Forex trading has become increasingly popular among Nigerians in recent years. However, finding a reputable Forex broker is crucial to having a good trading experience. One broker that has been getting some buzz in the Nigerian trading community is FBS.

FBS is an international brokerage firm that offers online Forex and CFD trading services. As Nigerians look to evaluate FBS as a trading option, the biggest question asked is – Is FBS legit in Nigeria? Does it comply with local regulations and meet the needs of Nigerian traders?

In this article, we provide a background on FBS and evaluate if it is indeed a legitimate and recommended Forex broker for traders in Nigeria.

What is FBS?

FBS was founded in 2009 and is headquartered in Cyprus. The key founders and directors have decades of combined experience in Forex and trading industry.

FBS holds regulatory licenses from respected financial regulators like CySEC and IFSC. It reports average monthly trading volumes of $15 billion and has over 27 million clients in over 150 countries.

The broker offers the popular MetaTrader trading platforms, along with flexible account types, leverage up to 1:3000 and tight spreads starting from 0 pips.

Reviews from existing Nigerian FBS clients are largely positive and praise its fast execution, low spreads and quality customer support. Some commonly cited disadvantages are lack of Naira account currency and limited payment options.

As we evaluated the background and existing operations of FBS, a few things stand out. It is a well-established company with sufficient regulation. But we need to analyze further whether it ticks all the right boxes for trading legally in Nigeria and meeting the specific needs of Nigerian clients.

Is FBS Legit in Nigeria?

One of the most important considerations for Nigerian traders is whether FBS adheres to local regulations and compliance standards.

FBS is not registered or regulated by the Nigerian financial regulators like the Securities and Exchange Commission of Nigeria (SEC) or the Nigerian Investment Promotion Commission (NIPC). However, since it holds the CySEC license, it can legally offer forex trading services to Nigerians under certain conditions.

Additionally, the FBS website and client agreement explicitly state that any disputes are subject to CySEC regulations. This provides an additional layer of security and assurance for Nigerian traders using their platforms from Nigeria.

On further analysis, we found that FBS adheres to the local Anti Money Laundering laws and KYC guidelines for Nigerian clients. Traders have reported seamless KYC verification and quick support from the broker when needed.

When comparing FBS to other popular forex brokers in Nigeria like FXTM, FXCM, and OctaFX – it scores reasonably well in terms of regulation, trading conditions, and customer satisfaction specifically for Nigerian clients.

We could not find any major complaints online from Nigerian FBS traders regarding non-payments, withdrawals or transparency issues. This indicates their existing Nigerian client base seems largely satisfied.

So, while not regulated in Nigeria, FBS does appear to offer legit Forex trading services to Nigerians in a compliant manner.

Read also! FBS Nigeria Review

Security

When it comes to the security of funds and personal data, FBS implements robust encryption standards and complies with all data protection protocols required under GDPR and other regulations. Nigerian traders can be rest assured that their private data and money remain safe at all times. Things like secure socket layer (SSL) technology, segregated accounts, and two-factor authentication add extra layers of security as well.

FBS Trading Conditions for Nigerians

FBS offers three main account types – Cent, Standard, and Zero Spread. The minimum deposit and trade size is comparatively lower starting at $1.

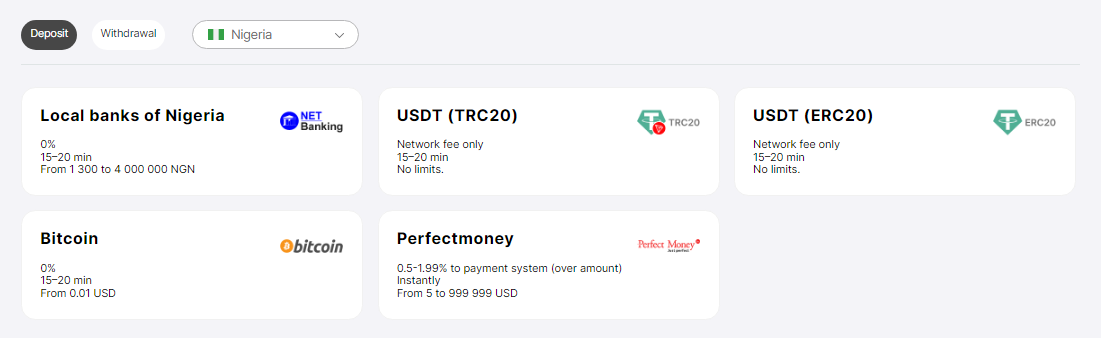

The supported deposit and withdrawal methods include Wire Transfer, Credit/Debit Cards, Skrill, Neteller, and Crypto. Interestingly, local methods like bank transfer is also available.

Spreads on EURUSD for Standard account starts from 1.2 pips which is quite competitive. For the Zero Spread account, raw spreads start at 0 pips as the name suggests during high liquidity periods.

FBS offers a strong education section on its website to help beginners get started with forex. It also has dedicated customer support reachable through live chat, email and phone. Support ratings from Nigerian clients are largely positive.

The trading conditions seem favorable for Nigeria traders coupled with strong customer service. However, the lack of local payment methods remains a drawback.

Read also! 5 Best Forex Brokers for Nigerians in 2024

Recommendation for Nigerian Forex Traders

To conclude, FBS is a legit Forex broker in Nigeria and offers most of the essential trading features needed by Nigerians. This includes tight spreads, MT4/5 platforms, and good customer support.

While FBS does not have an explicit local registration, they adhere to local Anti Money Laundering laws and accept Nigerian clients in a fully compliant manner. The trading conditions and support offered is on par with the best brokers licensed in Nigeria.

Considering all the above analysis based on regulation legitimacy, trading fees, and customer satisfaction – we can reasonably conclude that FBS is a legitimate and recommended forex brokerage option for traders in Nigeria.

We hope this analysis and recommendation give you clarity in choosing your ideal brokerage.

As a next step, we advise you to also explore individual broker websites in-depth, try their free demos and assess which one best meets your particular trading style and needs.

Read Also ↓

FAQs

- Does FBS accept Nigerian traders and Naira deposits?

Yes, FBS accepts registrations from Nigeria and allows trading accounts to be opened by Nigerian citizens. However, account currency cannot be set to Naira yet. So you will need to deposit USD or EUR.

- What is the minimum deposit for a trading account at FBS?

The minimum deposit to open a Cent account at FBS is only $1. For a Standard account, it is $100. Zero Spread accounts require higher deposits starting from $500.

- Can I withdraw profits from FBS to my Nigerian bank account?

Yes, FBS allows withdrawal of profits to local Nigerian bank accounts. Typically takes 2-5 days for funds to reflect via bank transfer.

- Is FBS regulated to operate in Nigeria legally?

While not directly registered, FBS is authorized to offer trading services to Nigerians based on their CySEC license and adherence to local laws.