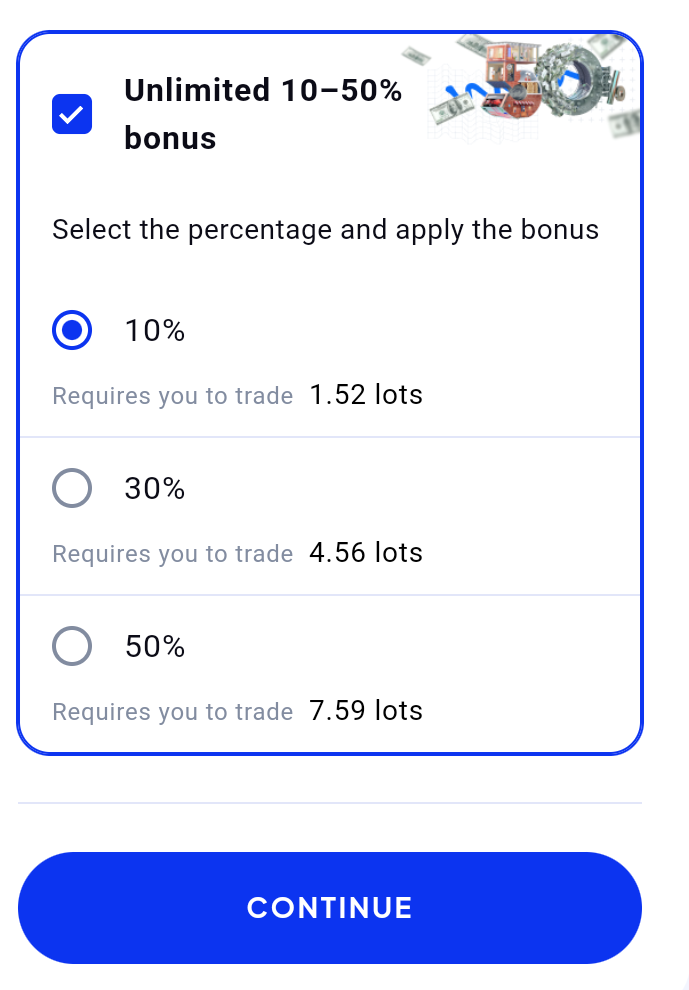

- Choose your 10-50% bonus that can provides higher trading volume and Can be converted to your money in full by trading.

- Follow the instructions to complete the payment. If you’re using a card, you’ll need to enter your card details.

- Double-check everything before you confirm. Make sure the amount is correct.

- Click “Make a Deposit” and proceed to complete the transfer.

And that’s it! Your money should now be in your trading account. If you used a card or e-wallet, it should appear almost immediately. Bank transfers might take a bit longer.

One more thing: Octa doesn’t charge any fees for deposits. However, your bank or card provider might have their own fees, so it’s a good idea to check with them.

In the next section, we’ll talk about understanding the platform to help you start trading on OctaFX with your newly funded account.

Navigating the Trading Platform

Now that your account is funded, it’s time to get familiar with your trading platform. Don’t worry if it looks complicated at first – we’ll break it down together.

First things first, you need to log into your account. Look for the “Login” button on the Octa website or app and enter your username and password. Once you’re in, you’ll see the main trading screen. Let’s explore the key parts:

- Chart Area: This is the big graph in the middle of your screen. It shows how the price of a currency pair has changed over time. You’ll spend a lot of time looking at these charts.

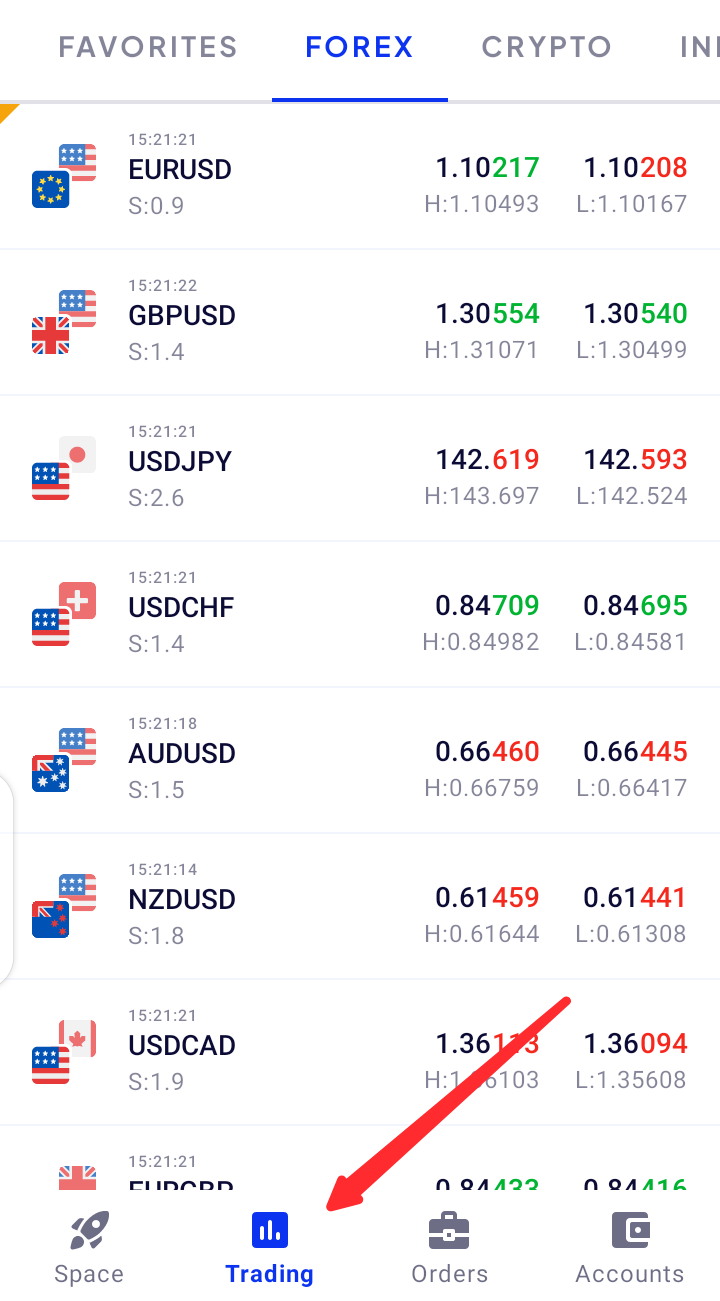

- Market Watch: Usually on the left side, this shows a list of currency pairs and their current prices. It’s like a menu of what you can trade.

- Navigator Panel: This is where you can find your account information, indicators (tools to help you analyze the market), and other useful features.

- Terminal: Often at the bottom of the screen, this shows your open trades, account balance, and trade history.

Take some time to click around and get comfortable with these different areas. Don’t worry about making mistakes – remember, you can always practice on a demo account without risking real money.

The Basic Concepts of Trading on OctaFX

Before we place our first trade, let’s cover some essential concepts. Think of these as the ABCs of trading.

Currency Pairs: In forex trading, we always trade currencies in pairs. For example, EUR/USD is a currency pair. The first currency (EUR) is the base currency, and the second (USD) is the quote currency. If EUR/USD is 1.2000, it means 1 Euro is worth 1.2000 US Dollars.

Read also! Best Currency Pairs for Beginners

Pips: A pip is the smallest price move in forex trading. For most currency pairs, a pip is the fourth decimal place. For example, if EUR/USD moves from 1.2000 to 1.2001, that’s a one pip movement.

Lots: This is how we measure the size of a trade. A standard lot is 100,000 units of the base currency. Don’t worry – you don’t need to trade this much! Octa allows you to trade micro lots, which are just 1,000 units.

Types of Orders

-

- Market Order: This is like saying, “I want to trade right now at the current price.”

- Limit Order: This is like saying, “I want to buy if the price goes down to X, or sell if it goes up to Y.”

- Stop Order: This is often used to limit losses. It’s like saying, “If the price reaches X, sell to prevent further losses.”

Reading Price Quotes

You’ll see two prices for each currency pair – the bid and the ask. The bid is the price at which you can sell, and the ask is the price at which you can buy. The difference between these is the spread we talked about earlier.

For example, if you see EUR/USD 1.2000/1.2002:

- 1.2000 is the bid price (you can sell at this price)

- 1.2002 is the ask price (you can buy at this price)

- The spread is 2 pips (1.2002 – 1.2000 = 0.0002)

How to Place Your First Trade on OctaFX

Excited? You should be! You’re about to place your first trade. Let’s walk through this step-by-step.

- Choose a Currency Pair: Let’s start with something common, like EUR/USD. Find it in your Market Watch panel and double-click it.

- Analyze the Market: Look at the chart for EUR/USD. Is the price going up or down? This is basic technical analysis. Don’t worry about getting it perfect – we’re just practicing.

- Decide on Position Size: For your first trade, start small. Maybe 0.01 lots (that’s 1000 units of the base currency).

- Open a Position:

- To buy, click the “New Order” button and select “Buy” at the current price.

- To sell, do the same but select “Sell”.

- Set Stop-Loss and Take-Profit:

- Stop-Loss: This is where you tell the platform to automatically close your trade if the price moves against you by a certain amount. It helps limit your losses.

- Take-Profit: This is where you tell the platform to automatically close your trade if it reaches a certain profit level.

For example, if you buy EUR/USD at 1.2000, you might set a stop-loss at 1.1990 (10 pips below) and a take-profit at 1.2020 (20 pips above).

- Confirm and Submit: Double-check all your settings, take a deep breath, and click “Submit”.

Congratulations! You’ve just placed your first trade. Now you can watch how it performs in the Terminal section of your platform.

It is important to add that as a beginner, you can also use Octa’s copy trading instead, which allows you to automatically copy experienced traders’ positions. This avoids making rookie trading mistakes while you learn! We have a complete Octa copy trading review you can check out later.

In the next section, we’ll talk about how to manage your trade once it’s open.

Managing Your Trade

Great job on placing your first trade! Now, let’s talk about what to do after your trade is open. Managing your trade is just as important as opening it.

- Monitoring Open Positions: Keep an eye on your open trades in the Terminal section of your platform. You’ll see important information like:

- The currency pair you’re trading

- Whether you’re buying or selling

- The size of your trade

- Your current profit or loss

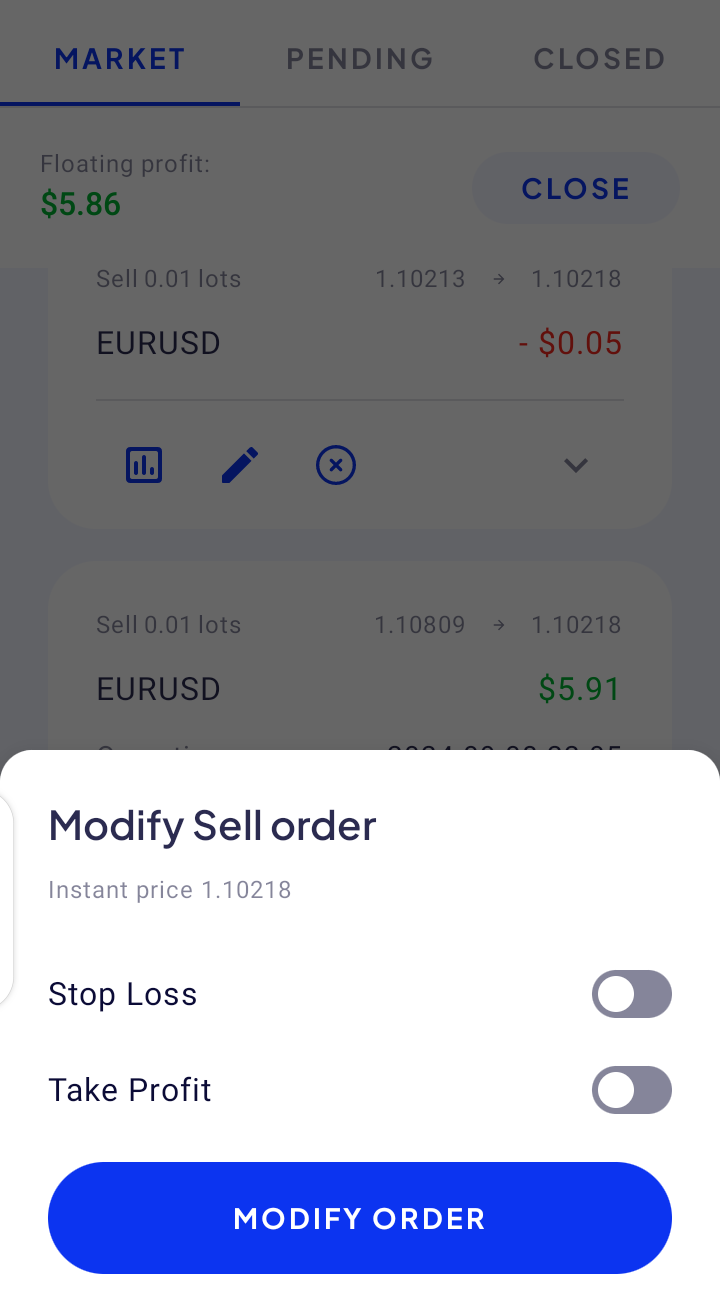

- Modifying Orders: Sometimes, you might want to change your stop-loss or take-profit levels.

Here’s how:

Here’s how:

- Open your app and click on “Orders“

- Enter your new stop-loss or take-profit levels

- Click “Modify Order” to save your changes

- Closing a Trade Manually: If you decide to close your trade before it hits your stop-loss or take-profit levels:

- Find your open trade in the Terminal

- Right-click and select “Close Order”

- Confirm the action

Remember, it’s okay to close a trade early if you feel it’s the right decision. Trust your judgment, but also stick to your trading plan.

Risk Management

Trading always involves some risk. We can’t avoid it completely, but we can manage it. Good risk management helps protect your account from big losses. Here’s are simple rules many traders follow:

- The 1% Rule: Never risk more than 1% of your account on a single trade. For example, if you have $1000 in your account, don’t risk more than $10 on a single trade.

- Setting Stop-Losses: Always use stop-losses. They’re like a safety net for your trades. Where to set them? It depends on your strategy, but here’s a simple approach:

- Look at how much the price typically moves in a day

- Set your stop-loss just outside this range

- Position Sizing: This means deciding how big your trade should be. Remember the 1% rule? Use that to guide your position size. For example, if you’re willing to risk $10 on a trade, and you set your stop-loss 20 pips away, your position size would be 0.05 lots.

- Diversification: This means not putting all your eggs in one basket. Trade different currency pairs, not just one. This can help spread your risk.

Remember, the goal is not to avoid losses completely (that’s impossible), but to keep them small and manageable.

Withdrawing Profits

Congratulations! You’ve made some trades and hopefully seen some profits. Now, let’s talk about how to get that money out of your trading account and into your pocket.

Available Withdrawal Methods

Octa offers several ways to withdraw your money:

- Bank transfer

- Credit/debit cards

- E-wallets (like Skrill or Neteller)

Usually, you’ll withdraw using the same method you used to deposit.

How to Request a Withdrawal

- Log into your Octa account

- Find the “Withdraw” button (usually near where you found the deposit button)

- Choose your withdrawal method

- Enter the amount you want to withdraw

- Fill in any required details (like your bank information for a bank transfer)

- Double-check everything g. Submit your request

Processing Times and Fees

- E-wallet withdrawals are usually the fastest, often processed within 24 hours

- Bank transfers can take 3-5 business days

- Credit/debit card withdrawals usually take 1-3 business days

Octa doesn’t charge fees for withdrawals, but your bank or e-wallet provider might. It’s a good idea to check with them.

- Withdrawal Limits: There might be minimum and maximum limits on how much you can withdraw at once. These can vary depending on your account type and withdrawal method. Check the Octa website or ask customer support for the most up-to-date information.

- Verification: For your security, Octa might ask you to verify your identity before processing your first withdrawal. This usually involves uploading a copy of your ID and a recent utility bill. Don’t worry – this is standard practice in the financial industry.

Remember, it’s a good practice to withdraw some of your profits regularly. This helps you enjoy the fruits of your trading while keeping some funds in your account for future trades.

How to Trade on OctaFX: Conclusion

If learning how to trade on Octa as a beginner seemed difficult initially, we hope you now feel empowered to get started! We covered all the critical first steps – from opening accounts properly to analyzing currencies charts to managing trading risks.

When you apply these steps and keep learning and growing your skills you’ll bee on your way to long-term success. Happy trading!

Frequently Asked Questions about Trading on OctaFX

- What is the minimum deposit for Octa?

The minimum deposit is $25 for most account types.

- Does Octa offer cryptocurrency trading?

Yes, Octa allows trading of various cryptocurrencies.

- Is Octa regulated?

Octa is regulated by multiple financial authorities.

- Does Octa offer copy trading?

Octa offers a copy trading feature called “CopyTrading”.

- Does Octa offer any trading tools?

Yes, Octa provides various trading tools including economic calendars and trading calculators.