Key Insights

- WorldCoin eye scanner threatens privacy and security

- Also, the tokenomics of the project and the control of market makers are highly questionable.

- The practice of user registration raises a number of ethical issues

The head of OpenAI, Sam Altman, is one of the most visible figures in the world of technology, which is why his recent entry into the cryptocurrency market with WorldCoin (WLD) has attracted everyone’s attention.

The launch of the controversial WorldCoin token has sparked increased interest from investors around the world. However, the tokenomics of the project, the ways of doing business and its potential risks raise many questions.

Market makers control 95% of WLD

The WorldCoin project was designed as a digital identity platform to distinguish real people from bots or artificial intelligence (AI) algorithms. Its main tool, Orb, is an iris-scanning device that is supposed to confirm the unique identity of each user on the Internet.

However, such an innovative idea by default comes with certain difficulties. Some of them may even border on ethical and practical gray areas.

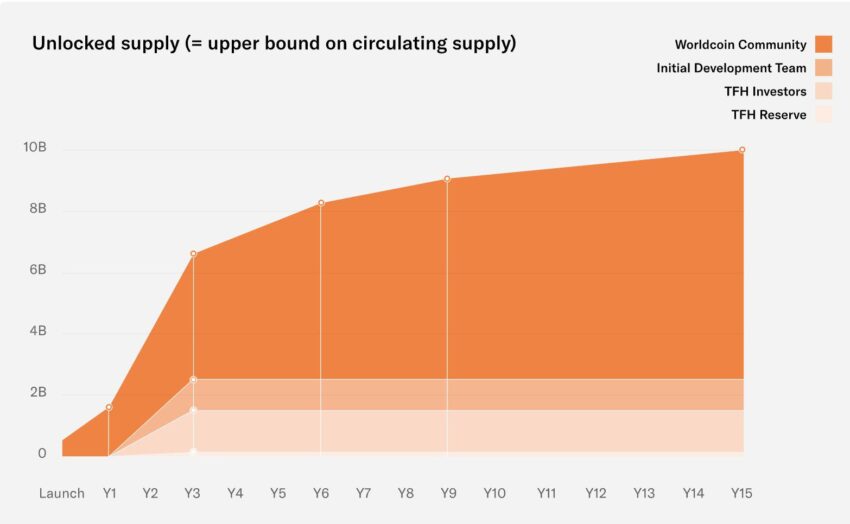

One of the first problems that arose after the launch was related to the tokenomics of the project. At launch, the number of WorldCoin tokens in circulation was 143 million. This included 43 million WLD allocated for the airdrop and 100 million WLD provided on credit for three months to non-US market makers.

The WLD Token starts with a relatively small circulating supply of no more than 143 [million] WLD (i.e. 1.43% of the initial total supply). This is due to the goal of creating a network that connects as many people as possible, and in order to achieve this goal, the bulk of WLD tokens will be transferred to new and existing users over the coming years,” says the WorldCoin whitepaper.

A more detailed examination of the data reveals that at the start, market makers controlled 95% of the total number of tokens in circulation, which led to the initial imbalance of the market.

While the strike price was set at $2.8, market makers had an incentive to push it past the $28B FDV. As a result, the WLD surge really took off, with FDV above $30B at the open. According to Matt Batcinelas, the general partner of Triblock, is reminiscent of the stories of past tokens such as Filecoin (FIL) and Internet Computer (ICP).

WorldCoin threatens privacy

In addition to technical subtleties, the method of registering users in WorldCoin has also caused alarm. The project team often mentioned their extensive user base, which in itself is not a problem.

However, the active discussion of the company’s potentially exploitative practices in developing countries paints a disturbing picture.

According to blockchain investigator @zachxbt, Worldcoin has been actively expanding its user base to include the children of Kenya and Chile. The analyst also reported on the emergence of a “black market” for WorldCoin accounts, where prices for one account on platforms like Telegram could be as low as $1.

The real subject of controversy is the very fact of scanning the iris of the eye. Although the WorldCoin team insists that the iris images are removed after scanning and only the uniqueness of the pattern is preserved, critics argue that this comes with significant risks.

We want to be clear that Worldcoin is not a data company and our business model is not to use or sell users’ personal data. Worldcoin is not interested in the identity of the user, but only in his uniqueness, i.e. that he had not registered with Worldcoin before, the company said in a 25-page response to an MIT Technology Review request.

However, privacy remains at the forefront of user concerns.

How can the platform ensure that the vast database of iris scans is not hacked or misused?

Related: Worldcoin Faces Investigation by French Regulator Over Data Privacy Concerns

These concerns are reinforced by comments from prominent figures such as Ethereum founder Vitalik Buterin. He recently listed several key risk factors inherent in the project. In particular, he attributed to them the risk of misuse or leakage of information related to user identification, as well as problems with accessibility and centralization.

That being said, he added, even if the software layer is decentralized, the Orb will remain a hardware device:

We have no way to verify that it is constructed correctly and does not have a backdoor. Thus, even if the software layer is perfect and completely decentralized, the WorldCoin Foundation still has the ability to introduce a backdoor into the system that allows the creation of an arbitrary number of fake human identities.

Now even the UK information regulator (ICO) is concerned about WorldCoin’s eye-scanning activity in London. He announced a review of the company for a “clear legal basis” for the processing of personal data.

According to a spokesman for the Office, the processing of special category biometric data can lead to high risk. If such risks are identified, consultations with the ICO are necessary.

Living in the Era of AI. But at what cost?

In a broader perspective, the key goal of the WorldCoin initiative is to create a “global financial and identity network based on proof of identity.” The goal is undoubtedly noble. However, achieving it without compromising the trust, security and privacy of users is a major challenge.

While WorldCoin assures users that it is not a data processing company and does not intend to use users’ personal data, its registration method, especially in developing regions, suggests otherwise.

Also featured in WorldCoin’s early funding round is Sam Bankman-Fried, the founder of the infamous FTX cryptocurrency exchange. This further emphasizes the controversial nature of the project.

Although it is premature to draw conclusions, the first steps of the project indicate that its activities are fraught with both ethical and operational problems.

Worldcoin is taking full advantage of the fact that the vast majority of people are complete idiots, unable to critically think about why they shouldn’t trade retinal scans for a few dollars, said Chris Black, crypto influencer and founder of the DeFi Watch analytics platform.

WorldCoin, like many other innovative technologies, teeters on the fine line between the digital identity revolution and the potential for error. Only time will tell whether the project will be able to organically combine promises and ambitions, on the one hand, and trust and security, on the other.

[…] Related: What Could Go Wrong with Worldcoin? Examining the Risks […]

[…] Read also: What Could Go Wrong with Worldcoin? Examining the Risks […]

This web page is mostly a walk-by for all the info you wished about this and didn抰 know who to ask. Glimpse here, and you抣l positively discover it.

[…] Read also: What Could Go Wrong with Worldcoin? Examining the Risks […]

[…] Read also! What Could Go Wrong with Worldcoin? Examining the Risks […]