Key Insights

- Bitwise CIO predicts Ethereum ETFs will push ether price above $5,000, setting new all-time highs.

- Ethereum’s near-zero inflation rate, reduced selling pressure, and locked supply expected to amplify ETF inflow effects compared to Bitcoin.

WASHINGTON (MarketsXplora) – In a bold prediction, Matt Hougan, Chief Investment Officer at Bitwise, suggests that the launch of spot Ethereum exchange-traded funds (ETFs) could propel the price of ether to unprecedented levels, potentially surpassing $5,000.

In a note to clients on Tuesday, Hougan outlined his expectations for the cryptocurrency market following the anticipated approval of Ethereum ETFs. While he foresees initial volatility, particularly due to potential outflows from the $11 billion Grayscale Ethereum Trust (ETHE) upon its conversion to a spot ETF, Hougan remains optimistic about ether’s long-term prospects.

“By year-end, I’m confident the new highs will be in. And if flows are stronger than many market commentators expect, the price could be much higher still,” Hougan stated.

The Securities and Exchange Commission (SEC) has already approved eight 19b-4 forms for spot Ethereum ETFs from various issuers, including Bitwise, BlackRock, and Fidelity. Trading is expected to commence on July 23, pending the effectiveness of S-1 registration statements.

Why Ethereum ETFs Could Push Ether to New Highs

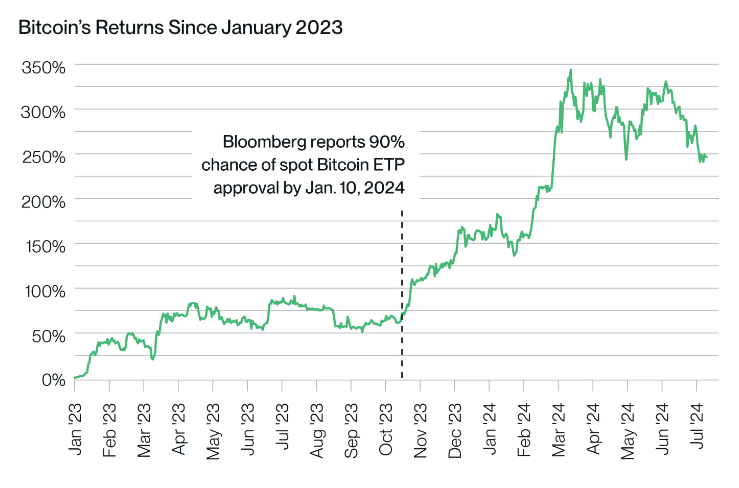

Hougan’s optimism stems from the potential impact of ETF flows on ether’s price. Drawing parallels with Bitcoin ETFs, which have purchased more than double the amount of bitcoin produced by miners since their launch, Hougan anticipates an even more significant effect on ether due to several factors.

Firstly, Ethereum’s near-zero inflation rate over the past year contrasts sharply with Bitcoin’s 1.7% at the time of its ETF launch. Secondly, ether stakers face lower selling pressure compared to bitcoin miners, who often need to sell newly mined coins to cover operational costs. Lastly, with approximately 40% of ether locked in staking and DeFi protocols, the available supply for trading is significantly reduced.

Hougan previously projected $15 billion in net inflows for Ethereum ETFs in their first 18 months. While this pace is slower than that of Bitcoin ETFs, which reached this milestone in just five months, Hougan believes the impact on ether’s price could be more pronounced.

Currently trading at $3,453, ether remains about 29% below its all-time high of $4,875 set in November 2021. However, if Hougan’s predictions materialize, the cryptocurrency could be poised for a substantial rally in the coming months.