As cryptocurrencies continue to gain mainstream traction, investors are looking beyond just Bitcoin and searching for the next potential breakout blockchain. One name that has rapidly grown in prominence is Solana, a unique smart contract platform focused on delivering speed and scalability. But is Solana a good investment?

In this guide, we’ll take a look at what exactly Solana is, analyze its merits as an investment, and explore predictions around the price of its SOL token. By the time you finish reading this guide, you’ll be able to decide whether it might be a promising investment for you.

What is Solana?

Solana was launched in March 2020 and was founded by former Qualcomm engineer Anatoly Yakovenko. The project is based in Switzerland, with additional team members located worldwide.

Solana utilizes a proof-of-stake blockchain that optimizes for speed through innovations like proof-of-history and parallel transaction processing. As a layer 1 smart contract platform, Solana competes with networks like Ethereum and Polkadot.

The network’s native cryptocurrency is SOL, which is awarded to validators and used to pay for transaction fees and resources.

Beyond raw speed, Solana aims to make decentralized applications as user-friendly as modern web experiences. The network offers rapid feedback and confirmation times to create a seamless user experience. Solana also fosters an open ecosystem that has birthed innovative projects in areas like NFTs, DeFi, and even blockchain gaming.

Is Solana a good investment?

Ah, the million-dollar question: Is Solana a good investment? Well, there’s no crystal ball, but I can give you some food for thought.

When it comes to scalability, there’s no denying Solana has some major advantages. It can process transactions faster than other networks like Ethereum due to optimizations in areas like parallel processing and proof-of-stake. From a raw throughput standpoint, it’s in a league of its own right now.

Beyond speed, I think Solana’s focus on making blockchain interactions smooth and seamless for end users is really important. Features like quick confirmation times, continuous transaction processing, and solutions for congestion demonstrate the team’s focus on usability. That’s essential for driving mass adoption long-term.

We can’t ignore that Solana has had stability issues though. The network has experienced downtimes that are unacceptable for many applications. But the team seems committed to resolving these technical problems. They’ve made upgrades and continue to innovate.

The ecosystem also shows promise in my view. Experimental products like blockchain phones and NFT apps create a sandbox for innovation. While not all experiments will succeed, some could unlock new use cases. Combined with a culture of openness to new ideas, Solana seems well-positioned to host the next viral application.

In terms of investment upside, Solana has levers to improve monetization and demand for its native token. With greater adoption, the network could capture more value and transaction fees. Features like token-voting governance can align incentives between users and validators toward common goals.

So in summary, I think Solana offers differentiated capabilities that make it an intriguing investment option compared to other Layer 1s. Execution risks remain, but the potential is there. A small allocation to Solana as part of a diversified crypto portfolio seems reasonable given the upside scenarios. Just my two cents!

So, before you make a decision to invest in Solana, make sure to do your own research, assess your risk tolerance, and maybe consult with a financial advisor.

Solana price prediction

Price predictions are always a tricky business. It’s like trying to predict the weather in a few months – you can make an educated guess, but you’re never 100% sure.

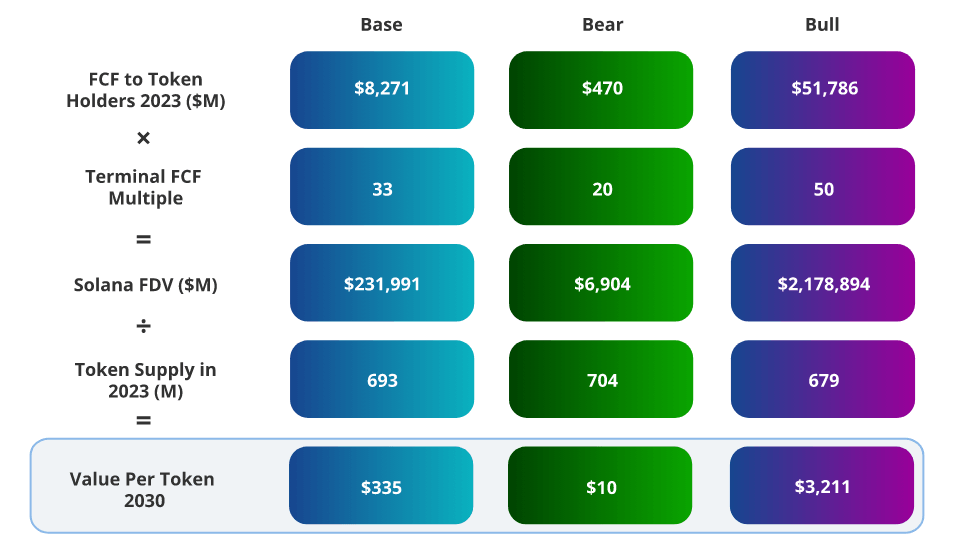

That said, some analysts remain very bullish on Solana’s growth potential. One report from VanEck predicts Solana could reach $3,200 per SOL token by 2030 based on optimistic adoption scenarios.

The high-end estimate of over $3,000 per SOL token would represent astronomical gains of 10,600% from current prices. Naturally, such a dramatic increase seems optimistic.

However, it highlights Solana’s immense upside potential if the network experiences massive growth in usage and market share. The “base case” prediction of around $335 from VanEck still implies nearly a 10x return on investment from today’s levels.

Here are some of the key factors behind VanEck’s lofty forecast:

- Massive increase in market share: The $3,200 price target assumes Solana captures 70% share of all value transferred across open blockchains by 2030. This implies massive growth from today’s levels and Solana overtaking Ethereum as the dominant player.

- Explosive growth in users: The model assumes Solana will have over 500 million monthly active users by 2030. For context, top social networks like Facebook today have around 2-3 billion monthly users.

- High utilization and transaction volume: VanEck estimates Solana will be processing over 600 billion transactions annually by 2030. This astronomical figure drives revenues from fees.

- Increased value capture: The report assumes Solana will significantly improve its ability to monetize economic activity on the network through transaction fees, data storage costs, and other measures.

- New revenue sources: Sources of revenue like MEV (miner extractable value) are expected to emerge and accrue predominantly to SOL token holders, further bolstering income.

Factors like this highlight why investors have become so excited about Solana. It shows the enormous price appreciation possibilities if Solana fulfills its promise and sees greater utilization.

Of course, we have to take sky-high predictions with a grain of salt. Actual adoption depends on many factors like competition, technology, and regulation. No one can predict the future.

But I think these forecasts are useful for signaling Solana’s possibilities.

Should I Buy Solana?

Now, the ultimate decision – should you buy Solana? Well, it all depends on your individual circumstances and goals.

For investors open to higher risk/reward investments, buying exposure to Solana seems a worthy consideration given its intriguing capabilities and growth prospects.

But, and it’s a big but, crypto investments come with risk. It’s not for the faint of heart. Only allocate an amount you can afford to lose and be comfortable with significant volatility. Diversification remains key, as with any cryptocurrency investment.

Solana offers upside potential but still has much left to prove. By taking a forward-looking, long-term outlook, Solana deserves consideration as part of a diversified crypto portfolio.

Conclusion

In Solana, we see a uniquely positioned blockchain project with huge scalability advantages if it can continue maturing its technology. For early crypto investors, Solana provides a worthy high-upside, high-risk wager on the future of decentralized networks. Its rapid rise already demonstrates the enthusiasm around its powerful capabilities and possibilities. As the Web3 revolution unfolds, Solana may emerge as one of the key players to drive it forward.