Key Insights

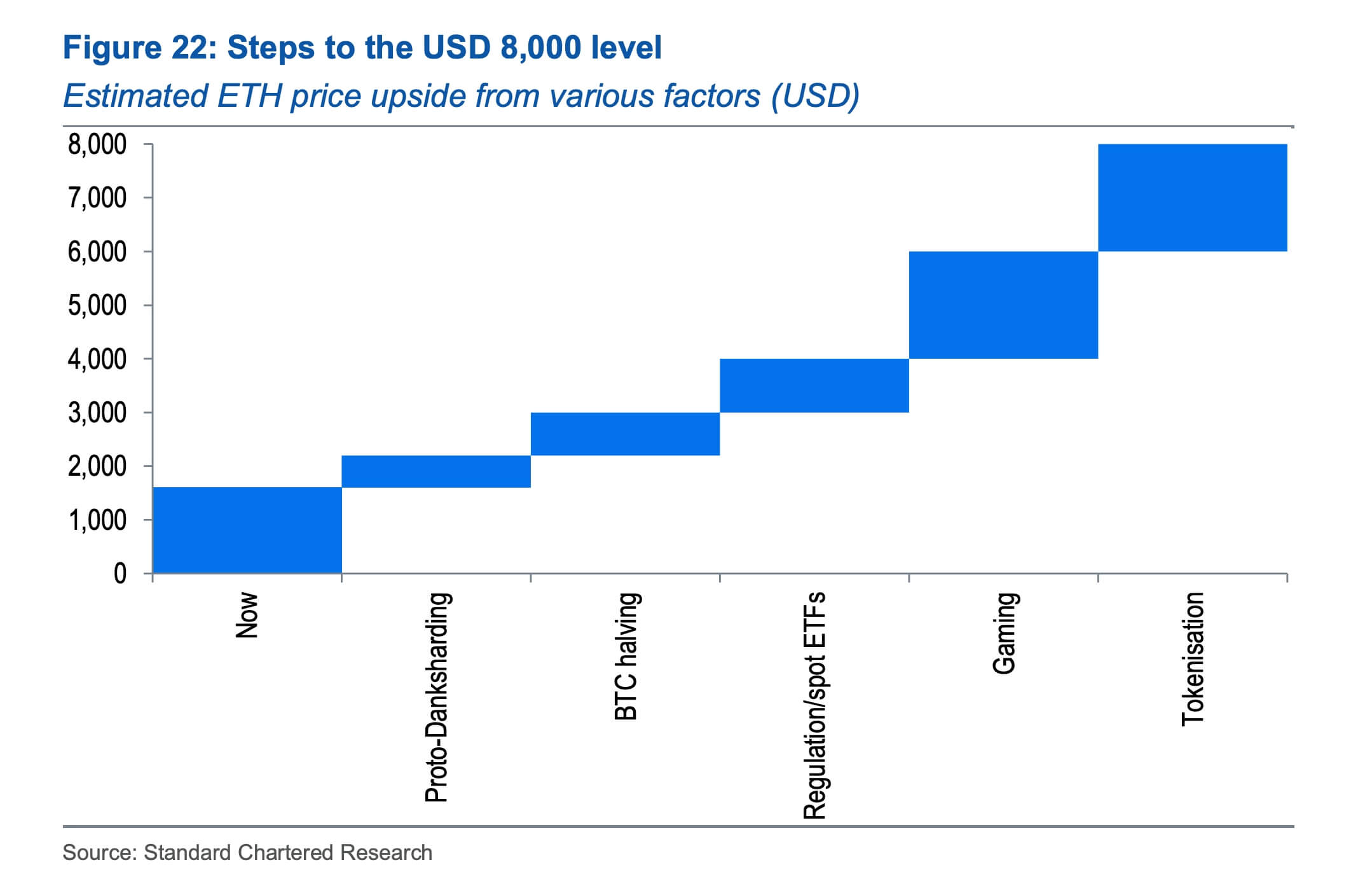

- Standard Chartered Bank predicts Ethereum (ETH) could reach $8,000 by the end of 2026.

- Ethereum’s Layer 2 scaling solutions are expected to expand, reducing transaction fees and solidifying its position in the smart contract space.

- The forthcoming Bitcoin halving in 2024 and potential U.S. regulation and spot ETFs are seen as factors that could drive ETH to $4,000 by the end of 2024.

NEW YORK (MarketsXplora) – Standard Chartered Bank has issued a bullish prediction for Ethereum (ETH), the native cryptocurrency of the Ethereum blockchain. The bank’s head of forex and crypto research, Geoffrey Kendrick, believes that ETH, currently trading at around $1,600, could surge to $8,000 by the close of 2026.

This projection is grounded in Ethereum’s dominance in smart contract platforms and its expanding applications in gaming and tokenization.

Kendrick sees this $8,000 milestone as just the beginning of Ethereum’s journey. Standard Chartered Bank has previously indicated a “long-term structural valuation” range of $26,000 to $35,000 for ETH.

Read also! Ether Price Will Surge to $6,500 on ETF Launch: Steno Research

Although this valuation relies on potential future use cases and revenue streams that have yet to fully materialize, Kendrick remains optimistic. He points to the tangible real-world applications of Ethereum in gaming and tokenization as factors that will drive this growth.

Factors Fueling Ethereum’s Rise

Ethereum’s Layer 2 scaling solutions are also expected to expand, primarily due to forthcoming technical upgrades, including “proto-danksharding,” which promises reduced transaction fees on these platforms. Kendrick asserts that this will solidify Ethereum’s dominance in the smart contract sphere, potentially increasing its price-to-earnings ratio in the coming years.

Furthermore, Kendrick anticipates that the upcoming Bitcoin halving around April 2024 will have a positive spillover effect on all digital assets, particularly benefiting Ethereum as the second-largest cryptocurrency.

Read also! Ethereum Price Forecast 2025: How Will 2024 Bitcoin Halving Impact ETH?

Additionally, the potential introduction of regulations and spot exchange-traded funds (ETFs) in the United States, penciled in for late 2024, is expected to boost both Bitcoin and Ethereum.

Kendrick concludes that these favorable conditions could propel Ethereum’s price to $4,000 by the end of 2024, although this would still be below its previous peak price of $4,866 reached in late 2021. It’s worth noting that Kendrick has previously made a bold prediction of a $100,000 price for Bitcoin by the close of 2024, reflecting his optimism about the broader crypto market’s future.