If you’re searching for a FundedNext review, chances are you’re wondering if this prop firm is truly worth your time and money. With so many funding options out there, it’s easy to feel overwhelmed or misled. That’s why this guide walks you through everything—how FundedNext works, what makes it different, and whether it fits your trading goals in 2026.

FundedNext Review: At a Glance

|

|

Launched |

March 2022 |

Headquarters |

No. 7, AI Robotics HUB, C1 Building, AFZ, Ajman, United Arab Emirates |

CEO |

Abdullah Jayed |

Parent Company |

NEXT Ventures |

Global Reach |

Traders in over 190 countries |

Offices & Communities |

Strong presence in Africa, Asia, Europe, and more |

Number of Funded Accounts |

Over 125,000 funded accounts |

Total Payouts to Traders |

Over $150 million |

Maximum Account Size |

Up to $300,000 |

Profit Split |

Up to 95% |

Trading Platforms Supported |

MT4, MT5, cTrader, Match-Trader |

Account Types |

Evaluation, Express, Stellar Lite, and Futures |

Payout Speed |

Fast payouts within 24 hours (after processing) |

Website |

What Is FundedNext?

FundedNext is a proprietary trading firm that funds traders with capital—so they can earn real profits without risking their own money upfront. Once you pass a trading challenge that proves your skill, FundedNext gives you access to an account worth up to $300,000, and you get to keep up to 95% of the profits.

FundedNext was founded in March 2022 by Bangladeshi entrepreneur Syed Abdullah Jayed and is headquartered in Ajman, United Arab Emirates. As part of NEXT Ventures and under the leadership of co-founder and CEO Abdullah Jayed, the company has rapidly established itself as one of the most trusted and fastest-growing names in the prop trading industry. FundedNext now serves traders across over 190 countries, supported by a team of more than 200 employees and regional hubs spanning Africa, Asia, and Europe.

Since launching, they’ve attracted over 125,000 funded accounts and paid out more than $150 million in profits. Their reputation is built on fast payouts, flexible trading rules, and a growing community of traders worldwide. And it hasn’t gone unnoticed—FundedNext was named Best Prop Trading Firm at the Smart Vision Awards 2022 in Egypt and has been featured by outlets like Yahoo Finance, Investing.com, and Business Insider.

But what truly sets FundedNext apart is its big-picture vision. They’re not just here to hand out trading capital. Their mission is to empower 50 million traders around the world by combining smart technology, top-tier support, and practical, fair trading challenges. In short: they’re here to change lives—not just fund trades.

Is FundedNext Legit?

Yes, FundedNext is a legitimate prop trading firm with verifiable business credentials and a proven track record. The company operates as GrowthNext F.Z.E., a registered entity under UAE law with additional operations in Limassol, Cyprus, and adheres strictly to regulatory standards. FundedNext has acquired a regulated broker license from a regulatory body, allowing them to offer both MT4 and MT5 trading platforms.

The firm’s legitimacy is further validated by substantial customer feedback, with over 38,300 customer reviews on Trustpilot, maintaining a 4-star rating and an impressive 4.6 out of 5 stars based on reviews with Trustpilot company verification.

Industry reports confirm FundedNext has paid out over $150 million to traders and maintains transparent operational practices across over 190 countries, supported by a team of 200+ employees and regional hubs spanning Africa, Asia, and Europe—demonstrating the infrastructure and scale of an established, legitimate business operation.

FundedNext at a Glance: Standout Features

Before diving into the different account types and rules, it’s helpful to get a quick snapshot of what FundedNext brings to the table—and why so many traders are turning to them.

- 💰 Up to 95% Profit Split – One of the highest in the industry.

- 📈 Up to $300,000 Trading Accounts – With options to scale or stack accounts.

- ⏱️ 24-Hour Guaranteed Payouts – Or they’ll pay you a $1,000 penalty.

- 🧠 No Time Limits on Some Challenges – You trade at your pace, not theirs.

- 🌍 125K+ Funded Accounts and $150M+ in rewards paid out

- 🏆 Awards for Best Trading Experience, Quickest Payouts, and More

- 📞 24/7 Customer Support and a growing global trader community

- 🤝 Partnerships with Google, Meta, and MetaQuotes

What this means is—FundedNext is not just promising big things; they’re actually delivering. And they’ve built the kind of infrastructure that gives beginners confidence: fast support, clear rules, and a commitment to pay traders quickly and fairly.

Now that you know what FundedNext is and what makes it unique, let’s look at the actual plans they offer—and which one might be right for you.

FundedNext Challenge Models Explained (Step-by-Step)

At the heart of FundedNext’s model is a simple idea: prove your trading skills through a challenge, and they’ll provide the capital. But unlike many firms with rigid or confusing evaluations, FundedNext offers four unique challenge types, each tailored to different goals, risk levels, and budgets. Whether you’re new to prop trading or a confident pro, there’s a plan that fits.

Stellar 2-Step Challenge

This is FundedNext’s classic evaluation model—a structured, two-phase challenge designed to assess your consistency and risk control. You’ll aim for an 8% profit target in Phase 1, then 5% in Phase 2, while staying within a 10% overall loss and 5% daily loss. Once funded, you can earn up to 95% profit split, trade news and weekends, and even get a 15% bonus from profits made during the challenge.

Account Sizes & Fees:

- $6,000 – $59

- $15,000 – $119

- $25,000 – $199

- $50,000 – $299

- $100,000 – $549

- $200,000 – $1,099

First payout is after 21 days, and the minimum trading days required is just 5. It’s a popular choice for those who want a well-balanced path to long-term funding.

Stellar 1-Step Challenge

Looking to get funded faster? This streamlined model skips the second phase entirely. Just hit a 10% profit target, stay under a 6% total loss and 3% daily loss, and you’re in. You can get paid in as little as 5 days, and you still keep up to 95% of profits, with news trading and weekend holding allowed.

Account Sizes & Fees:

- $6,000 – $65

- $15,000 – $129

- $25,000 – $219

- $50,000 – $329

- $100,000 – $569

- $200,000 – $1,099

This is ideal for skilled traders who don’t want to wait around to prove themselves.

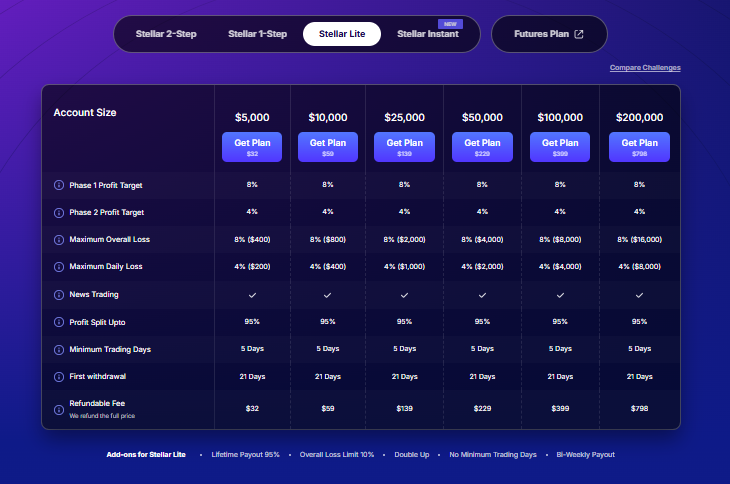

Stellar Lite

If you’re trading on a tighter budget or just starting out, Stellar Lite gives you a real challenge at a lower price point. You’ll go through two phases with 8% and 4% profit targets, and must stay within 8% overall loss and 4% daily loss. Despite the affordability, you still get up to 95% profit share, along with bi-weekly payout options, and helpful add-ons like “No Minimum Trading Days.”

Account Sizes & Fees:

- $5,000 – $32

- $10,000 – $59

- $25,000 – $139

- $50,000 – $229

- $100,000 – $399

- $200,000 – $798

First withdrawal is available after 21 days, with just 5 minimum trading days required.

Stellar Instant

Don’t want to take a challenge at all? Stellar Instant gives you a funded account from day one—no evaluation, no delays. You trade live with a 6% trailing max loss, can hold over weekends, and earn up to 80% profit split with on-demand payouts. This one’s for confident, experienced traders who want to get to work immediately.

Account Sizes & Fees:

- $5,000 – $195

- $10,000 – $399

- $20,000 – $780

There’s no consistency rule, and you can withdraw anytime. Just bring your skills.

Futures Plan: Tailored for Futures Traders

🚀 Rapid Challenge (New)

This one’s built for speed and simplicity. With no daily drawdown, no minimum trading days, and payouts in as little as 3 days, it’s ideal for confident traders who want to hit their targets fast.

- Profit targets range from $1,500 to $5,000, depending on your account size.

- There’s no activation fee and no minimum holding period, and resets are available for a flat fee.

- Position sizes are slightly smaller during the challenge (e.g., 2 minis on the $25k plan), but you get access to more once funded.

Legacy Challenge

Prefer a more traditional setup with a built-in reward? The Legacy Challenge includes a 15% performance bonus on top of your profits once you pass Phase 2—perfect for steady traders who want a little extra.

- There’s a soft daily drawdown, but clear max loss rules based on your end-of-day balance.

- Profit targets go up to $6,000 depending on the account, and you can trade with larger position sizes, especially after you’re funded.

- The reset fee comes with a 10% discount, and the consistency rule (40%) applies once you go live.

Whether you’re an aggressive scalper or a measured swing trader, you’ll find a plan that matches your pace and strategy. And the best part? FundedNext makes it easy to compare both Futures plans side-by-side on their website so you can choose with clarity.

Unique Features That Set FundedNext Apart

So what really makes FundedNext stand out in a crowded market of prop firms? It’s more than just nice graphics and a global community. They’ve built a system that rewards traders quickly, supports them genuinely, and removes the stress that often comes with evaluations.

Here are the standout features worth knowing:

- 💸 24-Hour Guaranteed Payouts – Finish a profitable trading period, request a payout, and get it within 24 hours—or FundedNext pays you $1,000 extra. That’s a bold promise, and they’ve been delivering.

- 📊 Up to 95% Profit Split – Most firms cap at 80%. FundedNext lets top-performing traders keep up to 95% of their profits.

- ⏳ No Time Limits on Challenges – Trade at your own pace without worrying about a ticking clock. This is especially helpful for beginners who want to be careful and deliberate.

- 🎁 15% Performance Reward in the Challenge Phase – Unlike most prop firms, FundedNext pays you even while you’re proving yourself. If you profit during the challenge, you can earn a bonus just for passing.

- 🔁 One-Time Fee, No Subscriptions – Once you pay for a challenge, that’s it. There are no recurring monthly charges, and in some cases, fees are refundable if you pass.

- 🧠 No Daily Drawdown in Rapid Challenge – This removes one of the trickiest rules in prop trading and gives fast, high-frequency traders more breathing room.

These aren’t gimmicks. They’re designed to make sure traders feel motivated, fairly treated, and supported from start to finish. FundedNext’s approach is refreshingly trader-first—and that’s rare.

Trading Platforms

FundedNext understands that traders have different preferences when it comes to platforms. That’s why they’ve made it easy to trade using popular, beginner-friendly platforms that many traders are already comfortable with.

Here’s what’s supported:

- 💻 MetaTrader 4 & 5 (MT4/MT5) – Ideal for Forex and CFD traders. You get all the usual tools, charting capabilities, and EA (Expert Advisor) support.

- 📈 TradingView – Loved for its clean interface and fast execution, especially among newer traders. You can connect directly via API and manage trades easily from your browser or app.

- 📊 NinjaTrader & Tradovate – If you’re trading Futures, these platforms are fully integrated into FundedNext’s Futures Plan. Both are trusted names in the futures trading world, with strong charting and order execution tools.

The experience is smooth and intuitive. Execution speeds are fast, and there’s no noticeable slippage or lag, even during volatile markets. Plus, you can hold trades overnight and over weekends, depending on the challenge you choose—giving you more flexibility in how you trade.

And if you ever hit a roadblock? FundedNext’s 24/7 support team is there to help, whether it’s technical troubleshooting or account questions.

FundedNext Payouts and Profit Splits — How You Get Paid

One of the top reasons traders choose FundedNext? Their payout system is fast and generous—two things that many other prop firms still struggle with.

Here’s how it works:

- ⏱️ 24-Hour Guaranteed Payouts

Once you’re in a funded account and make profits, you can request a payout at any time. Most are processed in just 5 hours, and if they miss the 24-hour window, they pay you an extra $1,000—no questions asked. - 📊 Profit Splits Up to 95%

Depending on your performance and account type, you’ll earn 80% to 95% of your profits, which is one of the most generous splits in the industry. - 🧾 Multiple Payment Options

Payouts can be sent via traditional bank transfers, crypto, or other popular payment gateways. The goal is to get your money to you fast and securely. - 🎁 Bonus: 15% Performance Reward

FundedNext is one of the only firms that actually rewards you during the challenge. If you profit while proving your skills, you can get a 15% bonus on top of your challenge results—even before you’re funded.

It’s rare to find a prop firm that pays traders this quickly and generously, especially during the evaluation phase. That’s why FundedNext’s payout system is often praised in trader communities.

Rules, Loss Limits & Consistency Requirements (What to Know Before You Trade)

Now, let’s talk about the part many beginners overlook—the rules. These are just as important as trading itself. Break them, and you could lose your funded status, even if you’re profitable.

Here are the key things to keep in mind:

🔻 Drawdown Limits

- Maximum Overall Loss: Typically capped at 6% of your account.

- Daily Drawdown (in most plans): A trailing loss cap, also around 4%, though the Rapid Challenge has no daily loss limit, giving you more breathing room.

- These limits apply whether you’re in the challenge phase or the funded phase.

📉 Trailing vs. Static Drawdown

Most accounts use a trailing drawdown, meaning the loss cap moves up as your equity grows, but never moves down. It’s designed to protect the firm’s capital—but it also means you’ll need to manage risk carefully.

📊 Consistency Rule

Once you’re funded, some plans—like the Futures account—enforce a 40% consistency rule. This simply means one day’s profit shouldn’t make up more than 40% of your total profits. It’s there to encourage consistent, stable performance instead of lucky one-off trades.

⚠️ Other Things to Note

- News trading and weekend holding are allowed on most accounts—but always check your plan details.

- Max position sizes apply to Futures accounts—these vary by account size.

- Violating rules may lead to account termination without refund, so take time to understand them before diving in.

While these rules might sound strict, they’re actually pretty reasonable—and far more transparent than what you’ll find with many other firms. FundedNext is upfront about expectations, which makes it easier for you to plan your trades and protect your progress.

Customer Support & Community

One of the first things beginners worry about with any prop firm is: “What happens if I get stuck or something goes wrong?” With FundedNext, you’re not left in the dark. Their 24/7 customer support team is available via live chat and email—and the response times are fast, often under a few minutes.

But support goes beyond just technical issues. FundedNext has built a thriving global community where traders can interact, ask questions, and share ideas. You can join their Discord and Facebook groups, both packed with educational content, news updates, and live discussions from real traders around the world.

They’ve even gone a step further by hosting real-life meetups and conferences in countries like Nigeria, the Philippines, and Thailand. It’s rare to see a prop firm investing this much in their community, and it shows they’re serious about building long-term relationships—not just funding trades.

Whether you’re troubleshooting a login issue, asking about payout timelines, or just looking for motivation, FundedNext gives you access to real people, real answers, and real support—any time of day.

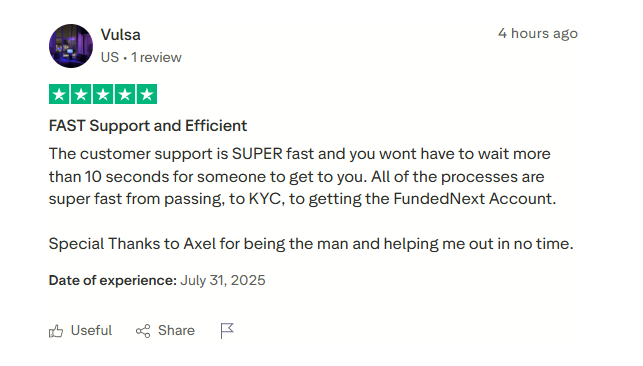

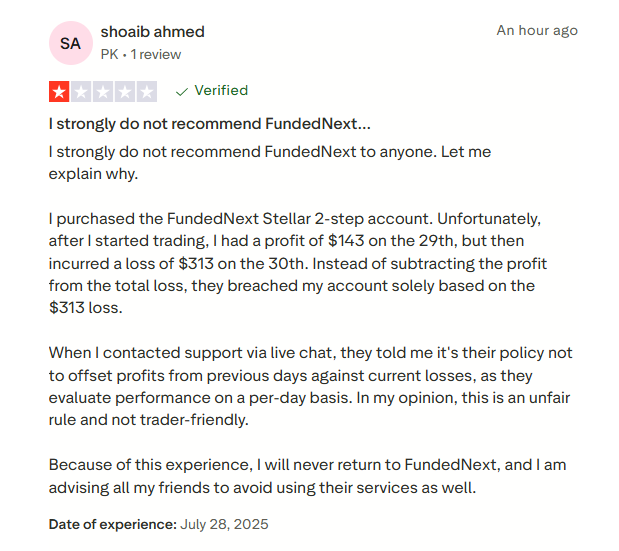

What Real Traders Are Saying on Trustpilot

You don’t have to dig too deep online to find positive feedbacks about FundedNext. Scroll through TrustPilot, and you’ll find dozens of traders sharing their success stories, and praising their rapid payout system.

With a solid Trustpilot rating of 4.6 out of 5, FundedNext also attracts criticism—giving prospective traders a realistic glimpse into areas to watch. For many, the onboarding process, dashboard usability, and responsive support are standout positives.

Hendry Akondi from South Africa, currently taking on the $25,000 Futures Challenge, says that although he’s still in the evaluation phase, “emails are answered quickly and the trading server has been stable with low latency.” He adds that the platform looks promising for “disciplined traders” and appreciates the clearly laid-out rules.

Over in the U.S., Vulsa gave FundedNext a perfect score, praising the “SUPER fast” customer support and efficient processes from challenge pass to KYC. He even gave a shoutout to a support rep: “Special thanks to Axel for being the man and helping me out in no time.”

However, not all feedback has been glowing. Shoaib Ahmed from Pakistan left a 1-star review after his account was breached due to FundedNext’s per-day loss evaluation rule. Despite making a $143 profit one day, a $313 loss the next triggered a violation. Shoaib called the policy “unfair” and “not trader-friendly,” warning others to avoid the platform.

On a more personal note, Nithin Kumar J from India shared a heartfelt 5-star review, saying FundedNext has helped him grow despite past struggles in his trading journey:

“After 7 years of life, I’m getting better now… This prop firm hasn’t been anything else than amazing for me.”

As these mixed reviews show, FundedNext has many fans—but like any serious trading platform, it comes with rules that may not suit everyone. The key is knowing your trading style and reading the fine print before diving in.

FundedNext Review: Pros and Cons

Let’s wrap this section up with a quick, honest look at what FundedNext gets right—and where it might fall short, especially for newer traders.

✅ Pros

- 24-Hour Guaranteed Payouts (with $1,000 penalty bonus if delayed)

- Up to 95% profit split—one of the highest anywhere

- No time limits on some challenges = less pressure

- Beginner-friendly models like the Rapid and Lite plans

- Performance bonuses even during the challenge phase

- Futures trading support with flexible position sizing

- Strong customer support and global trader community

- One-time fee only (no subscriptions or hidden charges)

⚠️ Cons

- Trailing drawdown can be confusing if not clearly understood

- Consistency rules (e.g., 40% rule) may limit aggressive strategies

- Some plans can be pricey for absolute beginners

- No full refund if you fail the challenge (though some plans offer a reset fee)

In short, FundedNext offers flexibility, speed, and transparency, which makes it a great option—especially for serious beginners who are ready to take prop trading seriously.

Should You Choose FundedNext?

FundedNext is designed with a wide range of traders in mind, but it especially shines for:

✅ Beginner Traders

If you’re new to prop trading, FundedNext offers flexible challenges, clear rules, and no time pressure. Their Stellar Lite and Rapid Challenge options are affordable and beginner-friendly, allowing you to ease in without the overwhelm.

✅ Traders Who Want Fast Payouts

You like to keep what you earn—fast. If that’s you, FundedNext’s 24-hour guaranteed payouts and up to 95% profit split will be a major draw.

✅ News & Swing Traders

Unlike many other firms, FundedNext allows news trading and holding trades over weekends on several plans. That’s a big win if you like to trade macro events or hold for longer periods.

✅ Futures Traders

Thanks to their dedicated Futures Plan, FundedNext is one of the few prop firms offering robust support for Futures markets, with position limits and platforms tailored for this trading style.

⚠️ Not Ideal For…

If you’re looking for a firm with no consistency rules at all, or you want a completely refundable challenge fee, you might find FundedNext slightly restrictive. But for most serious traders, the structure is very reasonable—and well worth the rewards.

FundedNext vs FTMO vs The Funded Pips: Which Prop Firm Stands Out?

If you’re considering joining FundedNext, you’re likely also curious about its top competitors—FTMO and the Funding Pips. These are three of the most talked-about prop firms in the industry right now, each with its own appeal. Whether you’re a scalper, swing trader, or just hunting for the best profit split and fastest payouts, this comparison will help you see how they stack up side by side.

|

|

|

|

Year Launched |

2022 |

2015 |

2021 |

Total Payouts to Traders |

Over $60 million |

Over $200 million |

Over $120 million |

Account Types |

4: Stellar 2-Step, 1-Step, Lite, Instant |

1-Step and 2-Step Evaluation |

Standard Challenge, Rapid Challenge, Royal, Knight, etc. |

Profit Split |

Up to 90% |

Up to 90% |

Up to 90% (Royal Challenge offers 90%) |

Trading Platforms |

MetaTrader 4, MetaTrader 5, cTrader, TradingView, NinjaTrader (Futures) |

MT4, MT5 |

MT5 |

Maximum Account Size |

Up to $200,000 (Express/Stellar) |

Up to $400,000 |

Up to $200,000 |

Global Reach |

Traders in 190+ countries |

Worldwide (excluding US residents) |

195+ |

Payout Frequency |

Bi-weekly or On-demand |

Monthly (can vary) |

Weekly |

All three firms—FundedNext, FTMO, and Funding Pips—are solid options depending on your trading style and goals. FTMO shines for its reputation and high account sizes, while FundedNext offers multiple plan types and flexible payouts. Funding Pips is newer but appealing for its simplicity and weekly payouts. If you’re weighing your next move, consider what matters most to you: speed of payouts, challenge structure, or long-term reliability.

How to Get Started with FundedNext

Getting started with FundedNext is refreshingly straightforward, even if you’ve never used a prop firm before. Here’s exactly how the process works, step by step:

🔹 Step 1: Choose Your Plan

Head to the FundedNext website and browse through the different challenge models. Whether you want to go slow and steady (Stellar 2-Step), get instant funding (Stellar Instant), or trade Futures (Rapid Challenge), there’s something for every style and budget.

🔹 Step 2: Pay the One-Time Fee

Once you’ve picked your plan, you pay a one-time fee (no subscriptions or hidden charges). Some plans start as low as $59 for smaller accounts.

🔹 Step 3: Pass the Challenge

Each challenge has profit targets and drawdown rules you need to meet. Take your time—some plans don’t have deadlines. And remember: during the challenge, you can still earn bonuses on your performance. That’s real money, even before getting fully funded.

🔹 Step 4: Get Funded

Once you pass, you’re awarded a simulated funded account, which functions just like a real trading account—but with no risk to your own money. From here on, you’ll receive a share of any profits you generate—up to 95% in some cases.

🔹 Step 5: Request a Payout

Make profits? Submit a payout request. Most are processed in under 5 hours, and always within 24 hours, or you get a $1,000 penalty bonus.

Whether you’re new or experienced, the entire onboarding process is designed to be beginner-friendly, fast, and transparent.

FundedNext Review: Final Verdict

After going through every detail—from account types and payout policies to support and trader feedback—it’s clear that FundedNext has built a serious, trader-first platform that’s more than just hype.

For beginners, it offers an easy learning curve, multiple paths to funding, and fast access to real profits without risking personal capital. For more experienced traders, the high profit split, instant funding options, and futures support make it an attractive long-term partner.

Is it perfect? No. But FundedNext does what many prop firms fail to do—it keeps its promises, pays on time, and provides a clear, fair path for traders to succeed.

So if you’re ready to put your skills to the test, get funded, and actually earn from your trading—FundedNext is 100% worth a serious look.

Compare also ↓

❓ Frequently Asked Questions

- Is FundedNext legit or just another flashy prop firm?

FundedNext is legit. They’ve funded over 125,000 accounts, paid out over $150M, and have strategic partnerships with companies like Google, Meta, and MetaQuotes.

- What happens if I fail the challenge?

You’ll need to purchase a new challenge or pay a reset fee if available for your plan. There’s no automatic refund unless specified.

- Can I trade with EAs or bots?

Yes—automated trading is generally allowed, especially on MT4/MT5. Just make sure your strategy complies with their rules.

- Do I have to trade every day?

No. Most FundedNext plans don’t require minimum trading days, especially the Rapid Challenge, which can be passed in just one day.

- Is FundedNext available in my country?

Most likely yes. FundedNext is available to traders worldwide, with strong communities in Africa, Asia, Europe, and the Americas.